The Amazon-NYC Fallout: An Economists’ Roundtable

Perspectives from three experts on the real estate market impact, the economic consequences and the future of Amazon's HQ2 plans.

Long Island City, N.Y.

As the dust settles from Amazon’s stunning decision to walk away from its plans to build a 4 million-square-foot campus in Long Island City, N.Y., CPE asked three leading economists to drill down into the real estate market impact, the economic consequences and what the future holds for Amazon’s HQ2.

Participants included Hugh Kelly, principal at Real Estate Economics and a CPE columnist; George Ratiu, director of quantitative and commercial research at the National Association of Realtors and a CPE columnist; and Mark Zandi, chief economist at Moody’s Analytics.

What’s your general take on Amazon’s decision to walk away from its proposed New York City campus?

Mark Zandi

Mark Zandi: Amazon’s decision is a significant missed opportunity for NYC. Amazon is among the premier global tech companies, and to turn them away means the city’ growth prospects will be diminished compared to what could have been. But the city will continue to attract highly creative young people and thus remain a thriving tech center. Commercial and multifamily markets will have some adjusting to do to the new reality, but will quickly regain its footing.

Hugh Kelly: The local politicians who apparently succeeded in scuttling this project—despite a recent poll showing the majority of New Yorkers in favor of the project—have done great damage to the city.

Yes, a project of this scope creates stress on urban systems. Yes, Amazon is a profitable company and the $3 billion in incentives in the NY package is a lot of money. And, yes, Amazon has been a disruptor with impacts across the economy and particularly in retail real estate.

Taking all that into account, though, the hype in the protests against the LIC project amounted to shallow thinking. Urban [challenges]—transportation congestion, high housing costs, and gentrification have existed for years, and Amazon’s project can’t be blamed for them. New York’s leaders have the responsibility of addressing those problems, with or without Amazon – and the base conditions are far more problematic than the marginal impacts of the Amazon project.

George Ratiu: the metro area would have likely seen a surge in real estate development. The New York market, like others around the country, has been working through a tight housing inventory. With over 95 percent of housing concentrated in the multifamily space, the metro area was lagging in permits. While the metro added an average of 100,000 jobs per year, it only approved permits for about 31,600 housing units. The additional employees would have required considerably more housing, in addition to office, retail and distribution warehouses.

With Amazon’s recent announcement that it will not pursue its project in Long Island City, the demand expected to be generated by those 7,500 – 12,500 yearly jobs will not materialize. For developers of housing, office and retail projects this will suck some of the air out of hoped-for returns.

Let’s drill down into the economics of the incentives, the criticism of Amazon’s plan and the economic impact of Amazon’s decision to step away.

Hugh Kelly, PhD., Economist

Kelly: [Regarding the size of the incentives], the essence of cost/benefit analysis is to look at both sides of the equation. Isolating the incentive package as a sole “talking point” is sheer dishonesty, if the benefits of the project are ignored—not just the 25,000 jobs and secondary employment effects (the multiplier), but the boost of blue-collar employment during construction and in servicing the campus thereafter.

Regarding Amazon as a corporate villain …bookstores, record stores, video stores, and countless other small retailers have undoubtedly been impacted by the Amazon model. Nevertheless, Amazon could not have succeeded in its enterprise without the whole-hearted endorsement of the American consumer.

In driving this project out of New York, there is no economic or real estate benefit derived that lessens the disruptive features of e-commerce, only the effect of turning the city’s back on its benefits to the local economy, including the strategic advantage of being at the heart of 21st century technology – a status for which Savills recently ranked New York number one in the world.

Ratiu: When Amazon chose Northern Virginia and Long Island City as twin locations for its new headquarters, the company was looking to leverage strong employment markets with ample qualified talent along with attractive incentives from the local and regional governments. In exchange, the company promised to create 2,500 new jobs each year for 10 years, with average salaries for employees north of $150,000.

Those 25,000 jobs over the 10-year period would have provided a much wider impact on the local economy due to the multiplier effect. Those employees would have required housing, household furnishings and appliances, and myriad other services such as restaurants, dry cleaners, fitness centers, transportation etc. Based on research from the National Association of REALTORS®, the multiplier effect would have ranged between 2 and 4, translating into a positive increase of 7,500 – 12,500 new jobs per year for the New York metro area. Over a ten-year period, Amazon’s presence in New York was expected to increase employment by 15-to-25 percent.

On the flip side, given the shortage of housing, Amazon’s presence in Long Island City would have added pressures on rents, home prices and the broader cost of living. Using Seattle as a benchmark, Amazon’s presence in the market had an impact on the metro area’s housing, as homes prices increased over 27 percent over the past 10 years.

Would you speculate on Amazon’s next move?

