The Ups and Downs of CRE Construction

Materials and labor shortages are clashing with an optimistic, rebounding market, according to RICS.

Image by anncapictures via Pixabay.com

The latest quarterly construction and infrastructure survey from RICS showed activity in the Americas grew during the second quarter of 2021, with respondents anticipating even greater momentum for private nonresidential and commercial workloads as well as solid growth in infrastructure projects.

But the good news in the Q2 2021 Global Construction Monitor was tempered by ongoing concerns about rising costs of materials along with shortages of materials, labor and skills. In the U.S., 86 percent of respondents were concerned about the cost of materials and 83 percent of respondents worldwide also raised it as an issue. Respondents feared that could hamper construction output going forward.

PODCAST: Global CRE Markets: Sentiment Continues to Edge Up

“Shortages of labor in general and of specific skills in particular comes through loud and clear in the survey with both being reflected in expectations for higher wage costs. This coupled with the ongoing issues around the sourcing and pricing of building materials suggest that the hoped for recovery in profitability, signaled by contributors to the survey, may take a little longer than envisioned to materialize,” Simon Rubinsohn, RICS chief economist, said in a prepared statement.

However, Rubinsohn did highlight the positive data in the survey results, particularly in the U.S., noting that the nation’s construction industry does appear to be in full recovery mode. He said the latest feedback from respondents to the RICS survey suggests the upturn in workloads is beginning to broaden out.

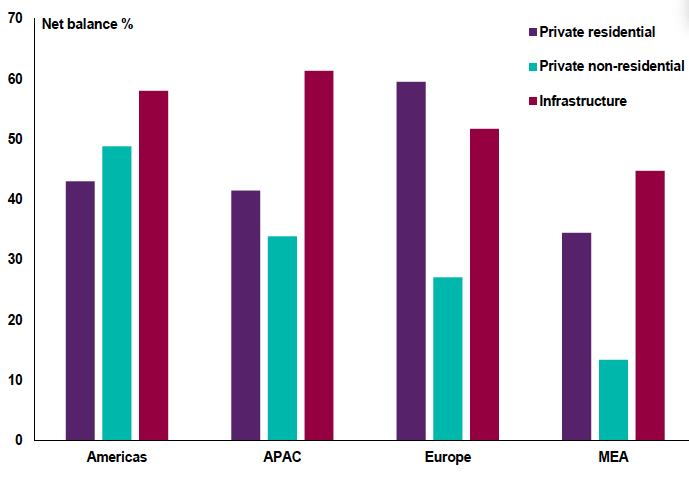

RICS 12-month Workload Expectations, second quarter of 2021. Chart courtesy of RICS

Looking forward, Rubinsohn said infrastructure is viewed as the most buoyant area of activity because of huge federal stimulus in the wake of the pandemic. He expects a significant jump in employee headcount as the industry gears up to meet the higher level of demand. RICS found 44 percent more of the survey participants are now anticipating an increase in headcounts over the coming year.

By the numbers

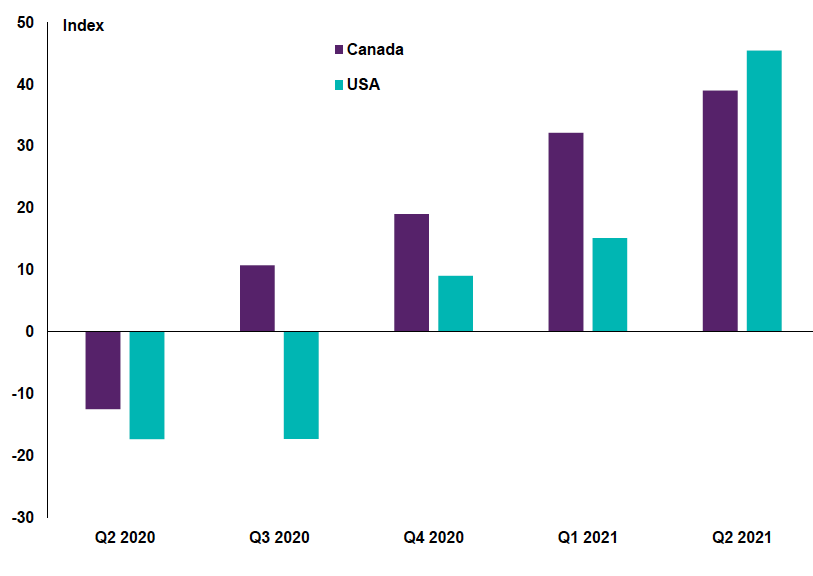

The second-quarter survey results for the Americas found all sectors had returned to growth at the aggregate level for the first time since the pandemic started. The upward trend for the U.S. and Canada began in the fourth quarter of 2020, with acceleration in momentum more evident in the U.S. The report notes a net balance of +49 percent of contributors within the U.S. reported infrastructure workloads had increased in the second quarter, up from +5 percent the previous quarter. The net balance for private commercial workloads was up +43 percent, a substantial turnaround from the first quarter, when it was -15 percent.

RICS Construction Activty Index, second quarter of 2021. Chart courtesy of RICS

Despite concerns about rising material costs and shortages, the 12-month expectations indicate solid growth in construction output throughout the Americas. That translates into anticipation for profit margins to potentially increase with a net balance of +23 percent expecting an improvement, compared to +14 in the previous survey.

Global data

The growth in construction output rose across all regions of the world, with Europe posting especially strong numbers, according to the RICS report. Infrastructure workloads led the way, followed by private residential and private commercial, which posted a small pickup in activity for the first time since RICS began the survey last year.

The Construction Activity Index, which measures current and expected market activity as reported by construction professionals, was up +25 in the second quarter globally, compared to +14 in the previous quarter. During last year’s second quarter, the activity hit a low of -24. Despite the overall good news across the globe, the index did show some variation with Europe (+34), the Americas (+29) and Asia Pacific (+21) all moving into expansion territory, while MEA feedback was much lower, at +8. In addition to the U.S., the countries with the best CAI readings were Portugal, the Netherlands and Saudi Arabia.

Survey participants also reported more positive outlooks for employment levels with a net balance of +27 of respondents expecting global headcounts to rise in the year ahead, up from +18. Close to 90 percent of the markets covered by the RICS Global Construction Monitor expect employment to increase.

You must be logged in to post a comment.