Strong Supply Takes Toll on Self Storage Rent Growth

Accelerated construction has dampened growth across the U.S. during the past couple of quarters, with rates declining in several large markets. Nonetheless, a number of key metros continue to offer development opportunities.

By Evelyn Jozsa

Despite a 5 percent year-over-year rent growth in the fall of 2017, the continuous delivery of new self-storage facilities, as well as slowing economic fundamentals, dampened rent growth over the past couple of quarters. On a national level, street-rate rents for 10×10 units actually dropped 1.7 percent as of May 2018.

Nonetheless, western markets remained strong, with Las Vegas and Phoenix reaching growth in the 7 to 10 percent range. Additionally, Southern California rents continue to gradually increase due to limited opportunity for new development in Los Angeles and San Diego.

A mixed basket

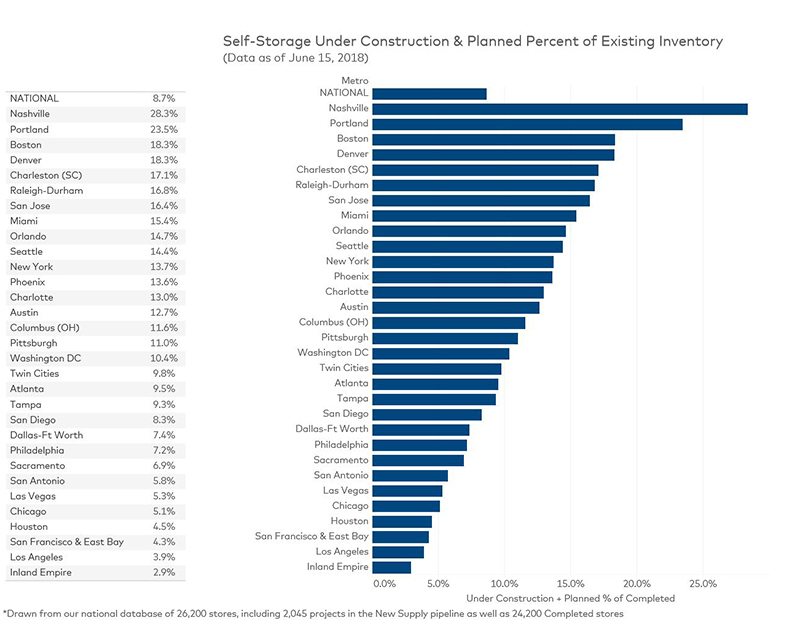

Rents were down in Texas self-storage markets, where the net rentable square feet per capita ratio is significantly higher than the 5.5 national figure. Metros such as Houston and San Antonio, with 9.1 and 8.0 net rentable square feet per person, now have reduced pipelines, equating to about 5 percent of existing inventory. For the whole country, planned and under construction projects account for 9 percent of the total self-storage inventory. According to Yardi Matrix, this figure is bound to remain around the 8 percent mark.

Millennials are the ones fueling new supply in metros such as Nashville, Portland, Denver and Raleigh-Durham, where the rate of population growth is double compared to other important cities, including New York and Chicago. Nashville has the largest rate of planned or under construction projects (28.3 percent of inventory), with Portland ranking second (23.5 percent) and followed by Boston (19.1 percent) and Denver (18.3 percent). Taking a look at the opposite end, Los Angeles (4.0 percent) and Inland Empire (2.9 percent) ranked at the bottom of the list.

Read the full Yardi Matrix report.

You must be logged in to post a comment.