Tenants Are Leasing More Office Space in Prime Buildings

Few occupiers reduced their footprint in the first half’s top deals, according to Savills.

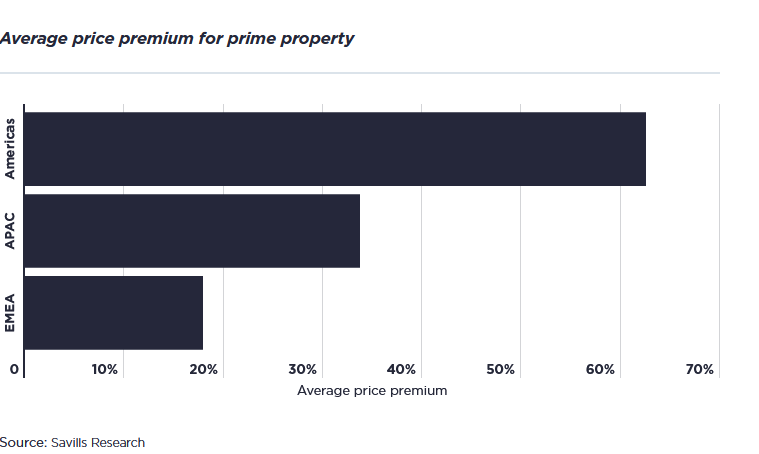

Rents for prime office space now average 31.4 percent over those for Grade A offices in markets globally, according to Savills, with North America having the highest premium, at 62.5 percent above Grade A stock.

The intense bifurcation in the commercial real estate market in the U.S. and Canada, with prime buildings seeing intense occupier demand for limited stocks despite high overall availability in Grade A buildings across North American markets more broadly, contributes to such a high premium, and that is likely to continue to grow, according to Savills.

Prime is described as the very top tier of Grade A office space in a market, typically the office space demanding the highest 5 percent to 10 percent of rents in that market. The term “trophy” is synonymous with prime.

Rick Schuham, CEO of Global Occupier Services at Savills, said there is a continued flight to prime space and much resilience in global top-tier office leasing markets.

In 94 percent of top office deals in H1, occupiers took the same amount or more space and only 6 percent reduced their footprint. This is a shift from about a year or less ago when companies were downsizing their lease space.

“Many of our clients rightsized their space due to the increase of implementing a hybrid work model,” Schuham told Commercial Property Executive. “Many occupiers now realize they overcompensated in space reduction and have a growing population of employees desiring to be in the office,” he said.

“This is especially true in the professional services sector among younger employees. Access to mentors is critical to career growth. We also see in some cases compensation enhancements that include rewards for in-person participation and investment in company culture. That certainly provides incentives to be present at the office.”

Thus, space demand is impacted.

“We have seen this effort particularly implemented in law firms,” he said. “Occasionally, a rightsized office footprint is followed by incremental expansion to adjust” for the over-correction of space. Some occupiers have ‘over-reduced’ only to be forced to add shortly thereafter.

“Those trends lead peers and competitors to make different, less drastic space decisions. This also explains why it is so important for tenants to have flexibility in their leases.”

Savills said prime buildings are seeing intense occupier demand for limited stocks despite high overall availability in Grade A buildings across North American markets.

How the flight-to-quality trend grows stronger

Speaking to today’s demand, Schuham said he has been through multiple down-cycles: 1992-1995, 2001, 2008-2010, and during each, occupiers took advantage of soft markets to upgrade building quality.

“In this case the market softness has not impacted the highest quality, Class A trophy buildings,” he said. “There are exceptions such as Denver where there are new buildings sitting essentially empty, yet others filled quickly.“

READ ALSO: Meet the World’s Largest WELL-Certified HQ

“On the other hand, in some markets such as Chicago or Miami, the best space is heavily competed for. However, in the end, providing high quality space within a financially stable building, in a persistent tight labor market is producing the demand in this cycle.”

“Office leasing was trending downward pre-pandemic but in almost all office markets across the U.S., we’ve seen two key trends: flight to quality and flight to capital. Those occupiers who can, have been upgrading their office spaces by relocating into better and more expensive buildings. As a result, prime office space, which is in the highest tier of the Class A office market has been seeing record high rents.”

“Flight to capital is a newer phenomenon where tenants are selecting buildings that are financially sound. It used to be the landlord would review a tenant’s financials but now it’s just as important for tenants to do the same as it relates to landlord financial capability. Tenants should examine the financial situation of a property owner to ensure they can fund operations or meet their financial obligations before a lease is signed.”

Schuham said this is expected to continue over the short-term as long as the economy continues to grow, and the labor market remains tight for college-educated and highly skilled workers.

The trend in higher premiums for prime space is expected to continue, Savills said.

“The power balance between employees and employers will determine when the supply of prime space begins to slow,” Schuham said. “The supply of college-educated and skilled labor is decreasing, not increasing. This factor combined with the economy will be the guide.”

“Currently, unemployment continues to dwindle as the supply of coveted workers declines. However, most economic indicators are positive including interest rate signals. The continuation of the flight to quality and capital trends will continue for the foreseeable future and this will keep construction cranes busy in general and will keep upward pressure on rents in the best buildings.”

Kelcie Sellers, associate director in the Savills World Research team, added that increased fit-out costs and macroeconomic uncertainty may loom in the background of real estate decisions for the foreseeable future.

Landlord concessions are likely to continue to favor tenants in markets where availability remains high, Sellers said, but in supply-constrained markets, she expects concessions to begin dropping and rents to rise.

“The cost to build new buildings and new space will be another major factor as we see those costs outpace declining broader inflation,” Schuham said.

You must be logged in to post a comment.