When Will Southeast Office Markets Stabilize?

Plus, the latest predictions on interest rate cuts and the impact of the presidential election on CRE, according to Avison Young.

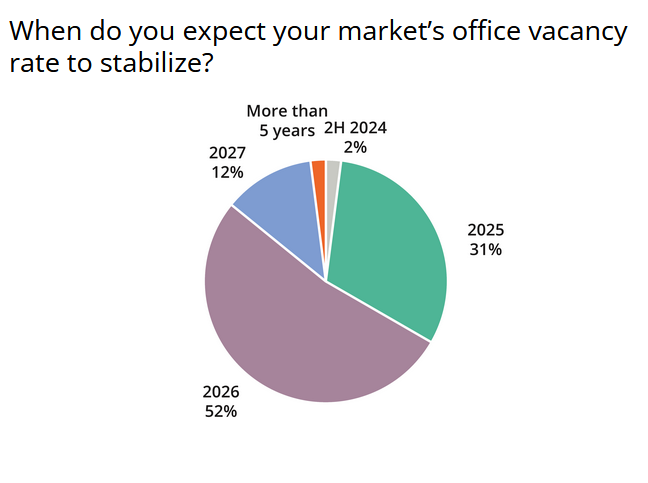

Office market vacancy in the Southeastern U.S. is expected to stabilize as soon as 2025, according to nearly a third of Avison Young brokers (31 percent) surveyed by their company, though a narrow majority—52 percent—say that the markets will have to wait till 2026 for stabilization.

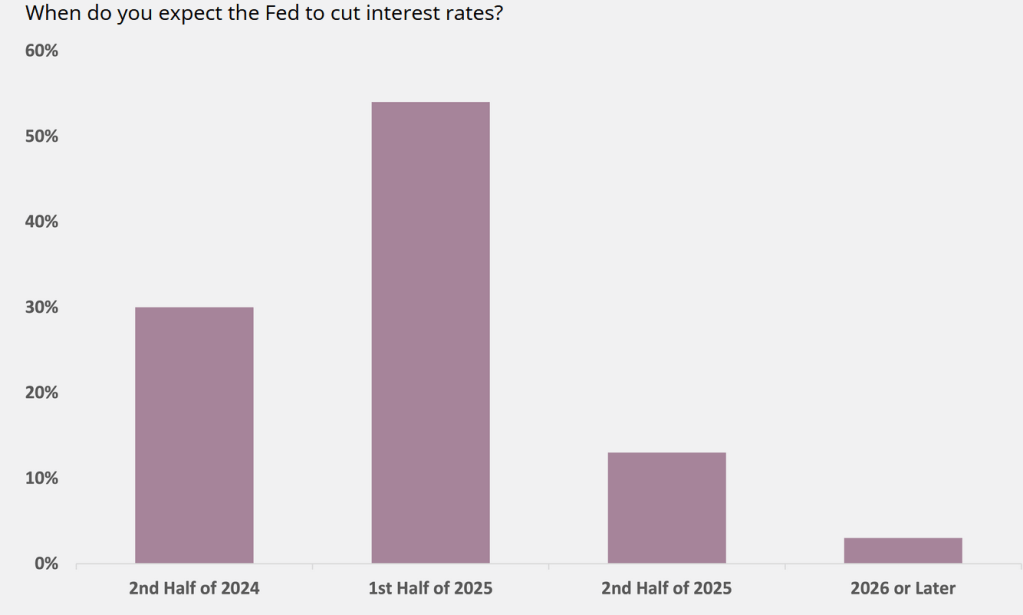

On the critical question of when the Federal Reserve might cut interest rates, the brokers were similarly divided between fairly optimistic, with about one-third positing it will be sometime in the second half of this year, and a little less optimistic, with more than half expecting a cut in the first half of 2025. More than 70 percent expect the Fed to cut rates between 0.25 percent and 0.50 percent.

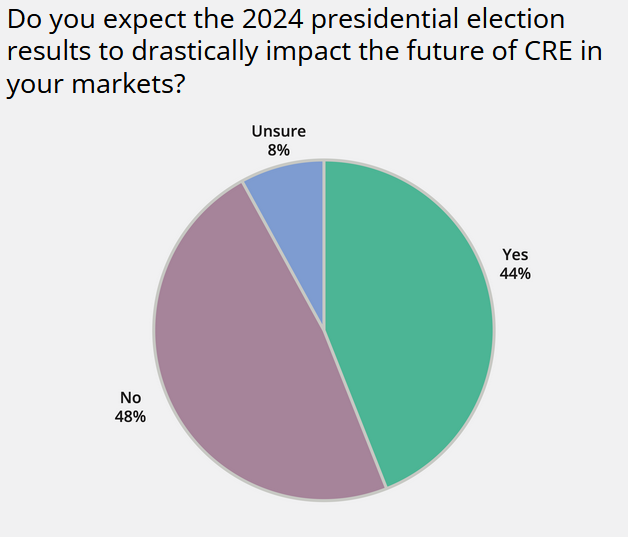

As for the impact of November’s election, 44 percent say it will “drastically impact” their markets, while 48 percent say it will not, and 8 percent are unsure.

