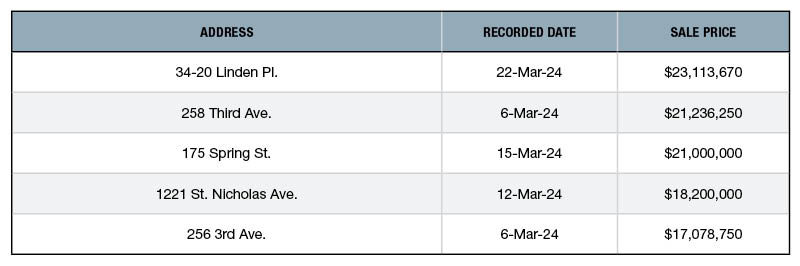

Top 5 NYC Retail Building Sales—March 2024

Property Shark’s latest roundup of the city’s top deals.

- 34-20 Linden Place, Queens

Sale Price: $23,113,670

The 67,197-square-foot retail property changed hands in a bankruptcy auction to Weizhen Chen, a Flushing, N.Y.-based real estate investor. The property was sold by a private seller and last changed hands in 2017 for $20.5 million, when the current seller picked it up from Global Universal Group, through another bankruptcy auction. The two-story retail property is now subject to a $16 million acquisition loan held n New Era Life Insurance Co.

- 258 Third Ave., Manhattan

Sale Price: $21,236,250

Legion Investment Group purchased the 3,402-square-foot retail property in Manhattan’s Gramercy Park from a private seller. The two-story, 1910-built property is subject to a $33.5 million portfolio loan originated by JPMorgan Chase Bank. Legion Investment Group’s transaction is part of a deal totaling $72 million where the buyer picked up a four-parcel assemblage for the development of a luxury condominium project, according to The Real Deal.

- 175 Spring St., Manhattan

Sale Price: $21,000,000

The 13,816-square-foot was sold by Extell Development and several other partners to a private buyer. The four-story property includes an additional 21,980 square feet of development rights and can be converted into a townhouse or a private condo, according to New York Post.

- 1221 St. Nicholas Ave., Manhattan

Sale Price: $18,200,000

An entity affiliated to Key Food Stores Co-Operative Inc. purchased the 17,100-square-foot retail asset in Manhattan’s Washington Heights neighborhood from a private seller. The property is subject to a $7.4 million acquisition loan and a second one totaling $582,081, both self-financed.

- 256 Third Ave., Manhattan

Sale Price: $17,078,750

The 4,729-square-foot, one-story retail property was purchased by Legion Investment Group as part of its multiple acquisitions in Gramercy Park. The property changed hands from the same private seller and is subject to the same $33.5 million portfolio loan held by JP Morgan Chase Bank.

You must be logged in to post a comment.