SMG/Shamrock, W Capital Group Grab Former Golden Sands Development Site in Miami Beach

A joint venture between SMG/Shamrock and W Capital Group has acquired a vacant lot at 6901 Collins Ave. in Miami Beach from a subsidiary of Lehman Bros.

By Keith Loria, Contributing Editor

A joint venture between SMG/Shamrock and W Capital Group has acquired a vacant lot at 6901 Collins Ave., totaling .93 acres, in Miami Beach from a subsidiary of Lehman Brothers.

A joint venture between SMG/Shamrock and W Capital Group has acquired a vacant lot at 6901 Collins Ave., totaling .93 acres, in Miami Beach from a subsidiary of Lehman Brothers.

CBRE Hotels represented the seller in the transaction. The price was not disclosed.

The approximately one acre of developable land was originally the home of a former Golden Sands development site, boasting more than 125 feet of ocean frontage. It is adjacent to the Canyon Ranch Hotel & Spa. The development site received approval in 2005 to allow up to 40 residential units comprising 57,945 net sellable square feet, 2,887 square feet of retail and 55 parking spaces in a 20-story building.

“It is rare to find beachfront property fully entitled and ready to be built, hence the attraction,” Christian Charre, a senior vice president with CBRE Hotels, told Commercial Property Executive. “Furthermore, this property has a structure with historical designation, which can create further delays in the approval process. The fact that the seller went through the entitlement process and was able to deliver the site with these approvals is rare and very attractive to developers, shaving months and sometime years off the development.”

The joint venture plans to construct a boutique, luxury 20-story tower comprised of 14 exclusive residences. Each residence will be approximately 4,500 square feet and will occupy its own private floor. The penthouse residence will be 7,000 square feet and occupy the top two floors of the tower. All residences will boast stunning oceanfront and bay views.

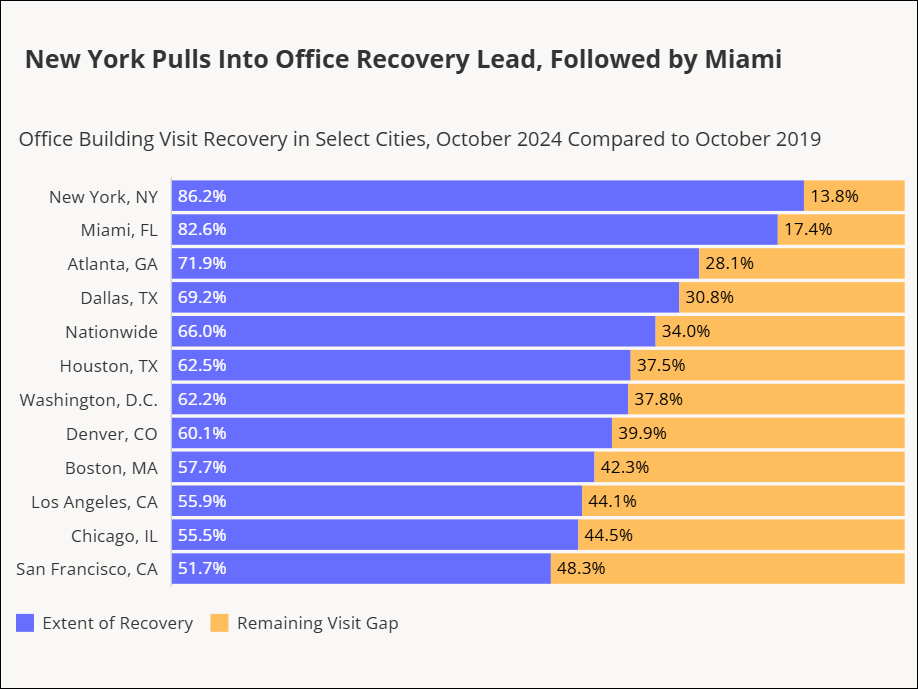

According to Charre, the north beach, which is changing rapidly since the canyon ranch was built, is quickly becoming an affluent destination in Miami Beach and many changes are coming to the area with multi-million dollar renovations of existing properties with new high-end residential products coming out of the ground in the near future.

“Miami Beach has become a primary market, attracting capital from the four corners for the world,” Charre added. “The current scarcity of beachfront sites in Miami Beach has increased the level of attention that this market receives from investors, which translates into a competitive environment among investors and creates a perfect opportunity for sellers.”

The groundbreaking is expected to occur in late 2014.

Paul Weimer and Natalie Castillo of CBRE Hotels and Robert Given and Gerard Yetming of CBRE Capital Markets, joined Charre in representing the seller.

You must be logged in to post a comment.