Tax Policy Largely Stays the Course for CRE Execs

Lawmakers dropped many proposals from Build Back Better that could have been detrimental to commercial real estate investors, but the industry remains on guard.

When President Joe Biden’s legislative agenda was unveiled earlier this year, a major part of the plan to fund the multitrillion-dollar plan was to eliminate or curtail tax policies favorable to the commercial real estate industry.

But when a draft of the Build Back Better bill, which initially came with a $3.5 trillion price tag emerged in September, many of the most worrisome tax proposals had been dropped or scaled back. Two months later, Biden introduced a framework that slashed its price tag by half as flawmakers further trimmed proposed tax changes.

Following passage of the bipartisan infrastructure bill that was originally part of the larger Build Back Better proposal, part of the issue is settled. Still in question is the future of the larger social spending proposal and its tax proposals. The fate of that legislation is now in the hands of the Senate, which is taking up the proposal after its approval by the House in November.

“I think that there has been a clash between expectations and reality,” said Jeffrey DeBoer, president & CEO of the Real Estate Roundtable, during a late October webinar sponsored by Marcus & Millichap. “Expectations were high because Biden won, he had a Democratic House, and the Senate was 50/50. But the reality is that none of these issues are easy.”

Bullet Dodged

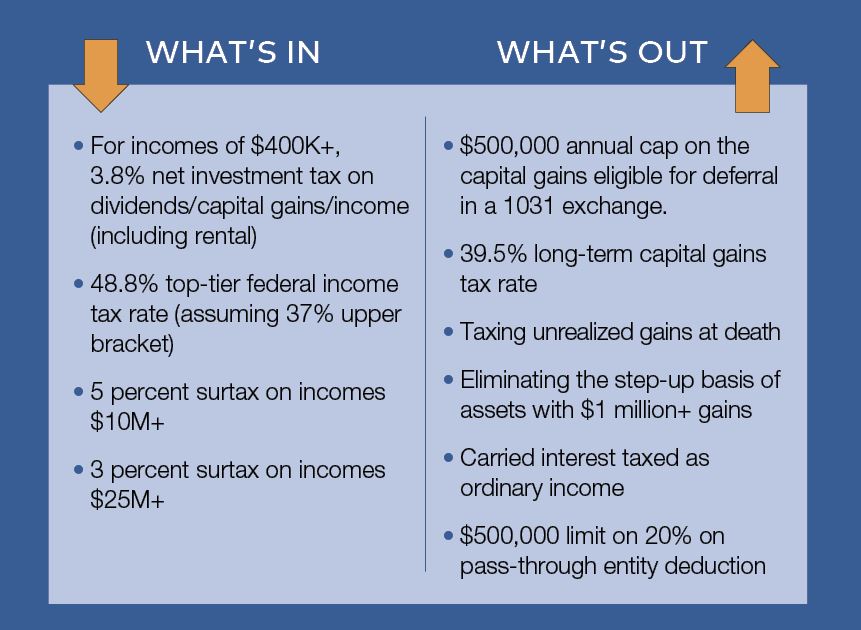

Indeed, several of the Biden Administration’s early tax proposals to pay for its agenda were either removed from the Build Back Better bill or were never part of it, including:

- Capping the amount of capital gains eligible for deferral in a 1031 exchange to $500,000 a year.

- Increasing the long-term capital gains tax rate to 39.5 percent from 20 percent. (The initial version of Build Back Better proposed hiking it to 25 percent, but that proposal, too, was eliminated.)

- Taxing unrealized gains at death and eliminating the step-up basis of assets with a gain of $1 million or more.

- Taxing carried interest at ordinary income rates.

- Limiting the 20 percent pass-through entity deduction to $500,000 for high-income earners.

“All of these changes that we thought were going to put us under the gun didn’t make it into the bill,” said Justin Ailes, managing director of government relations with the Commercial Real Estate Finance Council. “I think it shows that now the original proposal was drafted with a more of a progressive policymaking mindset than a more centrist, business one.”

The policy shift should help continue to propel what has been a robust recovery in commercial real estate investment activity following months of disruption by COVID. A healthy $315 billion traded hands in the third quarter of 2021, a year-over-year increase of 95 percent, according to CBRE. That brought total investment volume to $800 billion for the year, which was 3 percent better than the same period in 2019, the brokerage said.

Meanwhile, a recent Marcus & Millichap survey of nearly 3,300 commercial real estate investors revealed that 62 percent planned to buy in the next six to nine months while 42 percent planned to sell. What’s more, noted Marcus & Millichap CEO Hessam Nadji during the webinar, property investors are plowing more capital into secondary and tertiary markets than they were five years ago and plan to continue the trend.

“The investment market is extremely active because of ample liquidity and extremely low interest rates,” he added. “Based on evidence that the economic cycle is sustainable, we’re in for a very good few years of job growth and demand for commercial real estate.”

New Tax

The real estate industry hasn’t escaped all pain, however. Of the tax items that remained in the bill at press time, one of most consequential was to require real estate professionals with more than $400,000 in income to pay the 3.8 percent net investment tax on dividends, capital gains and income—including rental income—regardless of whether they are active or passive in the activity. Typical real estate partnerships and other structures were previously exempt from the tax, which became law under Obamacare to fund Medicare.

Some of the most affluent real estate investors could also find themselves impacted by broad tax policy changes, such as the proposed 5 percent surtax on income over $10 million and an additional 3 percent surtax on income over $25 million. That and the new 3.8 percent net investment tax could ultimately take a taxpayer’s federal income tax rate to as high as 48.8 percent if the upper tier tax bracket rate remains 37 percent. While the bill originally proposed hiking the maximum rate to 39.6 percent, tax rates in the latest version remain unchanged.

Still On Alert

Observers cautioned that lawmakers could still add provisions detrimental to property investors in the days ahead as the bill winds through Congress “Nobody feels completely comfortable because we’ve seen drastic changes in just the last two weeks,” said Lisa Knee, a tax partner and leader of the national real estate practice for the New York City-based EisnerAmper accounting firm. “I don’t think anything is necessarily off the table for good—there have to be some revenue raisers in the bill.”

That’s particularly true as House negotiators added a four-week paid family leave provision to the bill versus the 12 weeks initially envisioned. Additionally, the lawmakers also added a measure to expand the $10,000 limit on the state and local tax deduction to $80,000, which ignited the ire of some progressives, who charged that the provision benefitted the wealthy. Some wonder whether the bill includes enough revenue-generating measures to pay for universal preschool, subsidized childcare, expansion of the child tax credit and the other programs it has promised even before the changes.

“I’ve been looking at how much lawmakers have taken out of versus what was left in, and I don’t see how they are going to pay for it,” said Marc Wieder, a partner & co-leader of Anchin accounting firm’s real estate group in New York. “So, I personally foresee that either the bill is not going to pass or that we could see something possibly creep back in.”

You must be logged in to post a comment.