Tishman Speyer, Mitsui Fudosan Pay $146M for SoCal Site

The land is fully entitled for a 600,000-square-foot industrial development.

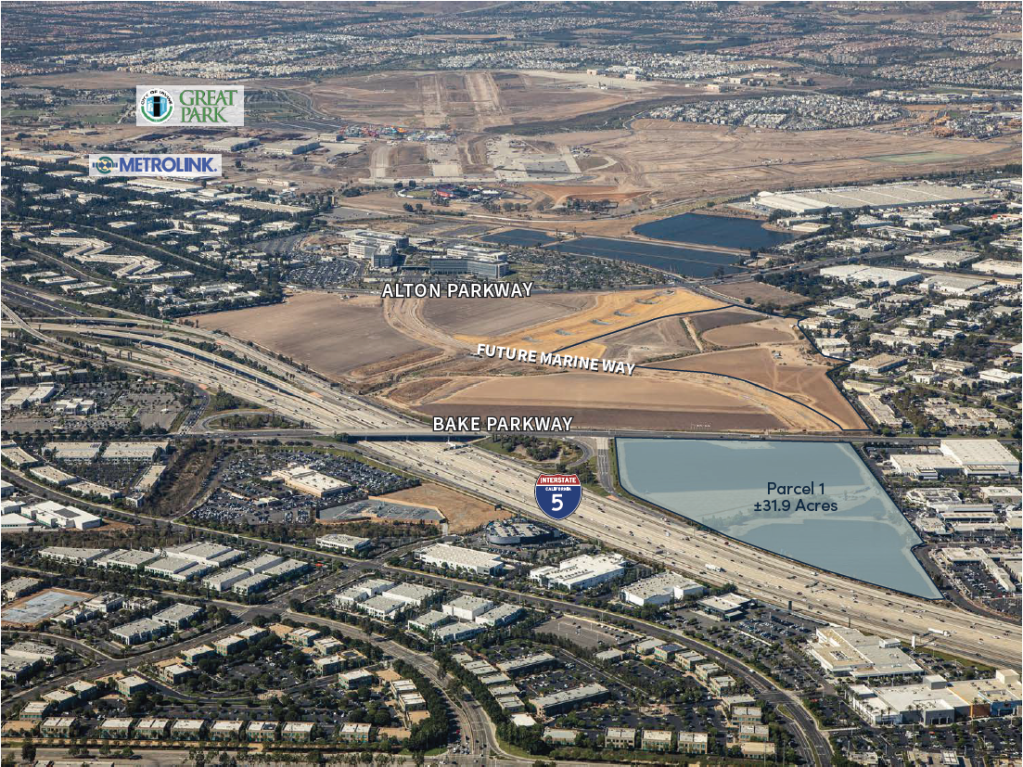

Tishman Speyer and Mitsui Fudosan America Inc. have acquired an approximately 32-acre lot within the Great Park Neighborhoods mixed-use community in Irvine, Calif., with plans to develop a 600,000-square-foot industrial project. The parcel traded for $145.9 million, or $4.6 million per acre, according to TheRealDeal.

The project will encompass four industrial buildings ranging in size from 73,000 square feet to 203,000 square feet. Construction on the first phase of the development is expected to start during the fourth quarter of 2024.

Plans call for a flexible and easily divisible building design for multiple users, catering to companies that are looking for distribution space, warehouses, manufacturing space or other types of flex space.

The 32-acre parcel represents the joint venture’s second acquisition. The companies formed the partnership in 2022, with an initial $500 million commitment sponsored by Mitsui Fudosan America Inc., and with co-investment funds from Tishman Speyer. The venture, called Tishman Speyer-Mitsui Fudosan America Logistics Venture focuses on ground-up developments, redevelopments or repositioning of industrial assets in major U.S. markets, prioritizing ESG investments that follow environmental certifications such as LEED or GRESB.

Developed by FivePoint Holdings, Great Park Neighborhoods is a master-planned community located close to John Wayne Airport and to the Los Angeles ports complex, that also provides easy access to interstates 405 and 5. The development site is located within the southern portion of the master-planned community and benefits from easy freeway access and signage capabilities.

Construction is slow, sale prices are high in Orange County

Orange County had the lowest under-construction pipeline among Southern California markets, a recent CommercialEdge report shows. As of November, industrial developments in the area totaled less than 1 million square feet. Not surprisingly, Orange County recorded a 4.7 percent vacancy rate as of November, one of the lowest among Western markets. The metro also recorded one of the highest average prices per square foot, at $309, securing the top third spot among all major U.S. industrial markets.

Other recent industrial acquisitions in Orange County include MIG Real Estate’s purchase of Mission Viejo Business Center, a 100,295-square-foot industrial park in Mission Viejo, Calif. The six-building industrial campus was sold by DWS in November 2023.

In April last year, Link Logistics sold a seven-property industrial portfolio in Orange County and Los Angeles County for $263 million. The buyer of the 851,131-square-foot portfolio is a joint venture formed between George Urban Advisors, Five Horizons Partners and DRA Advisors. New York Life Insurance Co. has provided $165.3 million in acquisition financing.

You must be logged in to post a comment.