The Inland Empire Expands

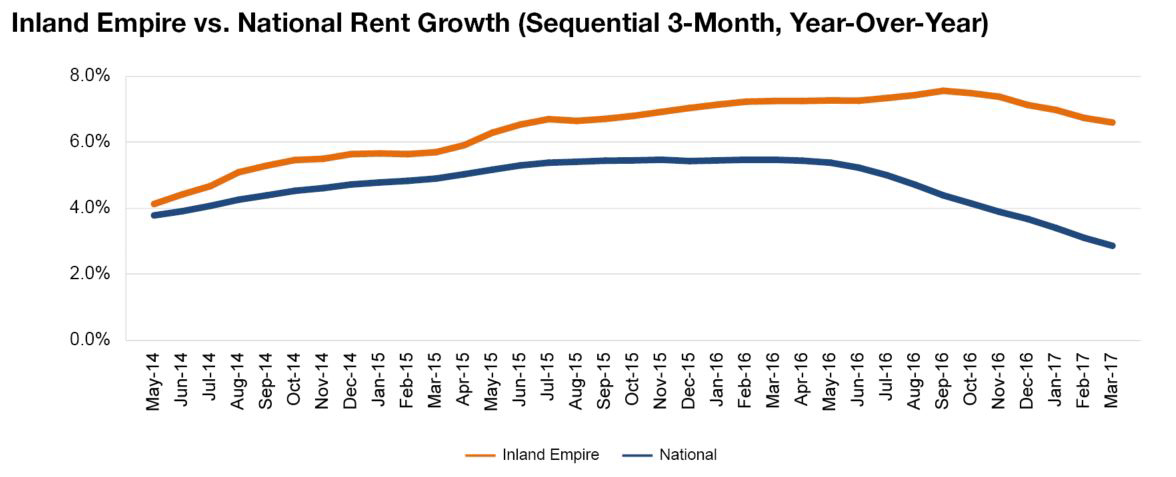

Multifamily rent growth in San Bernardino and Riverside counties continued its extremely fast pace over the past year, supported by a healthy job market and moderate inventory expansion, Yardi Matrix data shows.

By Alex Girda

Inland Empire rent evolution, click to enlarge

Rent growth in San Bernardino and Riverside counties continued its extremely fast pace over the past year, supported by a healthy job market and moderate inventory expansion. The metro boasts high occupancy rates—96.1 percent for stabilized properties as of the first quarter—and a pipeline brimming with new supply, though most deliveries are still a year or two away.

Although employment growth has tempered, the Inland Empire managed to outperform the national average, due to solid gains in trade, transportation and utilities; education; and health care. Rising global trade and the growth of e-commerce have increased demand for industrial and warehouse properties. California’s Road Repair and Accountability Act will bring projects worth an estimated $427 million to Riverside alone, further stimulating transportation and construction.

Evidently, investors are eyeing this area: More than $2.3 billion in multifamily assets have changed hands since the beginning of 2016. A limited amount of new inventory throughout the current cycle has helped bolster rents, which have risen modestly but not nearly as much as in most U.S. cities. As long as supply is weak and demand strong, rents in the Inland Empire should rise at an above-trend rate of 7.6 percent in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.