Emerging Trends for CRE in 2024 and Beyond

ULI and PwC’s flagship report takes an in-depth look at what’s ahead. Here are the main takeaways.

The commercial real estate industry is facing a post-pandemic era of higher interest rates, slower economic growth and the realization that hybrid work schedules are here to stay with wide-ranging impacts on the nation’s office sector and downtowns. With those issues and more as a backdrop, the theme for this year’s Emerging Trends in Real Estate 2024 from the Urban Land Institute and PwC US is “The Great Reset.”

More than 2,000 experts were interviewed and surveyed for the 45th edition of the annual industry trends report issued Tuesday at ULI’s fall meeting in Los Angeles. Their insights combined with proprietary data and analysis provide a look at the CRE environment this past year and an outlook for the year ahead, including markets to watch across the U.S.

What has become clear this year, the report concludes, is that the CRE industry can no longer rely on past benchmarks to determine how the market will function in the future and instead must set new norms.

Anita Kramer, senior vice president of ULI’s Center for Real Estate Economics and Capital Markets and the longtime editor of the annual report, said in prepared remarks it’s clear the real estate industry is entering a new era of thinking, building and operating. Kramer points to some key trends such as the emergence of hybrid work models, the strength of the retail sector, and growth of Sun Belt markets that underscore the new reality, especially in the top cities to watch in 2024—Phoenix; Dallas/Fort Worth; Atlanta; Austin, Texas; and Nashville, Tenn.

READ ALSO: Opportunistic Investors Are Waiting to Deploy $100B+ of Dry Powder

Kramer notes the data shows there’s been a certain degree of caution this past year in both development and investment. But it’s time, a turnkey moment as she puts it, for CRE industry professionals to innovate and adapt to shape a resilient real estate landscape for the future.

Andrew Alperstein, a leader with PwC’s U.S. real estate practice, was realistic in his comments, noting that there have been economic headwinds and challenges with obtaining credit. But he was also optimistic stating there are opportunities available for high-quality properties and firms must learn to ride out the current short-term risks and adapt their growth strategies to succeed in this “period of higher-for-longer interest rates.”

Alperstein’s comments come as the U.S. Federal Reserve Open Market Committee announced Wednesday it will not raise interest rates at this time, keeping them at the current range of 5.25 to 5.5 percent. While acknowledging there have been some recent indicators that economic activity has been expanding, including rising GDP and strong job growth, Federal Reserve Chair Jerome Powell did not rule out another rate hike in the near future, possibly as soon as next month’s FOMC meeting, as the Fed continues to try and tamp inflation.

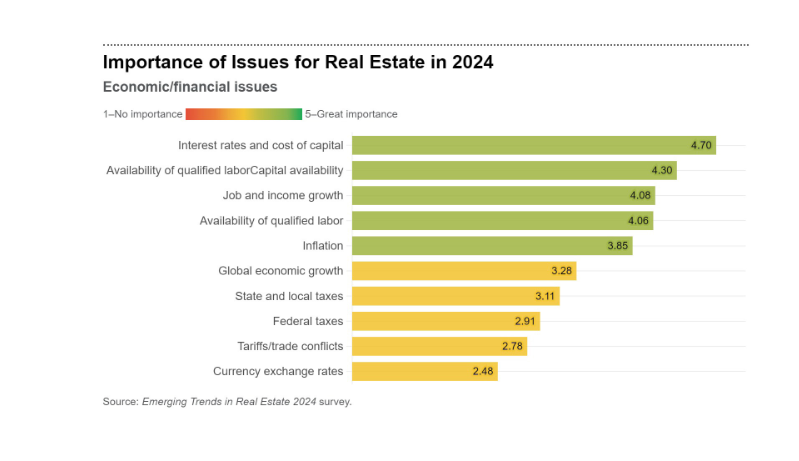

More than half the respondents to this year’s Emerging Trends survey believe inflation will decline in 2024 and another third believe inflation will at least stabilize. However, only three in 10 survey respondents expect commercial mortgage rates to drop next year. Indeed, one of the messages of the report is to expect rates to be higher for even longer.

