The Fixed-Rate vs. Floating-Rate Dilemma

Locking in low interest rates may not be enough to protect your property from a rise in debt costs.

With the Federal Reserve continuing to push down interest rates, it would seem that investors should pin down low capital costs while they can. But current dynamics in the still frothy debt and equity markets tell a more complex story.

Joseph Iacono, CEO of Crescit Capital Strategies, warns that a short-term fixed-rate strategy is not the best way to protect a property from increasing interest rates. Image courtesy of Crescit Capital Strategies

Despite more cautious predictions at the beginning of the year, investment activity seems close to matching 2018. High transactions volume has been supported by increased liquidity in the equity and debt markets―mostly private capital. According to a recent Cushman & Wakefield capital markets report, capital availability in the lending environment for the second half of 2019 is expected to “remain elevated with multiple lender groups active and greater competition between fixed- and floating-rate execution.”

Current investment trends keep demand for floating-rate loans high, a financing tool that has been traditionally viable for short-term holders. “There is a lot of capital chasing value-add deals that lend themselves to a floating-rate execution. Also, the commercial real estate collateralized loan obligations market has created demand for shorter-term floating-rate paper. The proportion of floating-rate executions is definitely increasing,” said Shaunak Tanna, head of structured finance at Basis Investment Group.

In July, the Federal Reserve cut interest rates by 0.25 percent for the first time in a decade to a range of 2.00 to 2.25 percent. While the decrease will benefit both fixed-rate and variable rate borrowers, it is definitely time to pin down historically low rates on stabilized properties, especially when the intention is to hold them for the long-term. Michael Campbell, CEO of private equity banking firm The Carlton Group, expects to see an increase in fixed-rate loans, which require a well thought out approach, particularly in today’s volatile environment.

“If your property qualifies for long-term fixed-rate loans, then this is a good time to lock in lower rates. But it’s worth noting that while benchmarks may go lower, we may see some spreads widening, which offsets some of the reduction in benchmark rates,” said Joseph Iacono, CEO of commercial real estate debt provider Crescit Capital Strategies.

When it comes to short-term fixed-rate executions, things can get tricky. Demand for this type of financing products is on the rise due to more affordable costs, but lenders warn that, in the end, this might not even be an efficient way to protect properties from the possibility of rising rates down the road. Iacono believes that borrowers in this category will find themselves in the market for a refinancing soon enough when the initial loan matures and will be subject to that particular rate environment. Therefore, lenders agree that for properties that are “in transition” (from one owner to another) and require bridge financing, the floating-rate market provides better solutions.

Low rates, high risks

The Carlton Group CEO Michael Campbell says that this is the best time for long-term holders to pin down historically low rates on stabilized properties. Image courtesy of The Carlton Group

The overall expectation is that more interest rate cuts—anticipated from the Fed by year-end—will lead to a lower cost of debt, but experts claim there’s more to this. “On floating-rate, we expect to see the London Interbank Offered Rate decline over time. The LIBOR curve clearly indicates that this is the market view. We expect spreads to move up to compensate for market risks given the heightened uncertainty. Borrowers may not get the full benefit of declining rates if spreads move in the other direction,” added Tanna.

Regarding the elimination of the LIBOR index, the market has yet to reach a conclusion on how it will all play out. Some expect a smooth transition to the Secured Overnight Financing Rate and expect minimal impact on debt cost since the new index is based on the heavily traded Treasury market. Others are not yet sure how different spreads will react to it, since there haven’t been enough issuances tied to SOFR yet. In theory, LIBOR pricing factors in the credit risk premium. SOFR, on the other hand, does not, since it is based on the repo market. In this case, too, more time is needed to grasp the potential impact of the new benchmarks on debt cost and to develop the right tools to mitigate additional risks.

“It is possible that banks offering shorter-term fixed-rate products will compete better (after the swap). Capital markets lenders will have their costs tied to SOFR, so they will continue to offer loans with SOFR as the benchmark. We expect tools currently available to hedge LIBOR risks—swaps and caps—will be available to hedge SOFR risks, too,” said Tanna.

Unknowns ahead

Shaunak Tanna, head of structured finance at Basis Investment Group, backs up defensive and diversified “dequity” strategies as a hedge against a turning cycle. Image courtesy of Basis Investment Group

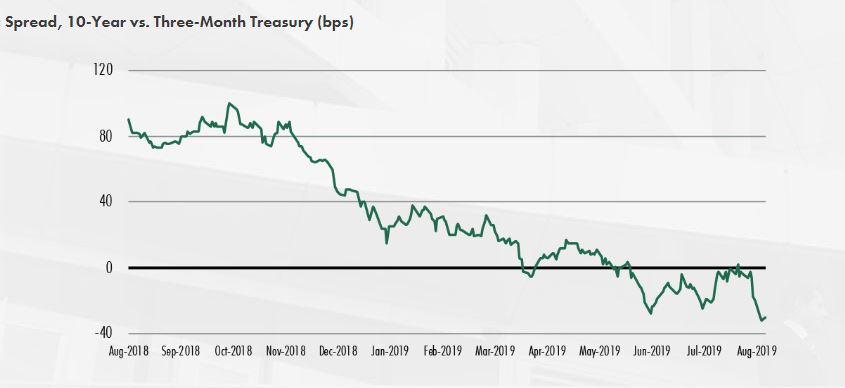

There are several macroeconomic factors that are affecting the real estate debt market right now, including the inverted yield curve, fears of a recession, decreasing condo prices, increasing multifamily supply in certain markets, as well as the trade discussions with China and the protests in Hong Kong due to the controversial extradition bill, Campbell noted. Even though Hong Kong leader Carrie Lam announced she would withdraw the bill, causing the 10-year Treasury yield to climb above the two-year rate, experts believe that this is not the end of the turmoil in the region.

READ ALSO: Balancing Access, Risk in Today’s Flush Debt Market

In fact, the “trade war” between the U.S. and China is considered the single biggest risk for economic growth and stability right now, leading to elevated expectations of a recession. The best strategy in this case is based on flexibility and diversity.

“Defensive and diversified ‘dequity’ strategies are expected to outperform in this market. The basis in real estate and the position in the capital stack will differentiate the winners when the cycle turns. Investors that rely on market rent growth or appreciation through cap rate compression will be disappointed. We believe realized returns in the ‘dequity’ space will be similar to or may even exceed equity returns, for a lot less risk,” said Tanna.

What lies ahead is harder to predict, as actions of other central banks may drive the U.S. 10-year yield even lower. At the same time, a trade-war resolution would clear the clouds and may result in the 10-year yields moving up.

“Macroeconomic uncertainty has caused the 10-year rate to be close to its all-time lows. But the U.S. still continues to be among only a handful of developed nations that have a positive yield. It’s tough right now to predict a direction as many political and macro-economic factors are in play,” Tanna concluded.

“There’s currently a lot of uncertainty in the market. The effects of a potential economic slowing will likely be felt on the demand side for real estate,” added Iacono.

You must be logged in to post a comment.