Surging Law Firm Leasing Provides Office Sector Bright Spot

As workplace strategies become clearer, activity is expected to remain strong.

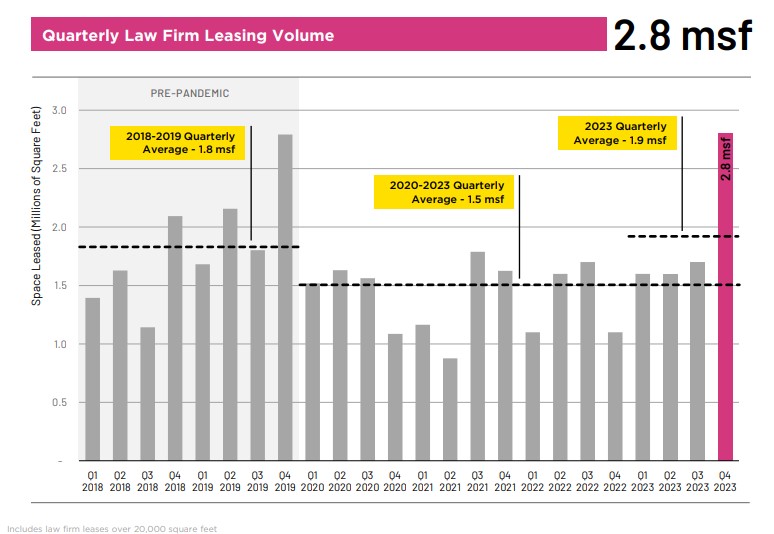

Fourth-quarter leasing by U.S. law firms surged to its highest levels since 2019, as velocity rose 45.1 percent in 2023 compared to the previous year, and 2.8 million square feet of space was leased.

That good office news came from Savills, which analyzed law firm transactions over 20,000 square feet across key markets for its latest U.S. Law Firm Activity Report.

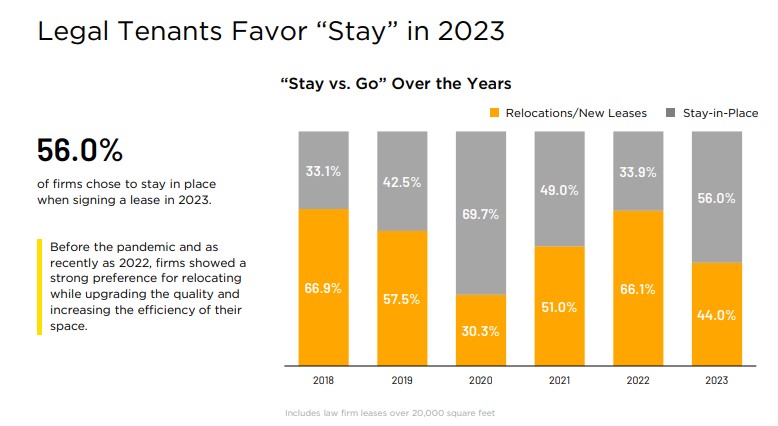

The majority of the firms—56 percent—chose to stay in place while expansions made up 43.6 percent of relocations and renewals in 2023.

Last year, 7.8 million square feet of office space was leased by law firms, the highest annual total since 2019, when 8.4 million square feet was taken. The robust final quarter pushed 2023 to the highest post-pandemic quarter recorded but Savills stated consistency played a crucial role throughout the year as leasing activity exceeded 1.5 million square feet each quarter. The average quarterly leasing activity last year was 1.9 million square feet, up by 0.5 million square feet from the 2022 quarterly average of 1.4 million square feet.

READ ALSO: What Workers Want Now in Office Design

“The timing of real estate transactions is typically driven by lease expirations. During the pandemic, firms held off on negotiating as they waited to see what the future held. Now that many firms’ workplace strategies are becoming clearer, they are making long-term decisions with more and more confidence,” Thomas Fulcher, Savills vice chairman, Mid-Atlantic region lead & director, told Commercial Property Executive.

“Whether rightsizing, growing or keeping space ‘as is,’ firms need to respond to their expiring leases or take advantage of current market conditions,” he said.

