Smart Buildings: Street Smarts

How new strides in automation are revolutionizing operations.

By Mallory Bulman

InnerSpace provides insights into interior foot traffic and amenity usage with its web- and mobile-based software.

The term “smart building” has been part of the real estate industry’s vocabulary for years, but today, the definition depends on who you’re talking to.

“A smart building is different things to different people. Everybody has their own views typically derived from their own agenda,” noted John Nicholls, executive vice president at Delta Controls. “A smart building has a lot of possible elements, like a massive jigsaw puzzle.”

Matthew LoPresto, project architect & senior designer at interior architecture firm lauckgroup, sums up the idea this way: “A smart building is one that interprets the needs and preferences of the user and the environment—and makes required adjustments for maximum comfort and efficiency through a series of automated systems.”

Whatever the definition, proponents say that automated systems can pay off in saved energy costs, tenant retention, increased security and higher market value. Nevertheless, experts acknowledge that smart building technology has some distance to travel before reaching its full potential. “The growth in raw data collected (with smart technology) is phenomenal, but in most situations it’s being massively underutilized,” said Bryan Bennett, CEO of Cortex Building Intelligence. “This creates an incredible opportunity to improve building performance by making better use of data.”

Autopilot

Some veteran owner/operators have tagged smart buildings as an attractive new line of business. Last year, New York City-based Rudin Management Co. created Prescriptive Data, a new company that offers an integrated operating system powered by MongoDB and dubbed Nantum. Touted as the “brain” of a building, Nantum collects data about factors like weather, power demand and occupancy, and presents the information on a cockpit-style control panel.

Nantum draws on historic data gleaned from elevators and turnstiles to provide recommendations about operations. For example, turnstiles record information about occupancy that is relayed to the HVAC system, which, in turn, adjusts building temperatures.

Rudin and MongoDB tested the new system at 17 office buildings and two residential towers encompassing 10 million square feet and are marketing the technology to the industry at large. Savings in Rudin’s portfolio have ranged between 10 and 15 percent, which translates to between 40 and 50 cents per square foot, the company reported.

On the research side, the federal government is joining forces with a broad-based coalition of property owners in the Smart Energy Analytics Campaign. Launched in 2016 as part of the U.S. Department of Energy’s Better Buildings Initiative, the two-year program targets individual buildings at least 50,000 square feet in size, along with portfolios and campuses.

The campaign’s goal is to promote the adoption of Energy Management Information Systems (EMIS), building analytics programs that can identify problems and typically trim energy use by 10 to 20 percent. DOE estimates that universal adoption of EMIS in U.S. commercial buildings would save owners $4 billion annually.

Participants receive a technical consultation from Lawrence Berkeley National Laboratories in Berkeley, Calif. In October 2016, DOE announced the initial cohort of 18 partners representing about 1,800 buildings and 50 million square feet. Flagship participants from the commercial sector include the Kohl’s, Macy’s and Whole Foods Markets retail chains. Also participating are municipal governments, such as Boston, San Antonio and Arlington, Va., and major research universities.

Until very recently, the building management systems that monitor, manage and assess building system efficiency required the supervision and operation of skilled technicians. While there will always need to be some human intervention, today’s smart BMS solutions are streamlining energy usage while collecting data that reveals inefficiencies, damage or wear and tear.

Data gathered by automated systems produces valuable insights into foot traffic, heating and cooling preferences, and security, for example. However, monitoring problems in a single area does not a smart building make. Experts emphasize that only a comprehensive approach delivers the full benefits. “You can embed intelligence into the control systems, like an HVAC system, but it’s an isolated thing,” Steve Nguyen, vice president of marketing and product at tech company BuildingIQ, explained. “When you allow it to interface with the environment around it and tailor its responses (to be) unique to the building itself, that’s what I think of as a truly smart building.”

On the horizon are systems that will use data to fix minor problems on their own. “Not only will the building collect data but it will use the data to learn and correct itself accordingly,” said Aaron Meyerson, director of business operations for WiredScore, a program that rates connectivity in commercial buildings independently.

Up Close and Personal

Some observers argue that the industry lags in automating data collection in a way that helps predict the needs of occupants, visitors and guests. “You can use your phone for finding restaurants close by, hailing a cab, finding a date and catching Pokemon, but they only work outdoors, where we spend roughly 10 percent of our time,” said Jason Gamblen, founder of Innerspace. “Indoors, there is no equivalent service or experience.”

With that in mind, people are stretching the boundaries of smart buildings. Gamblen’s platform provides a dynamic map and information for interior spaces analogous to Google Maps. InnerSpace relies on cookies gleaned from visitors’ Internet use for recommending websites or saving login information.

