The Science of Retail: Can Data Save the Store?

Investors increasingly rely on analytics to keep their assets relevant.

As data collection and analytics tools have improved, retail property owners are increasingly managing by metrics. And they are currently scrutinizing the data so they can endure and plan their recovery from the coronavirus pandemic.

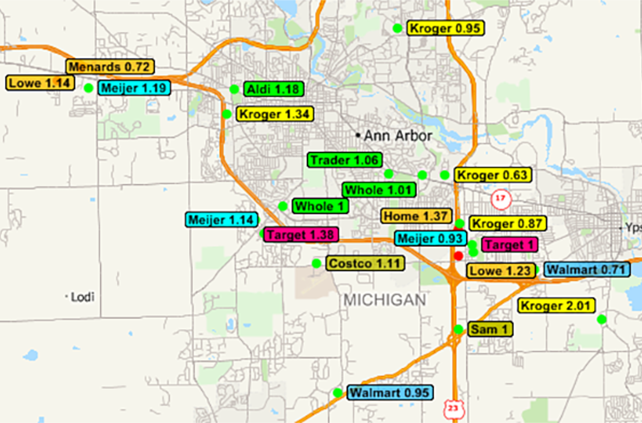

Major chains indexed to median Michigan store foot traffic. Image courtesy of Integra Realty Resources

“The COVID-19 crisis is reminding investors, advisers and retailers of the importance of nimble plans, customer engagement, as well as cash flow and balance sheet management,” said William Miller, managing director of Integra Realty Resources.

Transparency and access to real-time data are the driving forces behind today’s investment and leasing decisions in the sector, says Randall Lewis, executive vice president of marketing at the Lewis Group of Cos. Examples of this include trade area demographics, population, traffic counts and more specific data such as customer length of stay, the average number of stores visited and the total number of visitors to a property.

The latest in technology can paint a comprehensive picture for retail owners on how they can increase revenue by monitoring foot traffic, finding the right retailers that fit their properties and gauging the local competition.

Retail matchmaking

Using the latest in data tools, owners can set multiple criteria that include socioeconomic statistics and demographic and location insights when collecting information to fuel their decision-making process. “In the future, retailers and owners will have to truly harness the quantitative value of alternative datasets like social media, IoT and mobility data, instead of treating these like qualitative indicators,” said Vincent-Charles Hodder, co-founder & CEO of location intelligence company Local Logic.

When searching for the best retailer to occupy space at a property, landlords should consider the asset’s exact location within the neighborhood. Considerations such as corner vs. mid-block, eastbound or westbound, visibility, cross traffic, adjacency and free-standing or in-line will help them match the space with the right tenant. Owners should ask how a retailer benefits the potential customer, and by better understanding the consumer they will be able to make more comprehensive decisions on which tenants to pursue. At the same time, landlords can use data to approach specific tenants with relevant information about the property and how it works for their brands, Lewis explains.

Another metric that helps connect owners with the right retailers is customer tracking. Lewis notes that learning where shoppers go after visiting the mall can reveal their interests and needs. For example, if customers leave a retail center and drive across town to a Ross store, owners will know that discount stores are in demand. “We can then begin discussions with Marshalls, T.J. Maxx or Burlington, with actual data that demonstrates demand for their offering in our location,” added Lewis.

New data opportunities

With technology transforming at a rapid pace, it’s important to stay ahead of the curve and keep an eye out for the latest developments. Today, online sales are a big emerging opportunity for new datasets. James Cook, Americas director of retail research at JLL, explains that although different data is available to owners and retailers, nothing truly revolutionary has crystallized recently. However, one way that stakeholders can stay ahead of the competition is to use what is available but in a more advanced way.

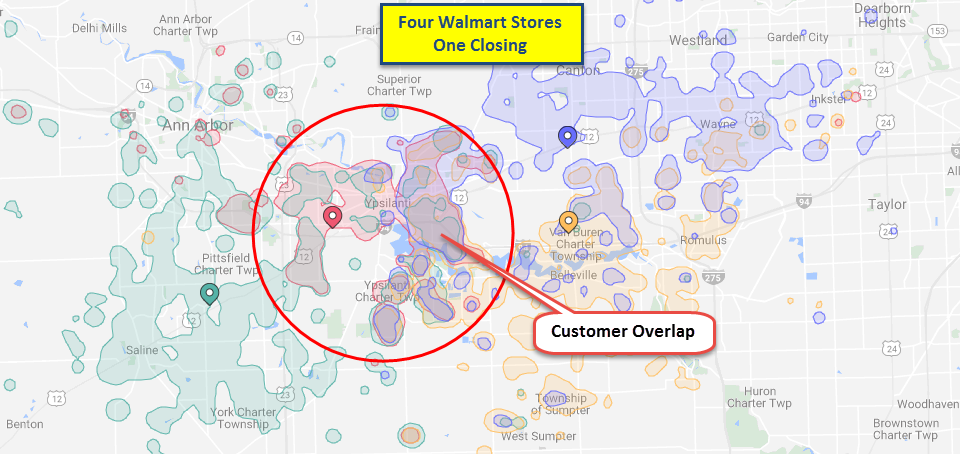

The closing of Walmart’s Ypsilanti Township store was announced on March 4, 2020 Image courtesy of Integra Realty Resources

“One thing we see is property owners spending time and money to develop nuanced profiles of the consumer and trade area. Owners go through the trouble to look at that data and profile to find out who consumers are, then take steps to create a shortlist of retailers to go in their shopping centers based on these profiles,” said Cook. From there, landlords can talk to these retailers about their interest in opening a new location and identifying their target customer. If retail owners can go the extra mile and get sophisticated and connect the dots, their property will stand out in the eyes of the retailer.

READ ALSO: Bracing for a Wave of Missed Retail Rents

In essence, today’s developers, investors, advisers and retailers are looking at real-time data before making a decision, compared to a few years ago, when the general demographic was the main research factor considered. Owners previously approached retailers with general, estimated population data in the one-, three- or five-mile radius around a center. Now, they have access to the actual income figures for residents in a particular area, as well as behavioral information concerning the people that live and work in the markets they serve, Lewis explained. This helps retail stakeholders make better-informed decisions.

Today, the elements of timing are less about cyclicality than they are about three other forms of change: disruption, trend and change of state, according to Integra Realty Resources’ retail report for 2020.

“The COVID-19 recession will prune the retail market. Value-oriented retailers outperform during economic shocks,” said Miller. “Today, that means online and delivery. A retailer that can simplify life has a better chance of success.”

You must be logged in to post a comment.