The report acknowledges the obvious—transaction levels are down, particularly in the office sector—and the bid-ask spread is still wide. But the survey found investors are eager to acquire new assets, with the Emerging Trends Barometer for 2024 registering the highest “buy” rating since 2010.

Here are some of the other main takeaways of the ULI/PwC report:

Retail emerges as an unlikely CRE darling

Though there are challenges in the retail sector, including crime, some retail bankruptcies and CBD retail that has been impacted by fewer office workers, retail tenant demand is up. Some Class A and trophy malls are reporting high occupancy rates, luxury retail demand has increased and hybrid working means people are home more and visiting strip centers, power centers and grocery-anchored shopping centers more frequently.

Even the pandemic-induced spike in e-commerce demand has leveled off. The U.S. will close the year with about 35 million square feet of new retail product across all shopping center types and 2024 will likely see about 45 million square feet of new product come online.

The future of work is (still) hybrid

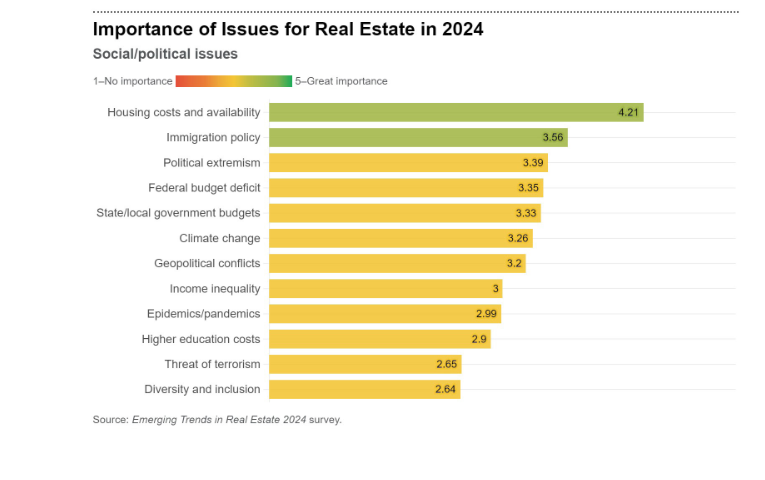

This was the year that most in the real estate industry realized the office sector will not be returning to pre-pandemic status and hybrid work is here to stay. The report states the shift to remote work might be the single most important trend for property market dynamics in generations, with other far-reaching impacts on our lives and property markets.

One of the biggest impacts has been on investors as sales transactions dropped more than twice as much as other major property types. Paul Fiorilla, a director at Yardi and contributor to the report, told Commercial Property Executive core office markets are undergoing some pain now in both fundamentals and capital markets.

“Demand for space is down, vacancies are up, and expenses are mushrooming. Meanwhile, property values are falling as loans come due, which will lead to distress,” Fiorilla said.

But Fiorilla noted major cities like New York and San Francisco have survived past major disruptions. New York City, he pointed out, still has multifamily occupancy rates and rents at all-time highs.

“San Francisco has larger problems and will take longer to recover, but it remains the center of the tech industry and will be boosted by the growth of artificial intelligence,” he said.

Downtowns need to change—again

The report notes there is a call for repurposing high-vacancy office buildings, but industry leaders caution not all can be economically converted, and a better solution may be demolishing some and repurposing them. However, Fiorilla believes some reinvention can occur to create a mixed-use environment. Some buildings could be converted to other uses including residential, hospital and retail to create a live-work-play atmosphere that will attract people.

“This reinvention will be a lengthy process that requires subsidies and cooperation between the public and private sectors. But I think the pandemic and growth of hybrid/remote work was deep enough of a shock that city and state governments will take action and certainly commercial property owners are on board,” he told CPE.

Sun Belt still dominates markets to watch

As we’ve seen in recent years, the Sun Belt continues to attract residents, firms and investors who are attracted to lower regulations and taxes, better quality of life, and a growing workforce.

“Sun Belt metros have been growing more rapidly than primary market metros for decades, and that can only be exacerbated by the remote work trend that enables people to live in less expensive metros while working in major metros,” Fiorilla said.

