The Great LIBOR Phaseout Is Sooner Than You Think

Fortunately, there is still enough lead time to amend existing loan documents to reflect more appropriate fallback provisions, explains Jay Maddox of Avison Young.

Jay Maddox. Image courtesy of Avison Young

While the world is focused on a myriad of other weightier issues, the countdown continues unabated to the mandated phaseout of the widely used London Inter-bank Offered Rate index at the end of 2021. Given that trillions of dollars of loans and securities are linked to this index, and the clock is running out, the urgency to act is now upon us.

Based upon the mandates issued by the Federal Reserve Bank of New York’s Alternative Reference Rates Committee, real estate industry players have settled upon using the Secured Overnight Financing Rate to replace LIBOR. SOFR is a benchmark interest rate that is based on daily transactions in the multi-trillion-dollar U.S. Treasury repurchase market. Since it is based on data from actual transactions rather than on estimated interbank borrowing rates, SOFR was deemed a reliable substitute for LIBOR, which is being phased out due to inappropriate manipulation during the Great Recession.

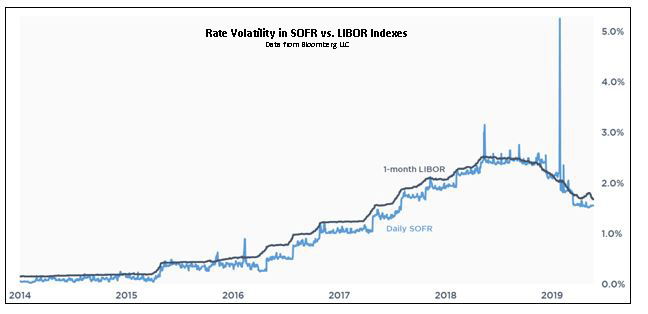

Implementing SOFR as an alternate reference index rate presents significant challenges. While it is highly correlated with LIBOR, SOFR tends to be much more volatile, and occasionally prone to violent changes, as evidenced by the chart below:

Volatility is a concern when using SOFR as the reference rate. For example, if the loan interest rate is adjusted periodically based on SOFR reference index on the first of each month, there could be a major market disruption on that date causing the loan interest rate to be artificially high. This is being addressed by implementing averaging techniques to smooth out the variability of SOFR.

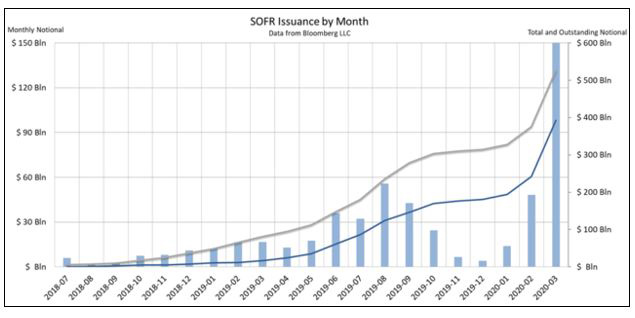

Another challenge is that SOFR is strictly an overnight rate, so alternative term structures need to be developed and incorporated into loan documents, like LIBOR. Forward-looking term rates based on SOFR futures are dependent on the development of a large and robust derivatives market. Fortunately, a SOFR futures market was established in May 2018 and trading volume has been growing consistently. Having said that, the size of the market is still relatively small compared to LIBOR. Also, the use of SOFR for issuance of fixed-income securities is in its early stages. However, issuance of SOFR-linked securities is on the rise, as the chart below demonstrates, and as the market grows inefficiencies should smooth out:

Concerns for CRE Borrowers and Lenders

There are several issues that CRE borrowers and lenders will need to address. Generally, all CRE market participants will need to carefully review fallback language in existing loan agreements that expire after December 2021―they could come back to bite you. Loan documents vary dramatically in terms of how they provide for LIBOR simply disappearing as a reference index. In many cases the existing fallback is to fix the interest rate at whatever the last LIBOR quote was, or to revert to the prime rate―either of which could have significant adverse impact on borrowing costs. Also, the lender may have broad discretion in resetting the rate, which could be to the borrower’s detriment. Further, SOFR is virtually always a lower rate than LIBOR, which would imply that if SOFR is used as the replacement index, borrowers will likely push for interest rate floors in existing agreements to be reduced or eliminated.

Many lenders are including fallback language in new contracts that provides for a substitute index which is consistent with then-current market practices in the event LIBOR is discontinued, but not specific as to the alternative index to be used. Some lenders are being more specific and referring the SOFR as the substitute index. Fortunately, there is still enough lead time to amend existing loan documents to reflect more appropriate fallback provisions.

In any event, lenders and borrowers will need to strike a balance that does not unduly benefit or harm either party. Given the inherent risk and complexity of this undertaking, it would be wise to work with commercial mortgage industry professionals.

You must be logged in to post a comment.