The Future Demand for Industrial Is Decarbonized

Leasing decisions will be increasingly linked to carbon reduction targets, according to JLL’s latest study.

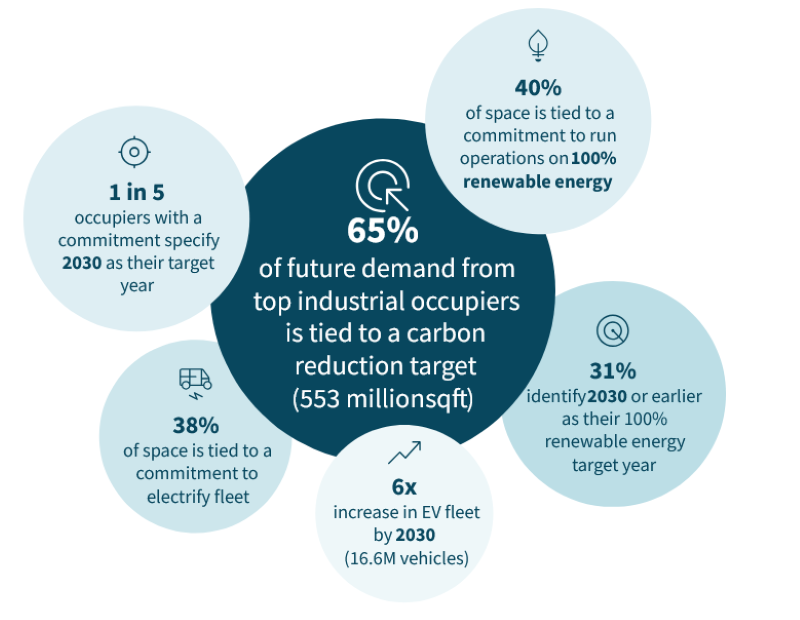

In the global industrial and logistics markets, some 65 percent of their future space needs will be linked to a carbon reduction target, according to Powering Operational Excellence, a new report by JLL. These targets will be met primarily through energy upgrades, fleet electrification and clean energy procurement.

“We’ve reached a critical juncture where the surge in demand for decarbonization-enabling sites presents a significant opportunity for property owners,” JLL Division President–Global Industrials Meaghan Elwell told Commercial Property Executive. “They have the capabilities to enhance energy efficiency, adjust rental rates upward and ultimately boost their property values.”

To compile the report, JLL evaluated the leased footprint of major occupiers in 18 major industrial and logistics hubs in North America, Europe and Australia, assessing current supply and construction pipelines, and analyzing publicly stated sustainability targets and other relevant details. The 900 occupiers in the study represent about 850 million square feet of leased space.

JLL found that occupiers are taking a stronger interest in decarbonization-enabling sites for a number of reasons, but top of this list is power availability and security. Increased automation, fleet electrification, the surge in advanced manufacturing, and competition with data centers for limited energy resources are reshaping market dynamics.

Occupiers are thus prioritizing energy-smart buildings to drive operational efficiencies, and for good reasons. Energy-efficiency upgrades can reduce costs by 10 percent to 35 percent for industrial properties, the report explains. Fleet electrification can save logistics companies 6 percent to 8 percent in overall P&L.

Another factor is the age of industrial portfolios. As inventory ages rapidly—with 76 percent of industrial stock over a decade old in the U.S., and 69 percent in Europe—retrofitting buildings will be a strategy for owners to mitigate obsolescence risk, and allow them to attract top tenants.

READ ALSO: C-PACE in NYC: Will the Program Finally Take Off?

Also, the sector faces heightened operational security threats from climate risk, the report explains. That is due to complex operations and a greater presence in areas more vulnerable to extreme weather events.

Struggling to meet the demand

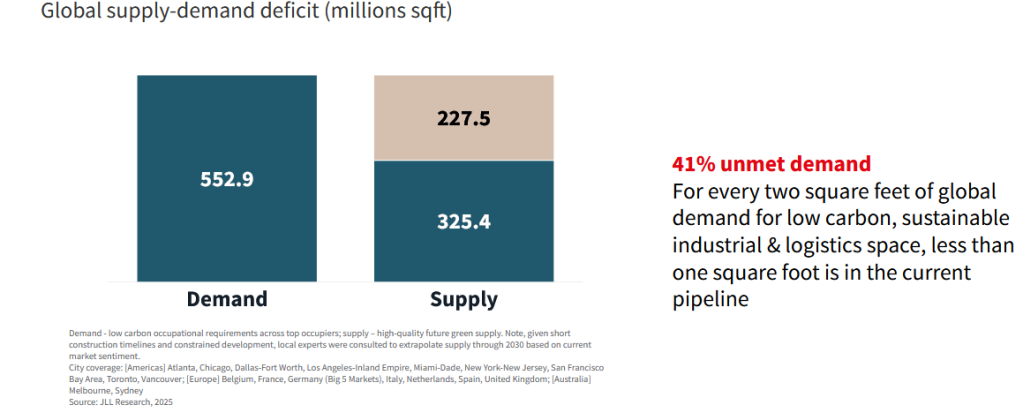

The demand for decarbonized sites is there, but the industrial market will struggle to meet that demand, though the overall results will vary by market and industry, JLL found. Across the 18 hubs researched in its study, 41 percent of projected demand for low carbon space will not be met by 2030.

In some instances, industrial and logistics landlords may be a little behind the curve in offering energy-efficient features.

“It’s particularly striking that more landlords and owner-occupiers haven’t leveraged industrial warehouse rooftops for solar installations—a commercial real estate decarbonization strategy that could help tenants to offset escalating energy costs while advancing carbon reduction objectives,” Elwell said.

Average lease terms are about seven years for industrial tenants, which means that leases inked now need to consider the 2030 targets of reducing emissions by 50 percent—an interim goal for many occupiers. So while the goal is a number of years off, the impact is now, with occupiers re-evaluating their current spaces in light of their future carbon reduction targets, the report explains.

Tenant activities are typically responsible for 90 percent to 100 percent of operational carbon emissions in industrial buildings, according to the report, compared to 55 percent to 75 percent in offices. So, collaboration between tenants and landlords, especially in the form of co-investments, will be key for the further decarbonization of the sector, JLL found.

You must be logged in to post a comment.