The Coming Wave of Pandemic-Induced Workouts

Short-term fixes will wear off, and borrowers will need longer-term restructuring solutions, according to Jay Maddox of Avison Young.

Jay Maddox

When the pandemic-induced 2020 recession hit the market like a Mike Tyson roundhouse punch, lenders suddenly found themselves awash in forbearance requests. Unlike the run-up to the Great Recession, for the most part there was no excessive leveraging as lenders and investors were more disciplined.

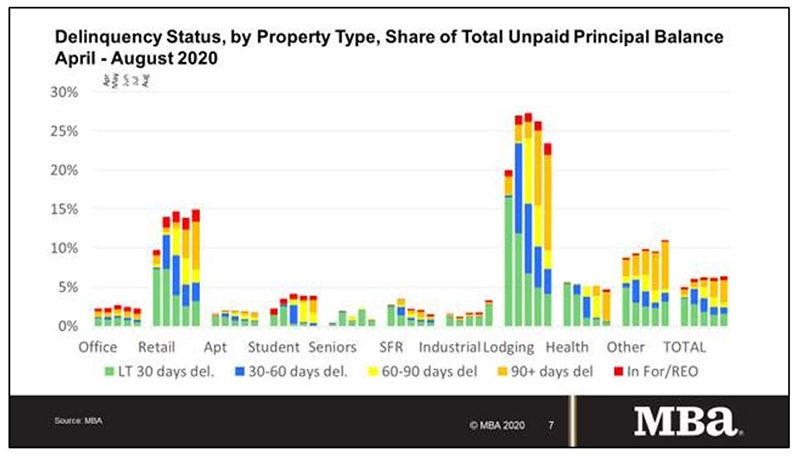

In response to these unique, unforeseen circumstances, many lenders stepped in with short-term relief for borrowers. But as the economy continues to swoon, the anxiety grows, especially for distressed hotels and shopping centers, with 30-day-plus delinquencies soaring to 15.0 percent and 23.4 percent, respectively, as the chart below illustrates.

Even though there has been some improvement in loan defaults recently, the overall ratios are still exceedingly high, and reality is sinking in. As short-term fixes wear off, borrowers will need longer-term restructuring solutions in order to preserve and protect their properties until the economy recovers. Many borrowers had substantial market equity in properties that were performing well before disaster struck. If these borrowers strongly believe their properties will recover, and if they have the resources to work with the lender, they most certainly will. Sadly, many other properties are likely to be foreclosed, especially those with commercial mortgage-backed securities loans. Vulture investors are already poised to feast.

Not for the faint of heart

A restructuring is a balancing act between the borrower and lender. Much depends on the type of lender, and much depends on the borrower’s credibility and relationship with the lender. For the lender, the choice is between a loan modification and their best alternative to a negotiated agreement, which is typically foreclosure or sale of the note. So, to be successful, the borrower must come to the table quickly with a credible plan and proposal, in order to convince the lender that it will be better off restructuring rather than foreclosing.

Some lenders will force the issue by exercising their default remedies immediately, rather than letting the situation fester. Those remedies span from a simple declaration of default to initiation of foreclosure proceedings, enforcement of cash management agreements such as a lock box, and in some cases appointment of a third-party receiver to protect the lender’s collateral. Other investors such as mezzanine lenders, preferred equity or b-note holders can greatly complicate matters by enforcing their rights and remedies. Further, banks are subject to regulatory considerations, and CMBS servicers are bound by their fiduciary obligations to bondholders. A complex restructuring needs to accommodate all of these stakeholders.

A simple restructuring may not involve much more than extending the original forbearance arrangement with the senior lender. This may be possible for properties with low leverage, or those expected to recover faster, such as apartments buildings. But it’s tougher for many properties where the future recovery is far less certain. And worse, matters may be complicated by the lender’s requirement to re-appraise the property, which can be a major wild card in the current market given the dearth of comparable sale transactions.

A loan restructuring for a more deeply distressed asset can take many forms, from a modification to the payment waterfall to more complex solutions. Virtually without exception, a meaningful additional contribution of cash or collateral will be required. The new cash infusion may be used for debt reduction, and/or reserves to cover future deficiencies and project costs that are expected to preserve or enhance property value. If these funds come from third parties, the borrower will likely face dilution of its equity ownership unless it also contributes capital side by side with the new investor.

In trouble? Get help!

Negotiating a restructuring is inherently very stressful and can sometimes lead borrowers to behave irrationally and make mistakes, especially early in the process. Potential exposure under loan guarantees will also be a pressure point. For that reason, it is vital to employ experienced advisors, do a careful situation assessment, examine all available, practical options, and develop a credible proposal.

Jay Maddox is principal of Capital Markets at Avison Young.

You must be logged in to post a comment.