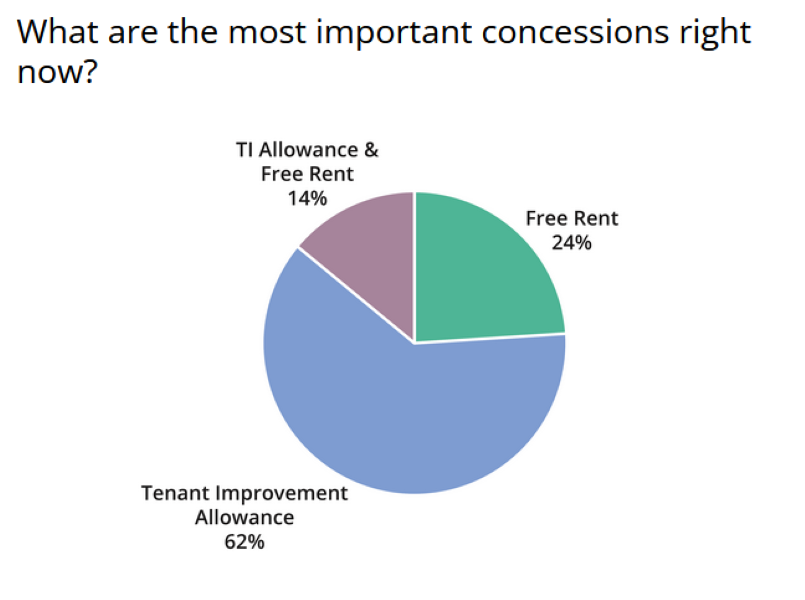

The brokers say that tenant improvement allowances are by far the most important concession in their office markets, with 62 percent of the respondents to the survey putting that first. Free rent is seen as most important by 24 percent, and a combination of both by 14 percent.

“The optimism expressed for the South Region is based on market conditions specifically, given the inbound population and business growth the region has been and still is experiencing,” Avison Young Principal and Regional Managing Director-South Region Chris Fraser told Commercial Property Executive.

READ ALSO: The US Needs CRE’s Power to Connect

The survey went to about 140 Avison Young professionals in Southeastern markets in Florida, Georgia, Tennessee and the Carolinas, and asked questions about office, industrial and retail markets.

The respondents aren’t entirely optimistic, however, with 87.5 percent noting that investor interest in office assets is either significantly down (57.5 percent) or slightly down (30 percent). Most see cap rates are higher than they used to be, with 17.9 percent saying significantly up and 43.6 percent slightly up.

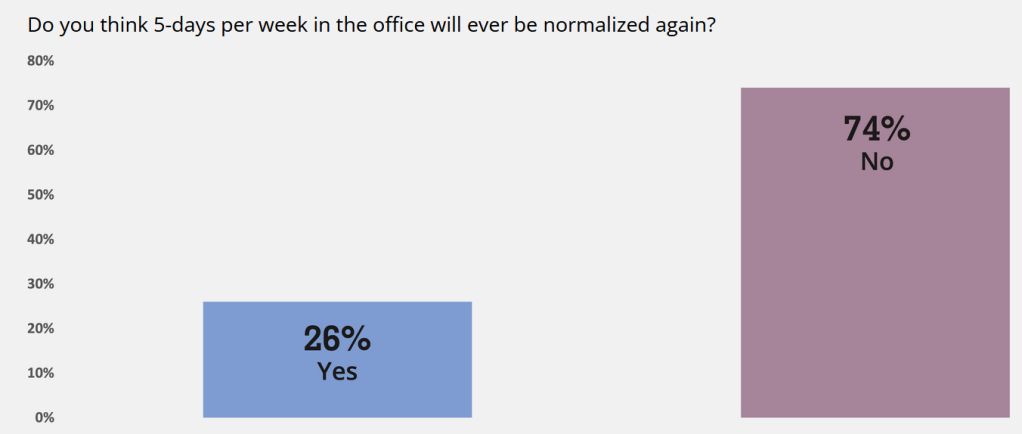

The brokers acknowledge the fact that the five-day work week is a thing of the past, with 74 percent saying that five says will never be normal again, and reporting that 95 percent of their clients have a two- to four-day in-office policy; only 5 percent are in the office five days a week.

The respondents were sanguine about rent growth in the industrial sector, with about half expecting 5 percent to 15 percent growth over the next 12 to 24 months. The other half expect growth of at least 5 percent, and no one expects a contraction. Some 31 percent of the respondents say that their clients are actively expanding their industrial footprint, while a majority (59 percent) say they will renew at the same sized space.

In the retail sector, respondents expect rents to continue to climb, but consumer spending will soften in the second half of 2024, according to an overwhelming 81 percent. Only 19 percent say consumer spending, which supports retail space absorption, will increase over the rest of this year.

Southeast growth outpaces nation

Population and economic growth have been pronounced in recent years in Southeastern markets. The trend is broad, with growth in the entire region since 2000 (and in fact before that) outpacing that of the U.S., according to the Bureau of Economic Analysis data. In 2023, the region’s population expanded by 1 percent, compared with only 0.5 percent for the U.S. as a whole.

Job growth since 2017 has been robust in a number of Southeastern metro markets, including Nashville, Tenn., Raleigh, N.C., Charlotte, N.C., and Charleston, S.C. In Nashville, one of the top economies in the nation, employment is up 14.2 percent since 2017. Greater Charlotte has seen 10.7 percent employment growth over that period, Charleston 11.6 percent and Raleigh 14.5 percent.

People are coming for jobs, but also for the relatively low cost of living, according to the Atlanta Fed. Though residents in the Southeast are facing rising costs—along with the rest of the nation—five out of the six states in the Atlanta Fed’s district were below the national average cost of living in 2023, the central bank reported.

You must be logged in to post a comment.