Tech Scene Stays Hot, Rent Growth Cools in San Jose

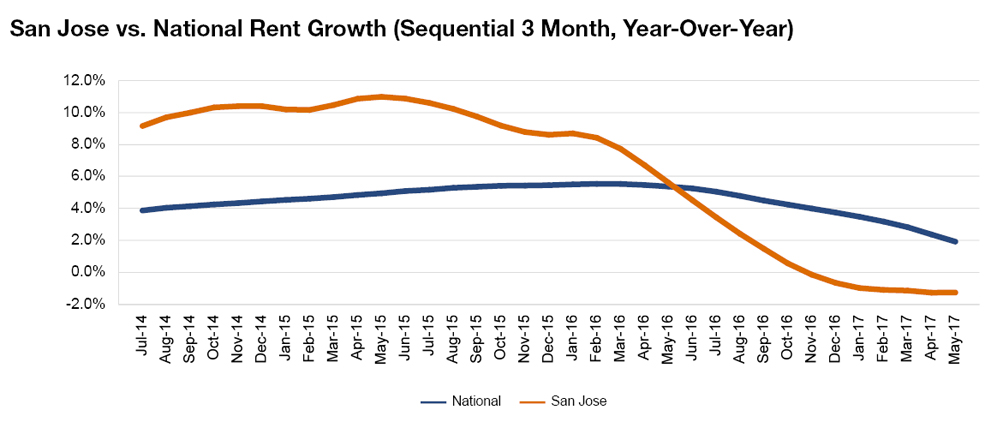

Rent growth has been decelerating since it reached double-digit levels in 2015. As of May, the metro’s $2,675 average rent was more than double the national average of $1,316, according to Yardi Matrix.

By Robert Demeter

Silicon Valley is the nation’s largest tech hub, a top-performing venture capital market and one of the most prominent locations for startups. The metro continues to thrive as an attractive destination for businesses and young, educated workers, as a result of consistent employment and wage growth. However, the rental market is cooling as San Jose becomes increasingly unaffordable, even for higher-paid workers. Rents dropped 1.3 percent year-over-year through May to $2,675, more than double the national average.

Employment gains were led by professional and business services, which added 6,900 jobs. The construction sector also gained traction, as a result of the Bay Area Rapid Transit (BART) Silicon Valley Extension. The 10-mile, $2.3 billion-dollar project is scheduled for completion in December and will create two additional metro stations: Milpitas and Berryessa. The project sparked investor interest, as Lyon Capital Ventures and Clayco Realty Group’s two communities are already under construction in Milpitas, with more than 370 units each.

The total multifamily pipeline consists of roughly 39,000 units in different stages of development, with about 4,000 projected to come online by year-end. Because San Jose is among the most sought-after and competitive markets in the U.S., investor interest is expected to remain high. Rents, however, will stay flat, as Yardi Matrix forecasts only a 0.5 percent increase in 2017.

You must be logged in to post a comment.