Starwood Closes Acquisition of 7 Malls from Taubman for $1.4B

Affiliates of Starwood Capital Group have acquired seven regional shopping malls totaling more than 7 million square feet of retail from Taubman Centers.

By Scott Baltic, Contributing Editor

Affiliates of Starwood Capital Group, Greenwich, Conn., have acquired seven regional shopping malls totaling more than 7 million square feet of retail from Taubman Centers, of Bloomfield Hills, Mich., the two parties announced Friday.

The seven malls, which went for a total of $1.403 billion, excluding transaction costs, according to Taubman, are:

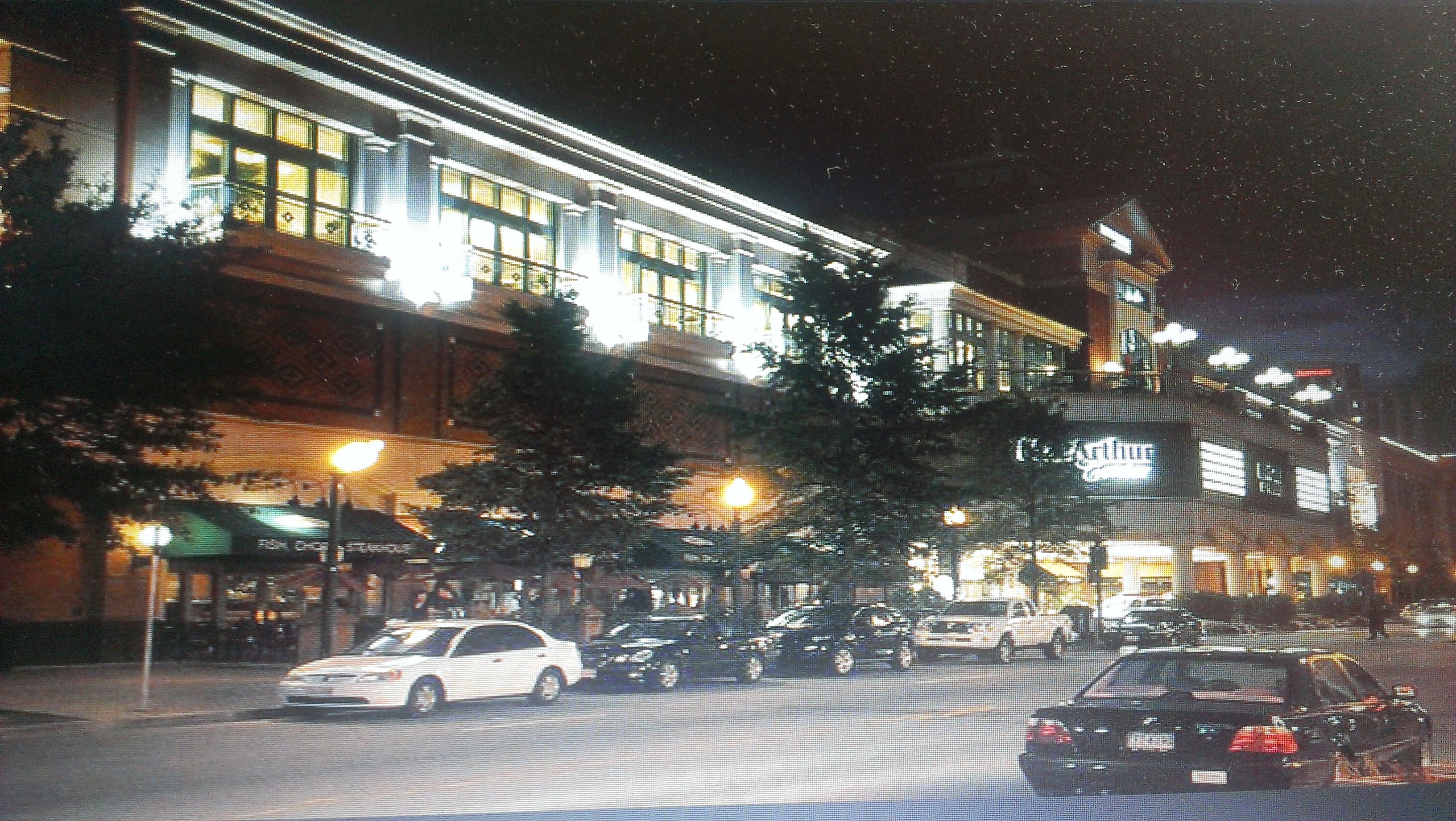

- MacArthur Center (Norfolk, Va.)

- Stony Point Fashion Park (Richmond, Va.)

- Northlake Mall (Charlotte, N.C.)

- The Mall at Wellington Green (Wellington, Fla.)

- The Shops at Willow Bend (Plano, Texas)

- The Mall at Partridge Creek (Clinton Township, Mich.)

- Fairlane Town Center (Dearborn, Mich.)

After the retirement of $623 million of property-level debt and accrued interest and $44 million of transaction costs, net cash proceeds were $736 million, of which Taubman’s share was $716 million.

The properties will be managed by Starwood Retail Partners, using the existing onsite management teams. Starwood Retail Partners will also perform all leasing services and, in conjunction with Starwood Capital Group, asset management functions.

“With the strategic addition of these seven assets to the Starwood Retail Partners platform, we have significantly increased the number of properties under our brand and expanded the square footage of our portfolio by approximately 38 percent,” Scott Wolstein, CEO of Starwood Retail Partners, said in a release.

The malls’ “high sales productivity is a strong complement to our portfolio,” Scott Ball, president & COO of Starwood Retail Partners, added in the same release.

As of press time, Starwood had not responded to Commercial Property Executive’s request for further information.

“The sale of these assets leaves our remaining portfolio significantly enhanced, with higher sales productivity and faster net operating income growth,” Taubman’s chairman, president & CEO, Robert Taubman, said in the REIT’s announcement. “It also allows management to focus on the company’s most strategic assets and development and redevelopment pipelines, where the greatest net asset value can be created.”

“[T]here was strong investor interest for this group of seven centers,” Taubman told CPE. “This transaction is consistent with our history and our strategy to continuously find ways to recycle capital for growth.”

Although specific uses for the net proceeds reportedly have not been determined, a portion of these funds are earmarked for a possible Section 1031 tax-deferred like-kind exchange, according to the Taubman release. It added that if a 1031 exchange can’t be arranged, a special dividend of up to $5 a share will be declared. The remaining net proceeds reportedly will be used for general corporate purposes and to reduce outstanding borrowings under Taubman’s revolving lines of credit.

“While we would like to complete a 1031 exchange and maintain all proceeds within the company, we would only buy an asset that is strategic to our portfolio,” Robert Taubman told CPE.

You must be logged in to post a comment.