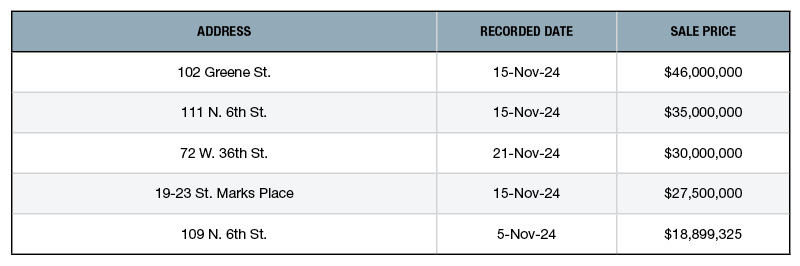

Top 5 NYC Retail Building Sales—November 2024

PropertyShark collected the city’s top deals for the sector.

Sale Price: $46 million

RFR Holding has sold the 10,139-square-foot retail building in Manhattan’s SoHo neighborhood to Japan-based Arkray Inc. The four-story building dates to 1910 and is currently occupied by the luxury brand Cartier, which upgraded the interiors in collaboration with Paris-based architectural firm Studioparisien. The property last changed hands in 2022, when RFR Holding paid $31.5 million. The seller was TA Realty.

Sale Price: $35 million

Empire State Realty Trust purchased the 7,684-square-foot retail building in the borough’s Williamsburg neighborhood from L3 Capital. The property is a three-building, single-story complex that dates back to 1945 and is now part of the new ownership’s collection of prime retail buildings on N. 6th Street. The building also includes a second-floor terrace and will be the future home of Hermès, according to Empire State Realty Trust’s website.

Sale Price: $30 million

A private individual working on behalf of George Schwartz estate sold the 16,000-square-foot, three-building retail complex in Koreatown to Houston-based Landry’s Inc. The property originally came online in 1915 and includes a five-story building and a total of 2,760 square feet of office space. It is occupied by Keens Steakhouse, which used it as a longtime location in Midtown Manhattan. The new ownership, Landry’s Inc., is a hospitality brand owned by Tilman Fertitta, the Texas billionaire who owns the Houston Rockets.

Sale Price: $27.5 million

UBS Realty Investors has sold the retail property in Manhattan’s East Village neighborhood to Lawrence Movtady’s MOVCAP. The 15,851-square-foot building dates back to 1920 and was the former home of Andy Warhol’s Electric Circus nightclub, that operated between 1967 and 1971. The seven-story structure previously changed hands in 2020 for $35 million, when UBS picked it up from Cape Advisors. The new ownership plans to touch up the asset and to continue to operate the multifamily component of the property, comprising 41 rental units, according to Crain’s New York Business.

Sale Price: $18.9 million

Acadia Realty Trust has purchased the 8,322-square-foot retail property in Williamsburg from MARK Capital. The two-story building came online in 1910 and was last upgraded in 2018. The asset includes 5,522 square feet of retail space, 2,800 square feet of storage area and is currently fully occupied by the apparel company Madewell.

—Posted on December 27, 2024

You must be logged in to post a comment.