Strong Deals and High Prices Keep LA Among Top Office Markets

The investment activity in Los Angeles commanded some of the highest prices in the country, CommercialEdge data shows.

Los Angeles’ office sector is ending the year with a new supply struggle, while investment activity picked up, placing the market among the most active metros in the country in terms of transactions, CommercialEdge data shows. The increase is paired with one of the highest prices in the nation, as Los Angeles was the third-priciest office metro in the country as of October.

With the rise of office vacancies across gateway markets, Los Angeles has fluctuated throughout the year, showing a slight improvement in September. Despite the difficult office landscape, there were some notable office leases that closed in the metro, with one of them dubbed the largest new office lease signed so far in 2024.

As of October, the metro had 1.5 million square feet of space under construction across 13 properties, representing 0.5 percent of the existing stock—nearly half the national rate of 0.9 percent. The metro only outperformed Chicago’s 0.3 percent among gateway markets. Boston led the fold with 4.3 percent, followed by Miami (2.9 percent), San Francisco (2.3 percent), Seattle (1.3 percent) and Manhattan (0.6 percent).

L.A. office development continues on large-scale projects

When it comes to square footage, the City of Angels’ pipeline outperformed Chicago in absolute numbers, too (1.9 million square feet under construction), as well as Washington, D.C. (2.3 million square feet), while Boston led the nation in this regard also, with 10.4 million square feet underway.

The largest office development currently underway remains the 731,250-square-foot Century City Center, developed by JMB Realty. Rising 37 stories at 1950 Avenue of The Stars, the Class A high-rise’s construction started in August 2023, with completion scheduled for early 2026. The project is financed by a $575 million construction loan provided by Crestbridge.

Another notable project is Echelon Studios’ 388,000-square-foot office component at 5601 Santa Monica Blvd. Developed by BARDAS Investment Group, in partnership with Bain Capital, the creative office and studio will be part of the companies’ two-building, 600,000-square-foot campus project. The development, backed by a $300 million construction financing, commenced construction last month and is expected to come online in April 2026.

Developers started construction on eight projects in the first 10 months of the year, totaling 419,000 square feet. With planned and prospective projects added, the metro’s pipeline reached 2.8 percent of total stock—still below the national figure of 3.2 percent but higher than Manhattan’s 2.5 percent.

Meanwhile, developers delivered 1.2 million square feet of space across 15 properties, with one of the largest being the 331,000-square-foot office building at 444 Universal Hollywood Drive in Studio City, Calif. Developed by NBC Universal, the 11-story Class A+ building was completed in September. The amount of office space delivered in the metro marked a 28.6 percent drop in year-over-year completions.

Los Angeles’ office inventory shows strong candidates for office-to-residential conversions

As developers and office investors struggle with high office vacancy rates and shifting market conditions, the interest in office conversions is picking up across the nation. The Conversion Feasibility Index is a new tool developed by CommercialEdge that shows property-level scores based on a comprehensive list of building features, assessing the building’s potential for residential conversion.

The index showed that in July, Los Angeles had more than 20 percent of its existing office inventory as solid candidates for residential conversions, above the national average of 14.8 percent of total stock.

Some examples of planned office-to-residential conversions include the makeover of 6380 Wilshire Blvd., a 150,246-square-foot office building in the metro’s Wilshire Corridor submarket. Jamison Services, a prolific developer of office to apartment projects in Los Angeles, filed plans last year to convert the 1967-built property intro a 210-unit residential community. CommercialEdge data shows a CFI score of 79 points, making it a Tier II candidate.

Jamison Services is now converting the 18-story South Tower of The Towers on Wilshire office campus, with plans to add 255 residential units and an extra 19th floor. The 217,406-square-foot office property originally came online in 1961 at 695 S. Vermont Ave. CommercialEdge shows a CFI score of 81 points, making it a Tier II property.

Pricey deals put LA among best-performing metros

More than 10 million square feet across 53 office properties changed hands in the metro for a total of $1.8 billion through the first 10 months of this year, with Los Angeles ranking fourth among the best-performing metros in the U.S. The investment volume marked a 30.6 percent year-over-year increase—way above the national average of 4.1 percent but almost the same as last year’s data.

Across peer markets, the metro’s investment activity outperformed those of Boston ($1.1 billion), Chicago ($987 million), Miami ($983 million), San Francisco ($722 million) and Seattle ($668 million), while Manhattan led the rankings with $3.3 billion in sales.

Significant sales included the $185 million acquisition of 2220 Colorado Ave., a 201,006-square-foot office building in Santa Monica, Calif., occupied by Universal Music Group. The property was acquired by Drawbridge Realty from Clarion Partners, after 20 years of ownership.

