The Potential in Reconstructing a Mall: NAREE

On a panel at the National Association of Real Estate Editors' 2020 annual conference, industry experts discussed the evolution of malls and how they can work to become viable pieces of real estate once again.

Counterclockwise: Brian O’Looney, Ellen Dunham-Jones, Beth DeCarbo, June Williamson and Rick Latella.

“The beauty of retail is that it has the continued ability to reinvent itself,” said Cushman & Wakefield’s Executive Managing Director Rick Latella. The retail market continues to face new challenges everyday, especially struggling malls that can’t afford to sustain tenants and are heavily impacted by the coronavirus. On a panel at the National Association of Real Estate Editors’ 2020 annual conference, Reconstructing the Mall: Adding Housing and Offices to Dead or Dying Shopping Centers, industry experts discussed the evolution of malls and how they can work to become viable pieces of real estate by transforming into mixed-use facilities.

Moderated by Wall Street Journal News Editor Beth DeCarbo, the panelists included Latella, Torti Gallas + Partners’ Principal Brian O’Looney, Georgia-Tech University’s Architecture Professor & Director of the Urban Design Program Ellen Dunham-Jones and City College of New York’s Associate Professor & Department Chair June Williamson.

READ ALSO: In a Murky Office Market, Go Bold: NAREE Panel

Raising the bar

By 2000, more than 51 percent of Americans lived in the suburbs, where only around 30 percent of households had children. The desire of Baby Boomers to age-in-community coincides with consumers wanting the ease of shopping and accessibility without needing to go to the city. “Now, working from home may change the patterns of where people might want to live,” said Williamson.

Developers are raising the bar on the suburban retrofitting agenda, focusing on these six urgent challenges:

- disrupt auto dependence

- improve public health

- support an aging population

- leverage social capital for equity

- compete for jobs

- add water and energy resilience

According to research conducted by Dunham-Jones, nearly 400 of the 1,500 shopping malls will be retrofitted into more sustainable and community-serving spaces. “Where malls and strip malls have been dying, has enabled the historic main streets that were killed by these properties back in the day, to come back to life,” she said.

These malls will be converted to now what is known as Work. Eat. Live. Shop. spaces. The changes are happening in reverse, with aging office parks bringing in urban housing and retail to promote the property’s walkability. Reinhabitation can help grow a wider variety of much needed jobs, with the number one non-retail reuse of former mall space being office and the second being medical or educational. This process aims to relocalize and service the local communities. It offers lower costs, lower rents, ample parking, reduced embodied energy than new construction and is often more geared to small business and circular local economies.

Replacement strategies

“Amazon and online shopping hasn’t killed the malls, malls have killed the malls,” said O’Looney. The U.S. is overstored, accounting for 23.5 square feet per person compared to Canada at 16.8 and Australia at 11.2, according to A.T. Kearney’s The Future of Shopping Centers report. O’Looney explained that before they were department stores, big retailers like Sears were supply houses, where consumers received catalogs in the mail and could order products direct to their door, much like how Amazon operates.

The key to making malls was having those supply warehouses, he said, but they eventually because victim to their own business model by diverging from their original use and losing track of who they were and who they were serving. “Sears went from a supply house to a department store to now being a real estate asset company selling off properties to the highest bidder to save themselves,” he added.

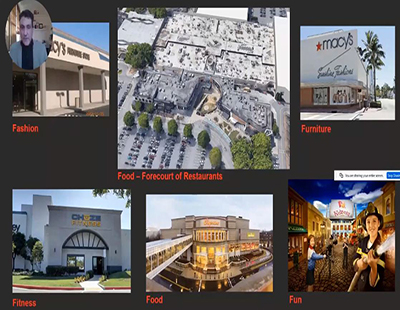

Anchor tenants began running the show, as part of the Reciprocal Easement Agreement (REA), in which the mall owner can’t make any changes until the anchor tenants agree. They began asking for bigger terms such as land and parking for free, which ends with chopping up the mall to the point that the developer has a X shape of land with tenants taking over larger pieces. It’s harder to redevelop these types of properties because mall owners and anchor tenants have been over-leveraged. In order to survive now the mall has to offer one or more of the five F’s—fashion, food, furniture, fitness, forcourt of restaurants or fun. If you can tear down one anchor, that can release a sizable property to redevelopment of 1,500 units, 3,000 people, O’Looney explained.

Retail circle of life

The panelists shared some interesting property evolutions throughout the years, showcasing how they can either perform successfully, or have to be redeveloped entirely for a different use.

The University of Rochester’s Medicine Orthopedics & Physical Performance Center. Image via NAREE 2020

One example of this was the Randall Park Mall in North Randall, Ohio. In 1908, the site started out as farm land and was later transformed into a race track in 1939. The track eventually went bankrupt and was sold. In 1976, the property opened as the largest indoor mall in the world. However, the decline of the mall started in 1994 and eventually closed its doors in 2014. In 2017, Amazon announced it would be demolishing the asset to build an 855,000-square-foot warehouse, bringing 2,000 full-time jobs to the area when it opened in 2018.

In Henrietta, N.Y., The University of Rochester acquired a former Sears retail space at the Marketplace Mall in 2019. UR announced plans to repurpose the 330,000-square-foot space to house its Medicine Orthopedics & Physical Performance Center. The center is estimated to cost $240 million to build and is scheduled for completion in 2023.

You must be logged in to post a comment.