Trump 2.0 Turns CRE’s Attention to Tax Policy

With the clock ticking on many provisions, executives are locked in.

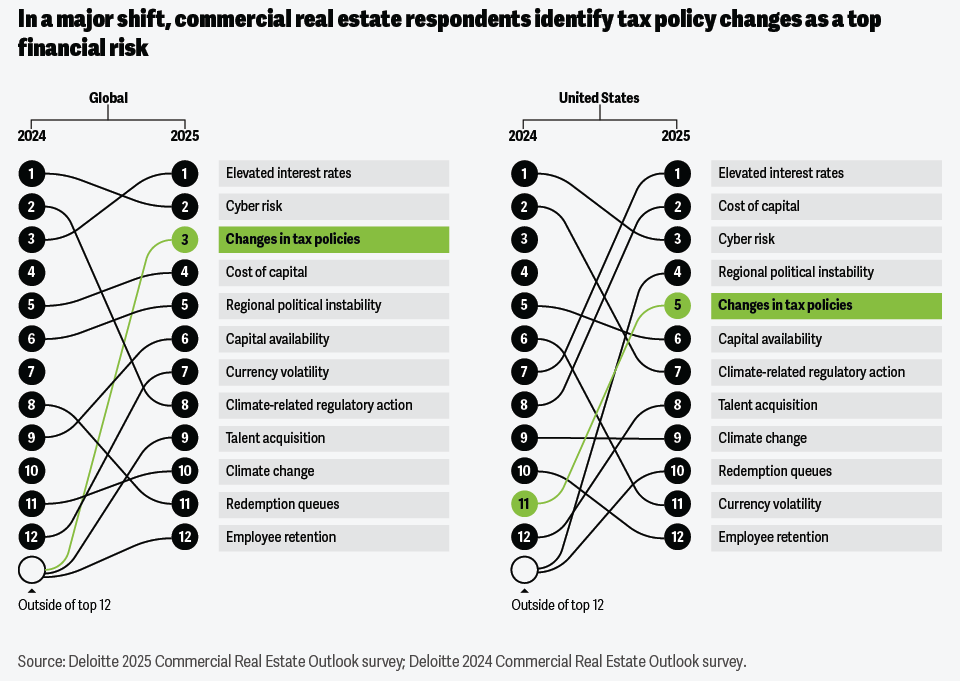

Concern is growing in commercial real estate regarding the potential effects of the Trump Administration’s tax policy, and recent Deloitte research backs this up. Tax policy has risen among the top five macro concerns as part of the company’s 2025 outlook survey. That was up from the 11th spot last year. Globally, tax policy saw an even stronger rise, landing in third place.

While nothing concrete has popped up yet, expirations related to the Tax Cuts and Jobs Act of 2017 are putting the spotlight on Congress right now, as some of these provisions are slated to expire by year-end.

“While it may seem too early to consider them today, provisions within the TCJA are expiring, and there will be changes coming,” Tim Coy, real estate research manager at the Deloitte Center for Financial Services, told Commercial Property Executive. “Get ahead on planning for all scenarios so there isn’t a last-minute scramble to respond.”

READ ALSO: The Trump Effect on Tariffs, Taxes, T-Bills

Any changes to corporate tax rates, interest deductibility, bonus depreciation, pass-through income treatment, small business expensing or the SALT deduction cap could affect these areas. These could come under discussion, whether scheduled for 2026 or proposed under Trump’s plan, and could significantly impact CRE firms’ construction costs, tax liabilities and investment structures, according to Deloitte.

Policy shifts regarding broader macroeconomic implications, such as inflation and interest rates, might also affect CRE firms’ costs, operating conditions and investment decisions.

Opportunity Zones, the FOMC and other concerns

The Opportunity Zone program, tariffs and sustainability credits, as well as incentives are also worth watching, the research shows. With Republicans controlling Congress, the odds will improve that provisions will be extended.

READ ALSO: Deloitte’s 2025 CRE Tech Outlook

Deloitte suggested that real estate investors focus on long-term growth because many CRE companies’ priorities span multiple presidential administrations.

As for interest rates, Deloitte economists expect the target rate range by the Federal Reserve to be between 3.75 percent and 4 percent by the end of the year. However, tariffs could potentially raise inflation enough to force the FOMC to pause rate cuts until mid-2027.

The Deloitte research drew its ‘at-large’ conclusions from some 880 C-suite respondents across 13 countries, including the U.S.

You must be logged in to post a comment.