Zandi: It appears that Amazon will take a quieter approach to deciding where to expand its operations. The highly public process for picking their HQ2 didn’t turn out as they had planned. The company was able to extract big subsidies, but they also attracted a lot of unwanted ire and concern. They will surely continue to expand in New York City, but it won’t be the big bang that they had previously envisaged.

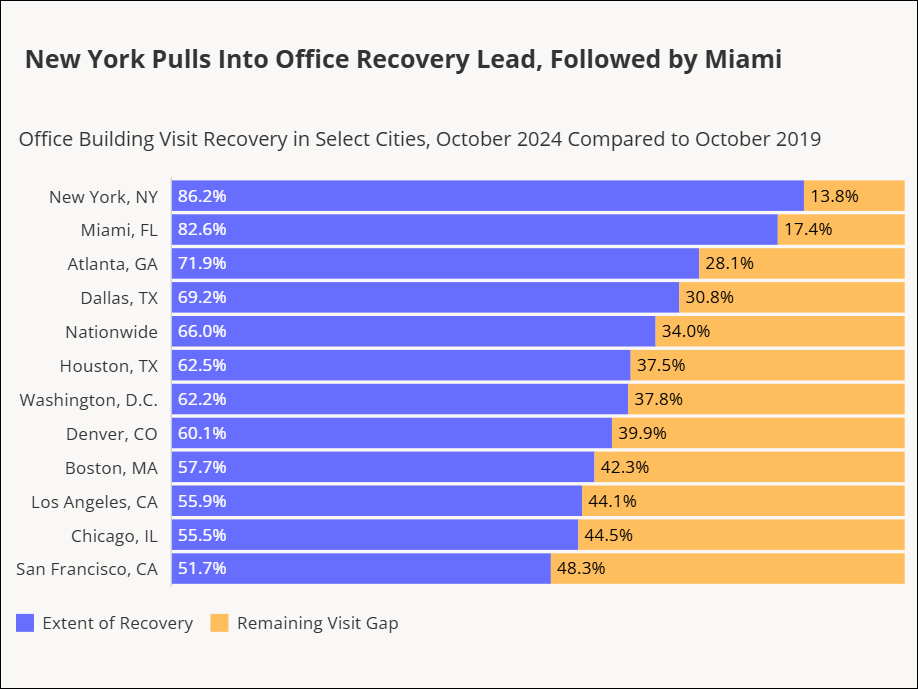

I suspect Amazon will not pick another campus, but it will expand in cities that have a young, diverse and highly educated workforce. The city also needs to be globally linked. Dallas and Atlanta would be good choices. And my favorite is my hometown of Philadelphia.

George Ratiu

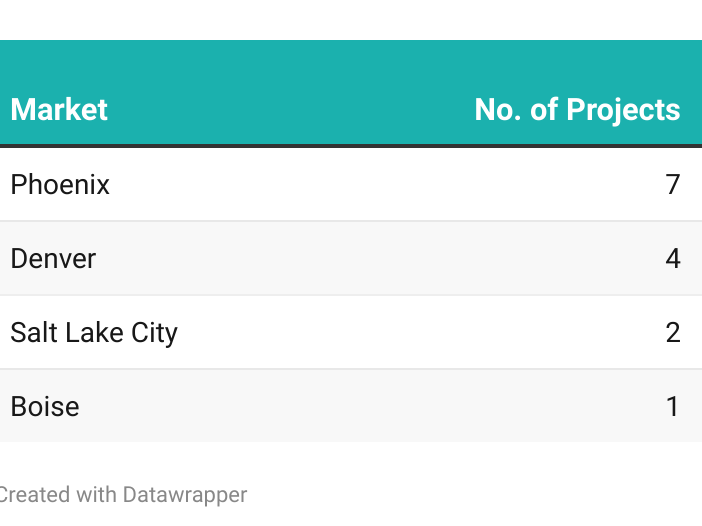

Ratiu: Looking at the systematic way in which the company has approached its site selections, it more than likely has several fallback plans. For one, it could boost its presence in the Washington, D.C., metro area. The Crystal City/National Landing site in Northern Virginia provides ample space for development. In addition, the company could consider additional locations in the metro, including sites in Maryland and Washington. For another, the company retains a long list of metro areas which have submitted their bids, with generous incentives, including Atlanta, Chicago, Denver and Newark, N.J.

Kelly: I have no idea what Amazon will do as Plan B, but they are now the one with all the options, not New York. I sincerely hope the Governor, Mayor, and a coalition of allies including business and labor, as well as real estate will strive to retain this project.

But, if not, I see those who so vociferously objected to this project as having the civic and moral obligation of (a) effectively solving the underlying economic and social stresses they claimed as excuses for opposing the deal, and (b) affirmatively working toward a higher probability, equal or better job creation, income generating, and tax-revenue-positive program that would exceed the Amazon deal in its benefits to New York. If they can’t come up with that – and fast – then they rival Captain Ahab as an avatar of destructive monomania.

You must be logged in to post a comment.