New York REIT Inc.

Woodstock Buys Out Partner in $88M San Francisco Deal

TPG Capital provided a loan for the acquisition of the remaining stake.

SL Green Inks Lease at Worldwide Plaza

The management and tech consulting firm will occupy an entire floor in the 49-story skyscraper under a 10-year agreement with the landlord.

Avison Young Leases 45 KSF at Manhattan Office Tower

Principal Todd Korren, Senior Director Brooks Hauf and Associate Peter Johnson represented the building’s owner in the lease transactions.

Columbia Property Trust Brings Manhattan Office Asset to Full Occupancy

Drive Shack signed for the last available floor of the 165,586-square-foot building. The current owner acquired the property in 2017, as part of a portfolio deal.

Manhattan’s Top 10 Office Deals of 2017

Although the first and last quarters of 2017 saw a decline in sales volume, the borough remains one of the priciest and most sought-after markets in the world.

Liquidation of New York REIT Accelerates

In a $520 million deal, the company sold 1440 Broadway, a LEED Gold-certified office building in Manhattan, to CIM Group. The transaction is accompanied by plans to sell three more buildings, soon after the announcement of yet another disposition, as the company winds down.

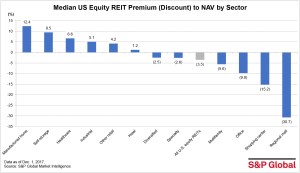

Regional Mall REITs Trade at Largest Discount to NAV

Retail REITs continue to be challenged, with the regional mall sector and shopping center sector trading at discounts of 30.7 percent and 15.2 percent, respectively, according to S&P Global Market Intelligence data.

New York REIT to Sell NYC Office Tower for $255M

The agreement to sell the 345,000-square-foot building at 333 W. 34th St. to Brookfield marks yet another step forward in the REIT’s plan of liquidation.

Investcorp Makes $156M Manhattan Office Buy

The firm joined forces with Brickman to acquire two assets totaling 267,000 square feet. The Midtown Manhattan properties are fully occupied by more than 20 long-term tenants.

M&T Bank, Natixis Co-Lead $195M NYC Office Refi

SL Green, New York City’s largest office landlord, and PGIM, the global investment management arm of Prudential Financial, purchased Tower 46 in 2014, with the help of a bridge loan from Wells Fargo.