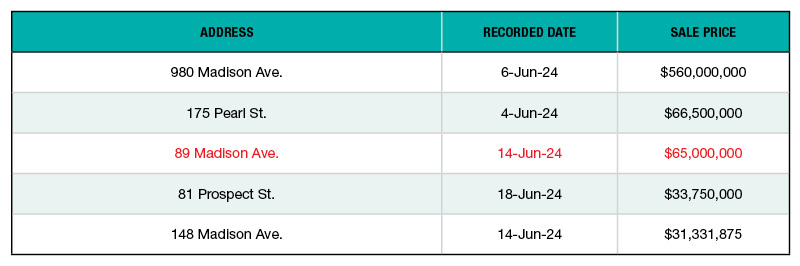

Top 5 NYC Office Building Sales—June 2024

PropertyShark collected the city’s top deals for the sector.

Sale Price: $560,000,000

RFR Realty sold the 118,635-square-foot, six-story office building in Manhattan’s Lenox Hill neighborhood to an entity related to Bloomberg. The property held an approximately $200 million CMBS loan, according to The Real Deal. The asset was built in 1949 and went through a complete upgrade in 2006. It includes 22,949 square feet of retail space.

Sale Price: $66,500,000

Watermark Capital Group purchased the 184,965-square-foot office property in downtown Brooklyn from seller Cannon Hill Capital Partners. The acquisition was funded by two loans totaling approximately $59 million, originated by BridgeCity Capital. The new ownership plans to convert the nine-story building into a 230,000-square-foot multifamily complex that will bring 238 units in the area, according to The Real Deal.

Sale Price: $65,000,000

The 146,161-square-foot office mid-rise changed hands from seller Sklar Equities to buyer Sunlight Development. The 16-story NoMad property became subject to bankruptcy proceedings in 2021. The new ownership secured $50 million in financing from S3 Capital. The property was originally completed in 1912 and, under the new ownership, will be converted into a mixed-use multifamily property that will include 70 apartments units, according to Traded.

Sale Price: $33,750,000

RFR Realty, together with Kushner Cos., sold its majority ownership stake totaling 84 percent in the 93,107-square-foot downtown Brooklyn office asset, to Pear Realty Management. The nine-story property last changed hands in 2017, when Invesco Real Estate sold it. The building was last upgraded in 2014 and includes 6,182 square feet of retail space.

Sale Price: $31,331,875

Gourmet Home Products acquired the 71,871-square-foot, 16-story office building in Manhattan’s NoMad neighborhood from a private seller. The new ownership secured a $19 million acquisition loan from Interaudi Bank, through an assumption note. The 1917-built asset is currently leased to multiple tenants.

You must be logged in to post a comment.