Tishman Speyer Grabs 153 KSF DC Office Building

Tishman Speyer has bought is 2000 K St., N.W., an eight story, 153,212-square-foot corner office property located in Washington's Central Business District.

By Anna Spiewak, News Editor

New York-based real estate building and operating company Tishman Speyer has bought 2000 K St. N.W., an eight story, 153,212-square-foot corner office property located in Washington’s Central Business District.

The building, on the southwest corner of 20th and K streets, is 79 percent leased and its price has not been disclosed. It is, however, within walking distance to the White House, the headquarters of the World Bank and the International Monetary Fund, as well as several hotels and restaurants.

The property includes a rooftop terrace, and a newly updated fitness center just for tenants, along with a two-level underground parking garage and ground-floor convenience retail.

“The building is well situated in one of District’s very best locations and has strong upside potential,” said Tishman Speyer co-CEOs Jerry and Rob Speyer in a news release.

Bill Collins, Paul Collins, Jud Ryan, Drew Flood and James Cassidy of Cassidy Turley represented the seller – 2000 K Street L.L.C. – in the transaction.

According to market sources, two tenants in the building include Rudy Giuliani’s law firm: Bracewell & Giuliani, and another law firm: Lerman Senter P.L.L.C.

Tishman Speyer plans to enhance the property and reposition it in the marketplace, according to the news release. The company refused to provide further details.

“We have confidence in the long-term vitality of the Washington, D.C., office market and this is a welcome addition to our portfolio,” the CEOs added.

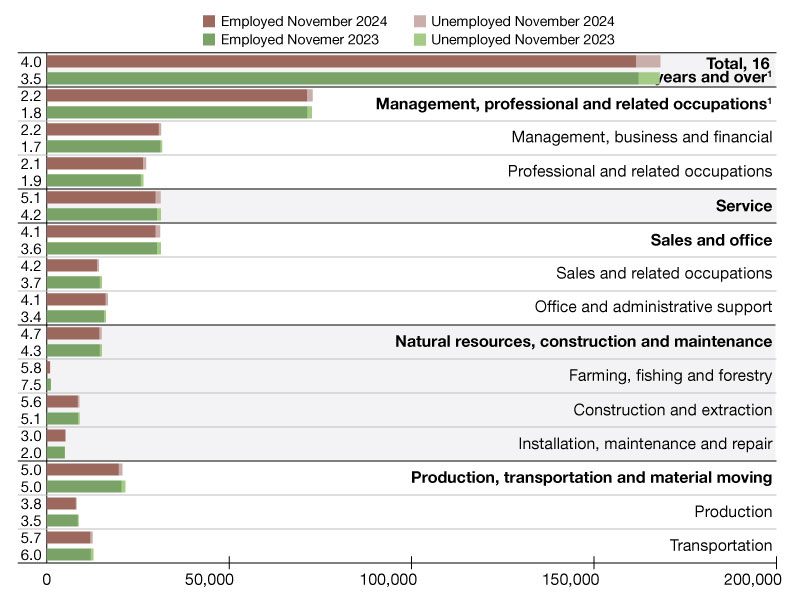

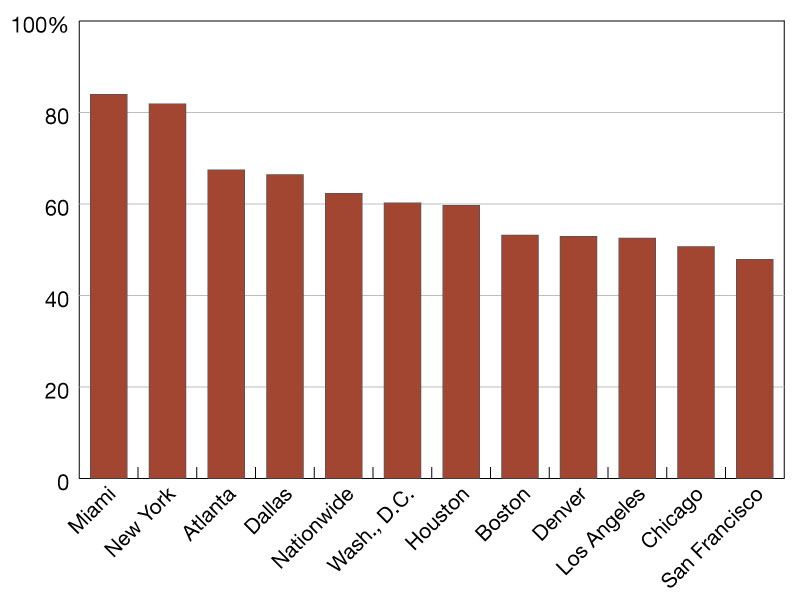

According to Marcus & Millichap’s Third Quarter 2013 office report, many tenants are preparing to vacate existing spaces for other locations or are downsizing. With additional space available on the market, owners of existing buildings will likely face more intense pressure to retain current tenants or attract new office users. These conditions are arising at a time when many office tenants are already re-evaluating staff and space requirements in light of the federal spending cuts that went into effect early this year.

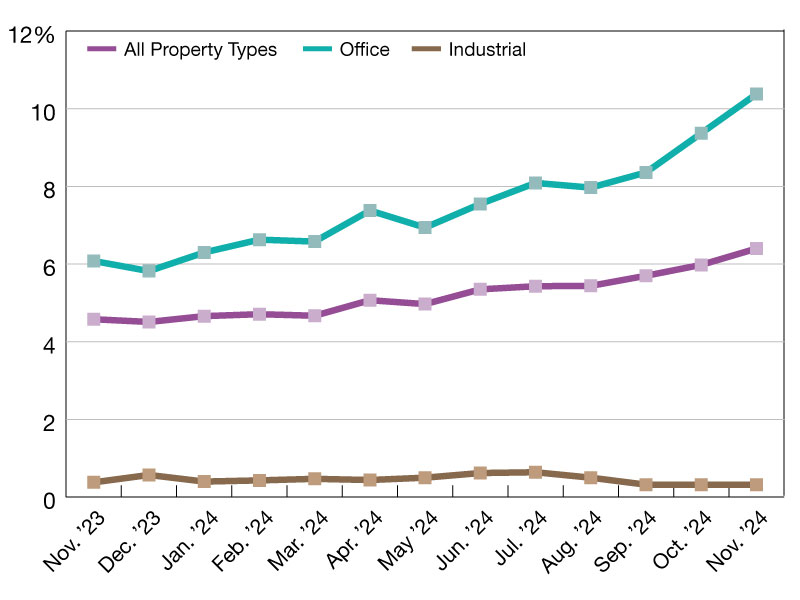

The rise in available space and a growing pipeline of planned and under construction projects will encourage investors to take a closer look at tenant quality and impending vacancies in surrounding buildings. Average cap rates have already risen, partly reflecting the changing market conditions and also a shift in the mix of properties sold.

As a result, availability in the metro will increase 130 basis points this year to 19.2 percent as demand lags supply growth and tenants place additional space on the market. Average rents in metro areas will rise 2.4 percent to $36.65 per square foot in 2013.

Tishman Speyer is active across four continents and as of June 2013 has acquired, developed and/or managed a portfolio of more than 123 million square feet.

You must be logged in to post a comment.