Tale of Two Sectors: Public Market Outlooks for Industrial and Office

While private market valuations remain uncertain, public REITs are offering guidance, observed Todd Kellenberger of Principal Asset Management.

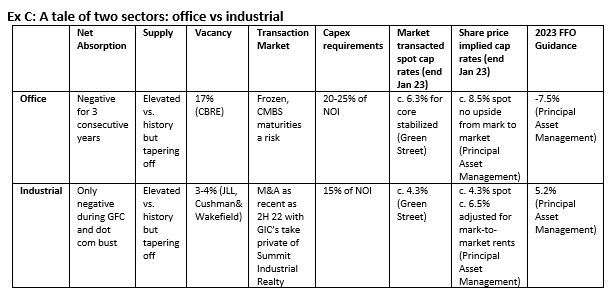

Industrial and office REITs lagged the broader US REIT market last year. Industrial suffered from concerns over greater property valuation downside sensitivity to rising bond yields given the ultra-low cap rates on industrial assets. Office, on the other hand, saw the continuation of a structural de-rating that started five years ago. Current public valuations are telling a very different story about the outlooks for both.

What Public Valuations Tell Us

As of January 2023, consensus Net Asset Values (NAVs[1]) for office REITs had fallen 16 percent from the end of December 2021. The sector was trading at a 42 percent discount to NAV, implying spot capitalization (cap) rates of 8.5 percent on average for the sector. Meanwhile, consensus NAVs[2] for industrial REITs were down 5 percent since the end of December 2021. The industrial sector was trading at a 2 percent discount to NAV or an implied spot cap rate of 4.3 percent [3].

For office, this suggests public markets are pricing in a circa 30-to-35 percent decline in capital values from the end of 2021 and a bleak longer-term growth outlook. For industrial, the implication is that private real estate values are likely to hold relatively resilient despite the ongoing risk of cap rate expansion. This resilience, however, can only be justified by strong forward growth prospects.

What REIT CEOs Tell Investors About Office

In the office sector, after a disappointing 3rd quarter 2022 report card that saw a spate of earnings misses, guidance downgrades, and hefty dividend cuts from highly levered REITs, such as SL Green Realty and Vornado Realty, it was encouraging to see recent 2022 4th quarter results come in broadly in line. Improving utilization rates was another small positive, as “return to office” momentum is improving amid a weakening job market.

That said, the outlook remains murky. The sector remains highly levered with limited top-line growth. Earnings guidance is still coming in slightly weaker with funds from operations (FFO) expected to fall 7.5 percent in 2023 as higher interest costs bite into earnings. Leasing volumes remain light, occupancy is under pressure, and pricing power is weak. Meanwhile, a potential wave of loan defaults appears to have started with Vornado and Paramount Group discussing loan restructurings with lenders.

The commentary from office REIT CEOs speaks for itself. Here’s Boston Properties CEO Owen Thomas:

- “Notwithstanding the running debate on whether the US economy will experience a hard or soft landing, commercial real estate markets are currently in a recession.”

- “Overall demand that we serve is unlikely to be growing the overall footprint in 2023, aka, it’s hard to see much in the way of positive absorption.”

And here’s what Vornado Chairman & CEO Steve Roth and President & CFO Michael Franco tell investors:

- “Capital is scarce, and that’s an understatement.”

- Regarding a default on a $450m loan on a Fifth Ave retail property: “the asset is not re-financeable today.” “But that’s the benefit of non-recourse debt … we have the option to walk away.”

- On hybrid work: “Friday is going to be a holiday forever. Monday is touch-and-go.”

What They Say About Industrial

Industrial demand, on the other hand, has normalized after two years of a pandemic-induced frenzied market. Notwithstanding a modest slowdown in the 4th quarter, demand has picked up again and remains robust, driving modest earnings beats. Earnings were strong across the board with nearly fully leased portfolios (98 percent or higher), 35 to 50 percent cash leasing spreads, and mid-single digit same-store net operating income and FFO growth. Elevated supply has yet to impact rent growth, which is still forecasted to be 5 percent, even in markets with more supply (e.g. the Midwest), and a much higher 10-15 percent for coastal and Southern Californian markets, where vacancy remains under 1 percent. Guidance was modestly below expectations, but this was largely due to conservatism and one-offs.

Therefore, industrial REIT CEO commentary was a stark contrast from office commentary. Here’s, Prologis Chairman & CEO Hamid Moghadam:

- “My bet would be a surprise on the upside over our assumptions (of 10 percent market rent growth). Not the other way around.”

- “Even if absorption goes to zero…. you will be under 5 percent vacancy, which used to be considered a great, strong market.”

- “I don’t think there will be a lot of forced sellers in industrial.”

His optimism was echoed by Rexford Industrial REIT Co-CEO Michael Frankel:

- “Infill Southern California continues to experience a virtually incurable supply-demand imbalance”

- “We believe there is potential for upwards of 15 percent market rent growth this year”

- “We’ve seen a pickup in activity since the beginning of the year”

What Public Market Signals Mean for Private Valuations?

For office, more likely than not, there is more scope for private valuations to catch down to those implied by the public markets. A wave of CMBS maturities will hit the market in 2023-24. With limited to no appetite from lenders to refinance, this could cause a wave of distressed sales. Right-sizing of space due to hybrid work is also likely to play out over several years creating a slow-motion train wreck for net operating incomes. The bifurcation of demand from flight to quality, highly amenitized buildings constructed to exacting environmental standards could result in many Class B/C buildings held in the private domain to become obsolete while higher quality Class A could be relatively resilient. Incremental capital deployment by office REITs is NOT going back to the office sector, a worrisome signal for the market. Office REITs are branching into life sciences, apartments, and even gaming; anything but office. This must mean office returns remain unattractive given the uncertain outlook and elevated cap-ex needs for the sector.

Industrial valuations, despite the strong long-term fundamentals, are declining. Prologis is shading down its appraised industrial values (-7 percent in 2H 2022 with further declines guided in 2023). That said, we are likely closer to the point where valuations should find support from significant embedded organic growth as maturing leases get marked to market 30-50% higher than expiring rents. This strong embedded rent growth should allow recent transaction cap rates (c 4.3 percent [1]) to “grow” into the 5 percent range within a couple of years. It will also cushion the impact of any cyclical economic slowdown.

Ex C: A tale of two sectors: office vs industrial

[1] Green Street

In conclusion, public market valuations are telling us that it is the best of times for the industrial market, and the worst of times for office. The direction of travel certainly seems right, although there remains quite a bit of ambiguity over the ultimate landing for private capital values. Our best guess is that the floor for office capital values is still some ways away from current transaction values. Conversely, recently transacted industrial values should be closer to finding a base if the signals from the public market are right.

Todd Kellenberger, CFA , is client portfolio manager, Real Estate Securities, for Principal Asset Management.

This article is for discussion and educational purposes only and should not be relied upon as a forecast, research or investment advice, a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are subject to change without notice. References to specific securities, asset classes and financial markets are for illustrative purposes only and should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances before making an investment decision. Investing involves risk, including possible loss of principal.

[1] Factset consensus

[2] Factset consensus

[3] Factset consensus, Principal Asset Management; office data exclude life science assets.

You must be logged in to post a comment.