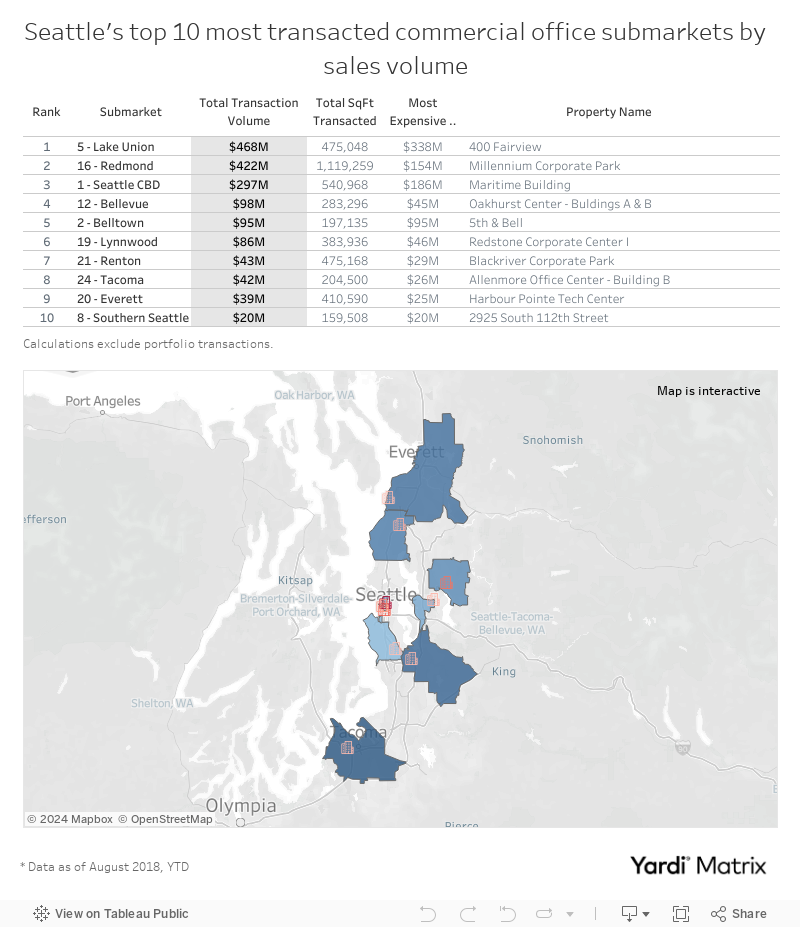

Seattle’s 10 Most Transacted Submarkets by Office Sales Volume

Seattle continues to shine due to its ongoing population growth, solid employment, strong academic footprint and tech-bolstered office demand. More than $2 billion worth of office assets changed hands between January and August 2018.

By Corina Stef

Seattle continued its fast-paced growth, having emerged in the past two years as the nation’s second strongest tech market. The metro’s booming economy is reflected through strong population gains and increased wages. Major powerhouses such as Amazon, Microsoft or Facebook are boosting the office development pipeline due to strong demand for quality office product. These companies are pre-leasing entire buildings or large blocks of space in the most supply-constrained submarkets, driving property prices further up. Following this trend, the appeal of the city’s strong tech sector is likely to be attractive when it comes to investment activity.

Total sales volume in Seattle surpassed $2 billion year-to-date in August 2018, as office campuses, portfolios and fully leased office assets changed hands at record prices. The list below highlights the most transacted commercial office submarkets by sales volume in the Seattle metro based on Yardi Matrix data.

var divElement = document.getElementById(‘viz1539070217120’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’800px’;vizElement.style.height=’927px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

10. Southern Seattle

Southern Seattle is a highly suburban submarket with affordable rates. Despite this, investors opted to focus their attention on submarkets positioned closer to the urban core, where cash flow is higher. In the seven months ending in July, a 159,508-square-foot property changed hands for $19.5 million. Boeing sold 2925 S. 112th St. in Tukwila, Wash., to Amerco Real Estate as part of a larger disposition plan of underused buildings in order to cut costs.

9. Everett

The submarket, a bedroom community for Seattle, recorded limited investment activity in the commercial sector. The largest city in Snohomish County saw nearly $39.4 million in sales across more than 400,000 square feet during the first seven months of 2018.