Another notable deal was the $141.5 million sale of 9536 Wilshire Blvd., a 178,174-square-foot office property in Beverly Hills, Calif. The property is part of Wilshire Rodeo Plaza, a 300,000-square-foot office-and-retail asset spanning an entire city block. The Mateen Brothers, including Tinder founder Justin Mateen, acquired the asset from Nuveen as part of a $211 million deal, marking the largest property deal in this submarket since 2019.

Office assets in Los Angeles traded at an average sale price of $354 per square foot—above the national average of $177 per square foot and higher than the prices recorded in Manhattan ($344 per square foot), Seattle ($263 per square foot) and Washington, D.C. ($225 per square foot). Los Angeles ranked third across the priciest office markets in the U.S., with San Francisco leading ($392 per square foot) and Miami following ($369 per square foot).

Vacancy still on the rise, despite large leases

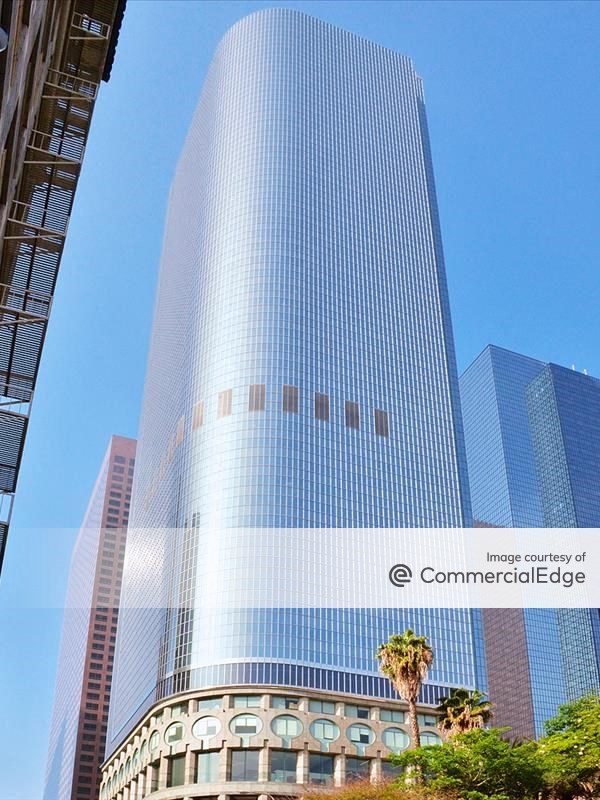

Los Angeles’ office vacancy fluctuated in 2024, but as of September it stood at 16.3 percent. One significant deal that closed recently is CIM Group’s 198,553-square-foot lease in downtown Los Angeles, at its City National 2CAL, a 1.4 million-square-foot skyscraper. The tenant is Southern California Gas Co., which will use the space at the property as its new headquarters. The deal is the largest new office lease signed so far in 2024.

Cruzan signed a 32,241-square-foot deal at its Wilshire & Pal, a creative office building totaling 110,000 square feet in Beverly Hills. The tenant is global music company Concord, which will move its Los Angeles office to the redeveloped property.

The largest lease extension in the metro remains Snap Inc.’s 467,000-square-foot deal at Santa Monica Business Park. The tenant signed a 10-year commitment at the 1.2 million-square-foot creative office campus, owned by BXP, where it was a tenant since 2017.

Los Angeles is still a coworking hotspot

As of October, the coworking sector in the City of Angels consisted of 6.5 million square feet, ranking as the fourth-largest flex office hub in the country after Manhattan (11.2 million square feet), Chicago (6.8 million square feet) and Washington, D.C. (6.7 million square feet). Other gateway markets with significant coworking footprints included Boston and San Francisco, with 4.8 million square feet and 3.6 million square feet, respectively.

Year-to-date through October, the flex office provider with the largest footprint in the metro was Regus (735,656 square feet), followed by WeWork (709,408 square feet), Spaces (594,194 square feet), Premier Workspaces (517,623 square feet) and Industrious (427,407 square feet).

The latter signed a 19,000-square-foot lease in Century City, Calif., in April at Watt Cos.’ North Tower of Watt Plaza, a 476,120-square-foot office property. The flex office provider entered into a 10-year agreement for a full floor of the property. During the same month, Industrious also opened a new 20,752-square-foot coworking location in Westwood, Calif. The flex office space is at Douglas Emmett’s Westwood Center, a 333,830-square-foot property.

You must be logged in to post a comment.