Of the top 20 markets for “overall prospects,” 15 are located in the Sun Belt, the report found: Nashville; Phoenix; Dallas/Fort Worth; Atlanta; Austin; San Diego; Boston; San Antonio, Texas; Raleigh/Durham, N.C.; Seattle; Houston; Denver; Charlotte, N.C.; Miami; Northern New Jersey; Washington, D.C./Northern Virginia; Los Angeles; Tampa/St. Petersburg, Fla.; Orlando, Fla.; and Las Vegas.

CRE must adapt to AI sooner rather than later

Artificial intelligence gets a lot of media attention these days and AI advancements are showing promise in the real estate industry, particularly in property search and analysis, assessing potential investments, improving customer experience, and streamlining due diligence. But the report notes many of the CRE experts surveyed are still not familiar with many of AI’s capabilities and a lack of understanding may lead to slow adoption. There have been fears AI adoption in warehouses could have an impact on industrial jobs but so far that has not been an issue, with warehouse jobs up almost 50 percent in this decade.

One impact, as Fiorilla previously noted, is in office leasing. JLL estimates the industry occupies more than 17 million square feet of office space, increasing to more than 60 million square feet within five years if recent growth rates are sustained. Much of that growth is occurring in the Bay Area and is expected to continue.

Adapting to future climate challenges

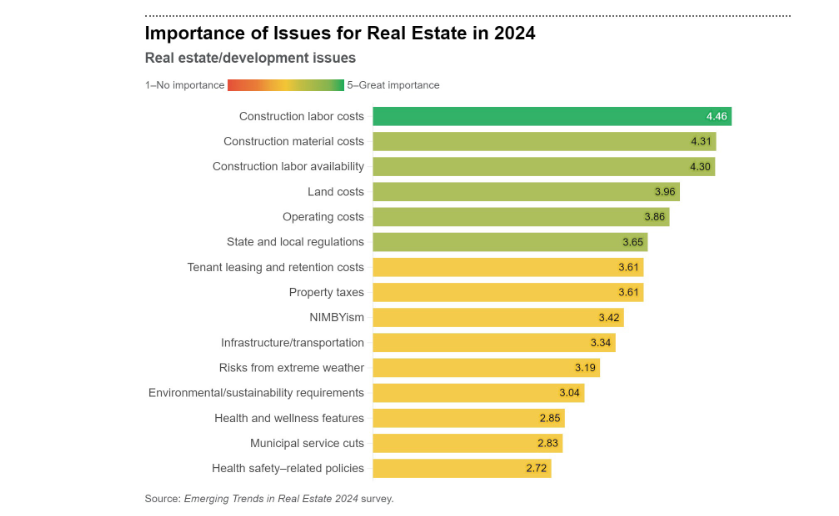

The number of billion-dollar climate events continues to rise with the U.S. already experiencing 24 billion-dollar events this year through mid-September. That compares to less than 5 per year from 1980 to 1999, adjusted for inflation. Over the past five years, the yearly average has risen to 18.

These events present increased costs and risks to owners and operating challenges for managers. They are also contributing to increasing costs and declining availability of CRE insurance. The industry will have to rethink the approach to insuring assets against growing climate risks.

It’s all about debt

Almost every industry participant interviewed for the report said debt became less available to them or the industry after the Fed began to hike interest rates in March 2022. Many blame this year’s sales transaction decline partly on capital market issues and reduced availability.

The report notes credit has become more expensive with stricter underwriting, leading some borrowers to just hold onto their existing debt. While distress levels so far remain low, a liquidity crisis is looming because many owners of underperforming buildings are facing debt deadlines and will be unable or unwilling to refinance their projects, prompting defaults or distressed asset sales.

Portfolio pivots

The shifts in property and financial markets are upending how CRE portfolios are constructed, including defining core assets. With downtown offices and regional malls suffering declines in demand and property values, fund managers are looking for other investments and are considering newer product types that were previously viewed as niche but offer more compelling returns.

Some of the investments are coming as extensions of more conventional property types. Core industrial may now include cold storage and self storage. Core multifamily now includes student housing and single-family built-to-rent properties. Other popular niche investments include digital infrastructure, data centers and life science properties.

You must be logged in to post a comment.