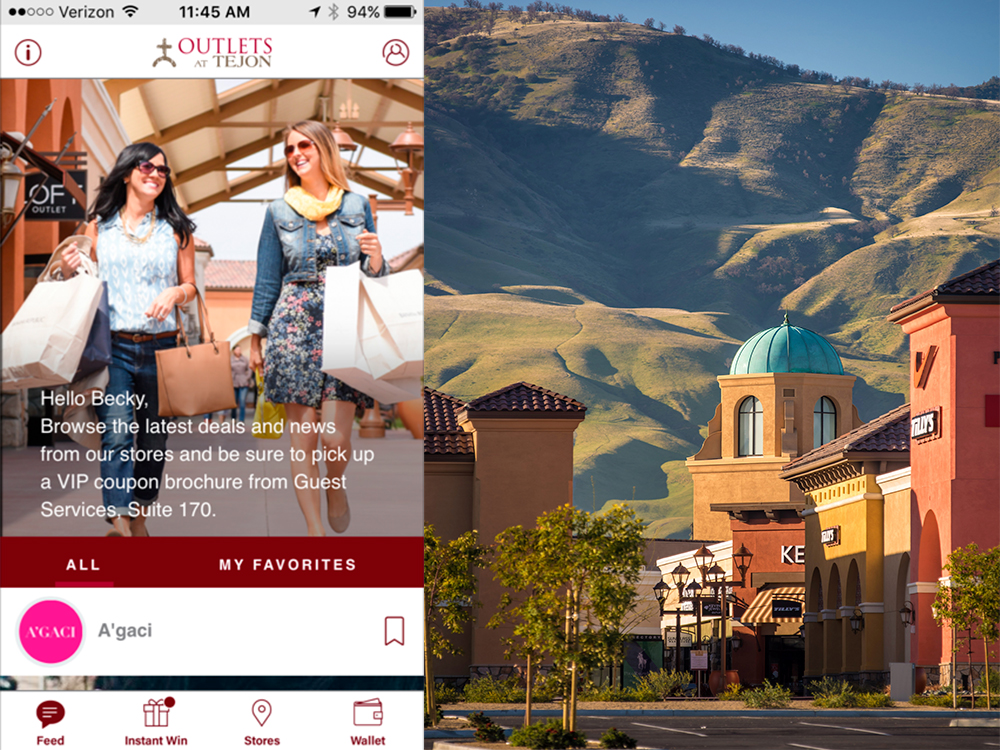

The Outlets at Tejon in Arvin, Calif., uses a smartphone app to provide directions around the outdoor shopping center as well as gauge consumer interest in particular stores. Photo by Reed Kaestner Photography

A similar principle is at work at the Outlets at Tejon in Arvin, Calif., an upscale 320,000-square-foot outdoor retail center that opened in August 2014. The property has its own app, where shoppers can connect to a map, information and social media accounts for the brands and stores. “I think you’re going to see a lot more of tracking customers (and) tracking their shopping habits,” predicted Hugh McMahon, executive vice president of commercial and industrial real estate for the property’s owner, Tejon Ranch Co.

“For example, when they come on to the property, we might be able to track which stores they frequented,” McMahon explained. The company is working with Apple to add a live map functionality to the app, so customers can navigate through the space easily, while Tejon Ranch Co. can use the information to inform its marketing and operational decisions.

That approach is a vast improvement over the first generation of smart technology for retailers, which tended to emphasize advertising rather than value, Gamblen contended. By offering a service in exchange for information, occupants in a space won’t think twice about downloading an app and thus providing location information, Gamblen explained.

“Now it’s about helping you get around the shopping mall, understanding which stores are open and where the bathroom is,” he noted. “That’s a lot of value and that’s a reason for consumers to want to download these applications and then engage with the property owner and the stores.”

Lauckgroup’s LoPresti envisions the applications for this technology in an office setting, where managers can track employee arrivals and departures or personalize room operations.“On the horizon, I see interior GPS technology becoming increasingly popular. This technology aids buildings in knowing where individuals are in the building and customizes conference room lighting and AV settings for the individual as they enter a room,” he said.

“Where it used to be about collecting data, it’s moving toward more tenant-focused flexibility and any uses of technology or data that allow for that flexibility,” Meyerson added.

Learning Curve

Industry insiders seem confident that smart buildings are the future of real estate, but exactly how the future will look remains unclear. “What we’re using now might be out of date in five or 10 years, so ensure that (tenants) can plug and play by swapping sensors in and out, (which is something) you’re going to have to adjust over time,” said Meyerson.

While it will be some time before the real estate industry as a whole comes around to the idea, self-sufficient buildings are on the horizon. “We’ll also see self-aware buildings that can diagnose, and possibly repair, plumbing, electrical or mechanical, and maybe even structural, system damage,” LoPresti said.

As with many such technological advances, the notion of turning over so much responsibility for operations to software and apps will take some getting used to. “Software supervision and control will eventually become the norm, but that’s a long transition, unfortunately,” said Nguyen. Many large commercial buildings are not functioning efficiency, and then “it becomes a question of will, resources and budget to how much one will fix or update the system.”

Deloitte Real Estate Predictions of 2017 contends that digital tools will be employed to resolve universal urban concerns, and McMahon concurs: “I think what we’re going to see is a smart community, as opposed to a smart building or a smart shopping center.”

Originally appearing in the March 2017 issue of CPE.

Correction: The March 2017 digital issue of CPE omitted Steve Nguyen’s full name and title. He is the vice president of marketing and product at BuildingIQ.

You must be logged in to post a comment.