The largest sale was Prescott Group’s disposition of Harbour Pointe Tech Center, a 334,090-square-foot office building situated at 6500 Harbour Heights Parkway SW in Mukilteo, Wash. An MRM Capital and InCity Properties partnership paid nearly $30 million for the fully leased property, whose tenants include Boeing, Prescott Group and Corporation Service Co.

8. Tacoma

In Tacoma, more than 200,000 square feet changed hands for a total of $42.2 million. The submarket boasted below-national-average vacancy rates and high development activity, turning out to be a budget-friendly alternative to more centrally located neighboring areas.

Healthcare Realty Trust’s acquisition of the 86,942-square-foot MultiCare Allenmore Hospital–Building B was the largest transaction in the area. Berschauer Group sold the property for $25.7 million. The asset is located at 1901 S. Union Ave. in Tacoma, Wash., on Multicare Health System’s Allenmore hospital campus.

7. Renton

The submarket boasts an ample office inventory of more than 6.2 million square feet and recorded more than $42.5 million in sales between January and August 2018. Renton is one of the most affordable submarkets in the metro, as it is located far from the massive road congestions the urban core.

The largest deal was Laird Norton Co.’s purchase of part of Blackriver Corporate Park. The acquisition included four office/flex buildings across 276,000 square feet located along Naches Avenue SW. Located less than 20 minutes from both Seattle and Bellevue, the assets have easy access to interstates 5 and 405, as well as routes 167 and 900.

6. Lynnwood

Despite encapsulating one of the largest concentrations of retail space in the metro and a limited office inventory of approximately 740,000 square feet, Lynnwood recorded $86.2 million in office sales during the first seven months of 2018. Three properties accounting for more than half of the submarket’s total stock changed hands, with the largest deal being PCCP’s disposition of the Redstone Corporate Center complex. The property encompasses 320,711 square feet and traded for $70.8 million.

5. Belltown

The submarket is Seattle’s most densely populated and one of its priciest neighborhoods, housing many new businesses and notable landmarks. Its office inventory comprises nearly 1.3 million square feet of office space. EQ Office sold 5th & Bell to Alexandria Real Estate Equities for $95 million. The 197,135-square-foot office building is located at 2301 5th Ave. Upon its 2002 completion, the property was named the NAIOP Office Development of the Year.

4. Bellevue

An edge city containing more than 1,300 businesses, Bellevue had an ample office inventory of nearly 5 million square feet, with a large amount of office space in various pre-construction stages. A total of $97.6 million in sales across nearly 300,000 square feet of office space was recorded between January and August 2018.

This year’s largest deal was the sale of a 143,191-square-foot building located at 14335 NE 24th St. in Bellevue, Wash. Swift Real Estate Partners paid Barings $45.4 million for Oakhurst Center–Buildings A & B. The sale was funded by a $33.1 million loan backed by Wells Fargo Bank.

3. Seattle Commercial Business District

The submarket with the highest leasing activity recorded $297 million in sales year-to-date in August. The CBD will also house two of the largest office buildings currently under construction, including Runstad & Co.’s 722,000-square-foot Rainier Square Tower that’s been fully pre-leased to Facebook.

The largest deal was State Teachers Retirement System of Ohio’s purchase of the 211,834-square-foot Maritime Building. The waterfront asset is located at 911 Western Ave. and was originally completed in 1983. The seller, Beacon Capital Partners, added three additional stories to the existing structure in 2018.

2. Redmond

Known to house Microsoft and Nintendo America, Redmond has emerged as a hub for the high-tech industry. The submarket’s office inventory counts more than 4.5 million square feet and 1.1 million square feet changed hands for $422 million between January and August. Gramercy Property Trust acquired Millennium Corporate Park from TH Real Estate in a $153.5 million deal. Located at 18200 NE Union Hill Road, the property encompasses six buildings on 30 acres and is anchored by Microsoft.

1. Lake Union

The submarket has recently become the most sought-after spot for large businesses leasing up massive amounts of space such as Amazon. In May, Lake Union boasted a very low 1.7 percent vacancy rate, as its major players from the tech and life sciences industry continue to draw other companies to the area. Despite its rising office rents, investors bagged $468 million for less than 500,000 square feet which traded between January and August interval.

The largest transaction was TH Real Estate and Skanska’s sale of 400 Fairview, a 345,048-square-foot premier office building. The fully leased, LEED Gold building’s acquisition marks Pembroke Real Estate’s first property in the metro and is part of the company’s West Coast expansion plan.

Images courtesy of Yardi Matrix

You must be logged in to post a comment.