Tech Tenants Inject Some Heat Into Tepid Office Leasing Market: CBRE

The industry was a standout in a year when total leasing volume for the 100 largest deals declined 32 percent.

The COVID-19 pandemic put a damper on office leasing activity last year, drastically shrinking the average deal size from the beginning of the year, according to CBRE’s new U.S. MarketFlash report on the Top 100 leases of 2020.

But one thing remained the same: Technology companies led transactions.

Rather than move forward with relocations, expansions or other real estate-related decisions amid pandemic-induced uncertainties, office users took a wait-and-see approach in 2020, as evidenced by the numbers. The cumulative square footage of the Top 100 largest office leases of 2020 was 29 million square feet, marking a 32 percent year-over-year decline in the 100 largest transactions.

READ ALSO: What to Expect From the Office Sector in 2021

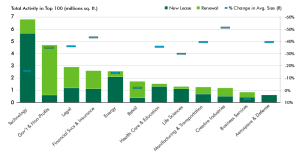

Additionally, the average size of the largest leases plummeted from 422,000 in 2019 to 290,000 square feet in 2020. Furthermore, with office users still skittish about making new commitments, renewals accounted for the bulk of activity, or 43 percent of the leases, marking a 10 percent year-over-year increase.

The tech sector provided a certain consistency in 2020, continuing an ongoing pattern of several years. “Tech companies accounted for 18 of the Top 100 leases and the most by square footage, 6.8 million square feet, largely in new leasing activity,” according to the report. The square footage marks 24 percent of the total square footage of the Top 100 leases.

“Nevertheless, leasing by tech companies was down by more than half year-over-year, demonstrating a slowdown by even one of the most resilient industries,” the report said. The government and nonprofit sector followed at a distant second with 4.7 million square feet and the legal industry took third place, claiming approximately 2.9 million square feet.

Local leaders

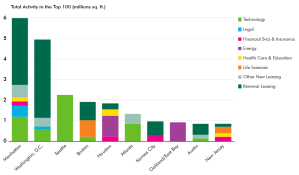

A whopping 38 percent of the square footage of the Top 100 leases in 2020 can be found in Manhattan and Washington, D.C., with Manhattan leading the way with 6 million square feet of the Top 100 leases and D.C. claiming 4.9 million square feet.

And while new leases were in the minority in 2020, 37 percent of new transactions took place at properties in Seattle, Boston, Houston and Atlanta—and 84 percent of the new transactions in those four markets involved tenants in the tech, life sciences and energy sectors.

Despite the hammering of sorts that office leasing took in 2020, CBRE anticipates that the pandemic’s effects will begin to dissipate later in 2021. “As positive sentiment returns to the market from lower COVID-19 transmission rates and wider administering of vaccines, occupiers will begin to form long-term portfolio strategies,” according to the report. “Improved office leasing activity in a more stable environment likely will begin in the second half of the year as workers return to the office and if economic growth continues.”

You must be logged in to post a comment.