Sluggish CRE Lending Persists: CBRE

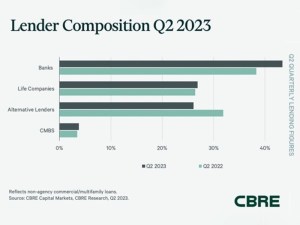

Banks accounted for the biggest share of non-agency closings.

For the fifth consecutive quarter, banks accounted for the largest share of non-agency loan closings. Chart courtesy of CBRE

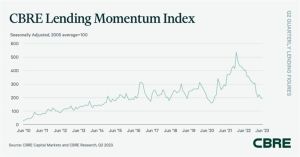

In the face of market uncertainty, CRE lending slowed in the second quarter, according to CBRE. The company’s Lending Momentum Index fell from 204 in the first quarter to 193 in the second quarter, representing declines of 5.4 percent from the first quarter and 52.2 percent year-over-year.

The CBRE Lending Momentum Index tracks the pace of CBRE-originated commercial loan closings in the United States.

Although debt is readily available, “choppy” markets have curtailed lending volume, noted Rachel Vinson, CBRE’s president of debt and structured finance for U.S. capital markets, in a prepared statement. That is moving borrowers to shorter-term fixed loans, as higher borrowing costs are keeping many on the sidelines, she added.

Many borrowers are turning to fixed-rate, short-term loans, according to Rachel Vinson, president of debt and structured finance for CBRE’s U.S. capital markets unit. Image courtesy of CBRE

For the fifth straight quarter, banks constituted the largest share of CBRE’s non-agency loan closings, at 43.4 percent of the total in the second quarter, up slightly from 41 percent in the first quarter.

“Smaller regional and local banks were the most active in this space, with 25% of bank loans used to fund construction projects, mostly in the industrial sector,” CBRE reported. “Approximately 43% of the loans were refinancings, while the remainder was allocated for acquisition loans.”

Life companies too grew their share, accounting for 26.8 percent of closed non-agency loans, up from 23 percent in the first quarter; these were focused on permanent multifamily and industrial loans.

Alternative lenders, including debt funds and mortgage REITs, were responsible for 26 percent of closings in the second quarter, a substantial increase from 20.1 percent in the first quarter. CBRE noted, however, that they “faced challenges on floating-rate bridge loans amid wider spreads and interest rate cap costs.”

Underwriting and CMBS

CBRE’s lending momentum index declined 52.2 percent year-over-year in the second quarter. Chart courtesy of CBRE

Underwriting criteria stayed tight in the second quarter, according to CBRE, “with slightly lower underwritten cap rates, debt yields and interest rates than last quarter.”

The average underwritten cap rate increased by 43 basis points in the second quarter, to 5.52 percent, from a year earlier, and average loan constants rose to 6.61 percent, from 5.43 percent, over the same period.

Notably, the percentage of partial- or full-term interest-only loans hit a record-high 82.1 percent in the second quarter, although other key underwriting measures saw little change.

Collateralized loan obligations dropped to just $2.1 billion in the first half, compared to nearly $24 billion in the first half of last year.

CMBS conduit lending sank to 3.8 percent of non-agency loan volume in the second quarter, from 15.7 percent in the first quarter. Industrywide, CMBS origination totaled only $16.5 billion in the first half, against $49.9 billion a year prior.

You must be logged in to post a comment.