Tech Sector Leads the Way Back to the Office

The push comes as all major markets continue to record double-digit vacancy, CommercialEdge reports.

With COVID-19 vaccination rates on the rise, companies have started to consider their return to office in the fall. Tech firms have become a reference point for office users across the nation, with large players such as Facebook or Twitter opting for a hybrid model; Meanwhile, Amazon and Google are pushing for a full-time return, expanding their footprint in the nation’s key markets. These announcements are paving the way for a change of heart in previously announced workplace strategies, including the reduction of office footprint.

As return-to-work scenarios continue to unfold, national average full-service equivalent listing rates clocked in at $38.67 per square foot in March, or a 36-cent increase from the previous month. The national average vacancy rate increased by 280 basis points year-over-year in March, reaching 15.6 percent. When the pandemic hit, few markets had vacancy rates below 8 percent. Now, no major market has a single-digit vacancy rate. Office vacancies rose considerably in Seattle (from 7.7 percent to 13.9 percent) and Austin (from 7.4 percent to 16.0 percent), largely due to new supply and shrinking office footprints.

Office-using employment decreased by 2.5 percent year-over-year as of March—but still fared better than the overall labor market. Of the 114 markets covered by CommercialEdge, only 18 showed growth in office employment. Among them were Salt Lake City (3.5 percent) and Raleigh-Durham (2.9 percent). Meanwhile, the tourism-dependent Orlando performed worst, recording a 7.4 percent year-over-year decrease.

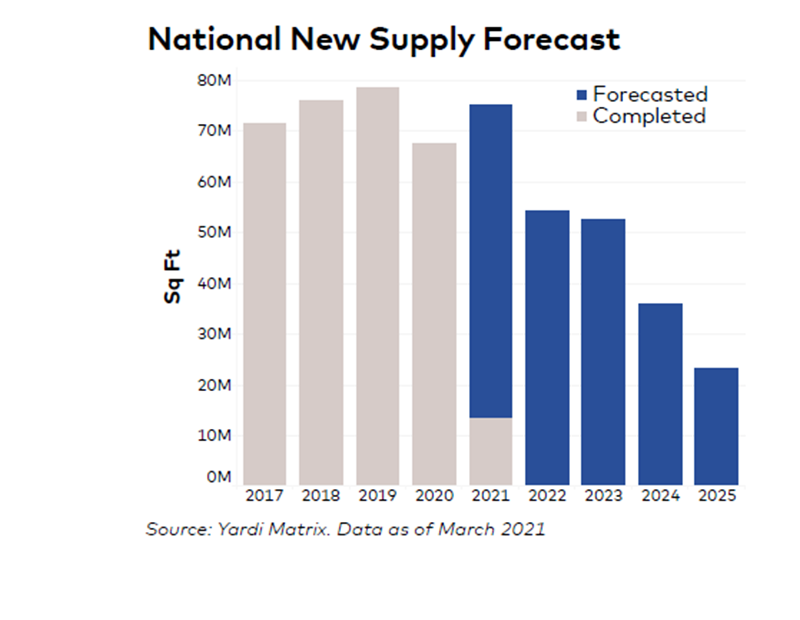

Despite challenges, office development continues to power through, with the active pipeline including 162.6 million square feet of space under construction. Despite speculation of a rebirth of the suburbia, 70 percent of the upcoming stock is located in the CBD or urban submarkets, highlighting the strength of pre-pandemic trends. Some 13.7 million square feet were delivered year-to-date, while another 63.6 million are scheduled for completion by year-end. The predominantly suburban Charlotte had the highest level of square feet underway as a percentage of stock (11.2 percent), with nearly half concentrated in the urban core.

Read the full CommercialEdge report.

You must be logged in to post a comment.