Fulcher said he expects law firm leasing to continue to be strong moving forward.

“Firms are committing to office space as essential to the long-term health of their organizations and requiring their professionals, some more aggressively than others, to be in the office at least three days per week,” Fulcher told CPE. “At that level of attendance, it is inefficient to give up too much space if everyone who is coming in that amount gets their own office. However, firms continue to push to be more efficient with their space. We are seeing more commonly increased hoteling and doubling up of associates in an office.”

Stay or go?

When it came to deciding on whether to move to new space last year, Savills found a majority of law firms stayed put rather than relocate when it was time to sign new leases. The 2023 statistic was 56 percent stay in place versus 44 percent for relocations/new leases. That was the highest percentage since the beginning of the pandemic in 2020 when 69.7 percent of firms chose to stay in place versus 30.3 percent relocations/new leases. In 2022, Savills found 66.1 percent of firms chose to relocate and 33.9 percent stayed in place when signing a lease.

“Before the pandemic, and as recently as 2022, firms showed a strong preference for relocating while upgrading the quality and increasing the efficiency of their space,” the report stated.

Savills points to several contributing factors for the higher percentage of firms hesitant to move in 2023:

- The number of newer, high-quality building options is limited in most markets.

- The cost of tenant improvements has risen significantly over the last three years.

- Many landlords face debt issues and improvement capital is scarcer than in recent years.

Office footprint, lease term trends

Firms signing leases of more than 20,000 square feet were expanding more in 2023 than in 2022. The analysis showed 43.6 percent of relocations and renewals signed in 2023 were expansions in size versus 28.5 percent the previous year. Savills stated 27.7 percent of the lease signings had negligible changes in size and 28.7 percent were downsizes.

On average, expanding firms increased their footprint by 24,193 square feet, while downsizing firms contracted by an average of 40,577 square feet, according to the report. The net change in footprint of all relocations and renewal transactions was down 61,994 square feet.

READ ALSO: Where to Find the Bright Side of Office

Another change observed in last year’s leasing numbers was term length. Lease terms fell during the pandemic as more firms took a ‘wait and see’ approach, extending their leases for short terms rather than committing to long-term leases. Starting in the first quarter of 2022, the average lease term began picking up again in most core law firm markets. Chicago, Dallas, Los Angeles, New York, San Francisco and Washington, D.C., are among the markets seeing terms rising as of the fourth quarter of 2023. Boston and Houston were the only core law firm markets that saw average lease terms flatten or fall in the fourth quarter.

New York City’s legal sector tops the charts

New York City saw the most amount of legal sector leasing in 2023, with the top five largest law firm leases of the year, according to Savills. Downtown Chicago came in second to New York with the most legal sector leases and total square feet signed for the year. Other top 10 markets last year were Washington, D.C., Los Angeles, Seattle, Houston, San Francisco, Philadelphia, Atlanta and Northern New Jersey.

Law firm Paul Weiss, Rifkind, Wharton & Garrison LLP’s relocation to 1345 Ave. of the Americas, where it took 765,931 square feet, was the largest legal sector transaction for the fourth quarter, the year and the largest since the pandemic. It was also the second-largest overall office transaction for the year. The new lease marked a 42.4 percent expansion from the firm’s 2009 renewal transaction at 1285 Ave. of the Americas, where it did some additional expansion before eventually signing the new lease in the fourth quarter of 2023 for the larger space.

Prior to the Paul Weiss deal, Davis Polk & Wardell had signed the largest New York City office lease for 2023. The firm signed a long-term lease extension and expansion totaling more than 700,000 square feet at 450 Lexington Ave. Davis Polk added an entire floor to its footprint for 25 years.

The other top legal sector leases signed in the fourth quarter of 2023 were: Dentons, renewal,159,522 square feet, 1221 Avenue of the Americas, New York City; Perkins Coie LLP, relocation, 150,962 square feet, 1301 2nd Ave., Seattle; Quinn Emanuel Urquhart & Sullivan LLP, relocation, 295 Fifth Ave., New York City; and Sheppard Mullin, relocation, 119,217 square feet, 350 S. Grand Ave., Los Angeles.

You must be logged in to post a comment.