Suburban DC Mixed-Use Project Prepped for TIF Financing

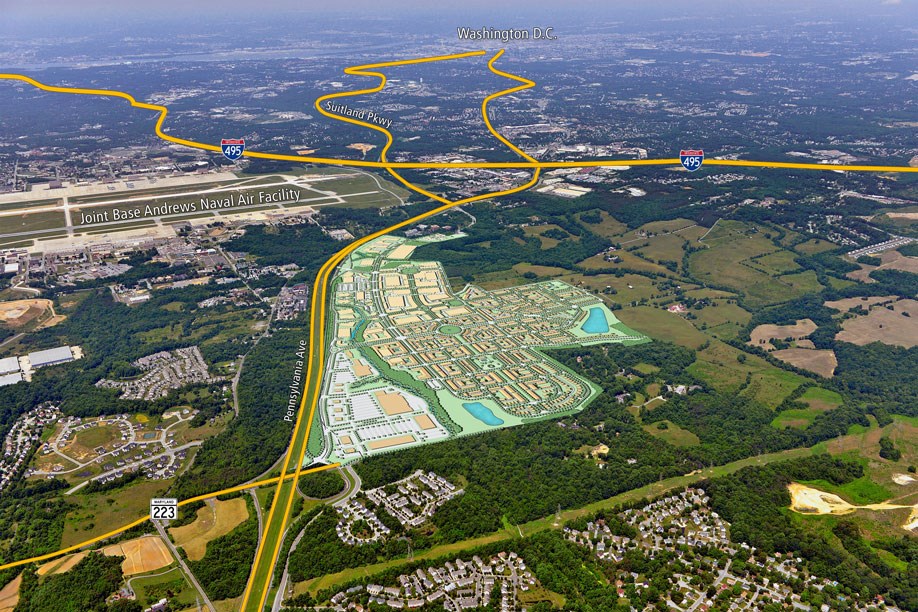

The 310-acre Westphalia Town Center will ultimately feature residential, retail, office and hotel space.

By Barbra Murray, Contributing Editor

Upper Marlboro, Md.—Walton Westphalia Development Corp. just received good news pertaining to its 310-acre Westphalia Town Center project in Upper Marlboro, Md., just outside Washington, D.C. In a unanimous vote, the Prince George’s County Council gave the green light for the formation of the Westphalia Town Center Development District and the Westphalia Town Center special taxing district.

“This is a very positive and exciting development for the corporation and the Westphalia project and will significantly assist in the financing of the development thereof,” as was noted in a press release issued by Walton Westphalia.

Ground broke on Westphalia Town Center in 2013 with clearing and grading activities in preparation for Phase I, which will feature 745 residential units, including 400 apartments and 345 townhomes; 300,000 square feet of retail space; and a 110-key hotel. Residences are the first segment of the multi-faceted project to sprout up, courtesy of NVR Inc., parent company of Ryan Homes, and Haverford Homes.

The Council’s recent decision paves the way for the eventual issuing of tax increment financing bonds, which would yield proceeds for the financing of transportation infrastructure surrounding the mixed-use project. Walton Westphalia has presented county officials with a proposal calling for the selling of the bonds in three series over the life of the Westphalia Town Center development. Prince George’s County and third-party consultants plan to perform due diligence on the project and the TIF financing proposal over the next few months. If all goes as planned, Walton Westphalia could see proceeds from the first series of bonds by the close of the second quarter of 2017.

Walton Westphalia is pursuing other means of financing for Westphalia Town Center as well. Working with Maryland Center for Foreign Investment LLC as a partner, the company is looking to the Federal EB-5 Immigrant Investor visa program, which could provide as much as $58 million in immigrant investor debt. “Currently, the blended interest rate on our Phase I construction debt is above 8 percent. If we are successful with the EB-5 program, we anticipate that the blended interest rate will be lowered to 5.25 percent,” Walton Westphalia noted in a press release on its fourth quarter 2015 results.

As for the aforementioned Westphalia Town Center construction debt, Walton Westphalia announced last month, on Oct. 14, that it had obtained a 30-day extension on a $23.2 million senior loan and an $11 million mezzanine loan, which had been scheduled to mature October 15 and October 21, respectively. The news spawned a rumor that the extensions constituted a move by Walton Westphalia to avert the development’s foreclosure—rumors the company immediately dispelled. “Walton wishes to be clear that the loan extensions…are solely the result of it looking to finance the Westphalia project in a different manner and requesting its lenders to work with the corporation to manage the timing gap between the current loan maturities and the timing of potential new financing,” the company disclosed in a prepared statement.

The multi-phase development of Westphalia Town Center is planned to take place over a two- to three-decade period, according to the Prince George’s County Planning Department. There’s a reason for the long construction timeline—ultimately the live-work-play destination will feature as many as 5,000 residential units, as much as 1.4 million square feet of retail space, 2.2 to 4.5 million square feet of office accommodations and three hotels totaling approximately 600 rooms.

You must be logged in to post a comment.