Specialist Insight: Brad Dockser, Green Generation Solutions

Brad and Debra Dockser wanted their real estate energy advisory firm to provide not just suggestions, but solutions.

By Leah Etling, Contributing Writer

Brad and Debra Dockser wanted their real estate energy advisory firm to provide not just suggestions, but solutions. With personal experience in commercial real estate portfolio management, they were very aware of the difference between a consultant’s advice and a fully implemented strategy – with measurable return on investment.

“We wanted solutions that were comprehensive and touched everything from the building envelope to mechanical systems controls, lighting, even policies and procedures and sequence of operations,” Brad Dockser said in a recent interview with CPE. “There’s no value creation in simply having a report – The value is in the solution being implemented and getting the savings.”

The goal of Green Generation Solutions (GreenGen), a Washington, D.C.- based company founded by the Docksers in 2011, is to provide such services for commercial real estate and government clients. With strategic partnerships in Europe and Japan, the young company has quickly expanded and is poised to continue to grow.

We talked with Brad Dockser, who started his career at JMB Realty and later co-founded Starwood Capital Asia and Starwood Capital Europe, about strategies for reducing energy use, adding value to an asset and measuring return on investment.

CPE: What challenges did you face when you started up Green Generation Solutions back in 2011?

Dockser: Early on, I think the biggest challenge was that people didn’t realize how much they spent on energy and how reductions in use could lead to tremendous cost savings. GreenGen could go in, make some strategic changes, and reduce their energy cost by 20-30 percent. Secondly, we could get rebates and incentives from utilities that might cover upwards of 20-30 percent of the project cost. That was also a great surprise for them.

CPE: In general, who are your clients?

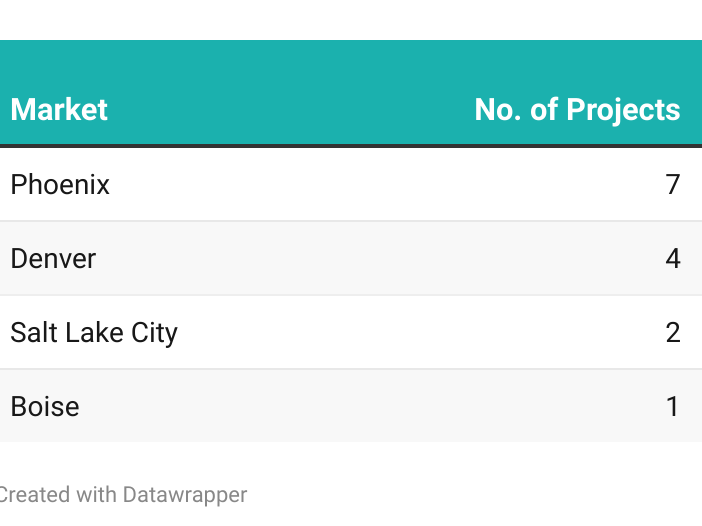

Dockser: The key to GreenGen’s business is to go beyond one-off projects and to do work with enterprise clients. Given my background, it is no surprise that our clients are largely real estate opportunity funds, REITS and private equity firms. We tend to be very portfolio/enterprise related. We’ve worked on large portfolios of shopping centers, on large portfolios of assisted living, and right now we’re working on something for a large public company – the pilot is 20 projects simultaneously across three states. We also have a large and growing business with the government, including the City of Washington, D.C., and the U.S. government.

GreenGen is also working with a hotel company that has more than 150 hotel properties to create an enterprise solution that not only delivers value, but can be scaled and implemented efficiently across their national portfolio.

CPE: Tell us about one of your most successful projects to date?

Dockser: We have been working on the Hyatt in Houston for several years. This is an older, 1,000-room hotel that had high-utility expenditures when it was acquired by a private equity firm. They noted that the utility spending was higher than they believed appropriate, and asked for help in reducing it.

Our assessment determined that there were multiple phases of a project that would improve efficiency. They had lots of old, low efficiency air handling units that ran 24/7 at full speed with no correlation to actual conditions. We replaced those and one-third of the project was paid for by CenterPoint, which is the Houston utility rebate administrator. We also put solar film on the hotel, to reduce the thermal load, and implemented an in-room control pilot for thermostat regulation.

The energy efficiency improvements resulted in a reduction in energy use of $1.25 million kWh per year. Cost savings on energy exceeds $150,000, and the payback period on the project was just 30 months.

CPE: Tell us about your international expansion?

Dockser: We made the decision to enter the European market because so many of our clients had assets in Europe. We are dealing with a lot of global investors and have worked on projects across Europe, in South America, and Japan. In Great Britain, GreenGen recently entered into a joint venture with BRE, a leading consultancy focused in the built environment that began life as the British government’s energy lab.

CPE: What will your early projects with BRE look like?

Dockser: BRE will work with us to carry out independent energy audits on buildings identifying quick win and long-term improvements that can be implemented. With a strong focus on delivering measurable commercial benefits, GreenGen will then provide cost and return data to clients based on the BRE recommended retrofit actions and manage the delivery of work for the clients.

CPE: How do you measure your success?

Dockser: Four years after establishment, we now do 80 percent of our work for repeat customers, and our current projects are taking one-half to one-third of the time from inception to implementation that the early projects took. Part of that is because from early on we very strongly believed in the importance of data. We did a lot of metering, sub-metering and data collection to prove out the projects GreenGen was doing and what savings our clients were getting.

We’ve built ourselves up by combining energy expertise with real estate expertise. This is about shifting the paradigm from thinking about energy as a cost, to thinking about energy as a driver of value.

You must be logged in to post a comment.