Top Retail Strategies for This Holiday Season

Mobile commerce, discounters, more pop-ups and warehouse space—these are the four key factors that CBRE identified as this year’s Christmas season preferences among shoppers. Clients want omnichannel access and enhanced consumer experiences.

By Laura Calugar

The holiday season is right around the corner and the Christmas shopping frenzy is inevitable. CBRE pinpointed that shoppers’ growing preference for variety and value will define this year’s holiday season’s retail trends. A greater proliferation of pop-up stores, the emergence of pop-up warehouses, an expansion of mobile commerce and strength in discount retailing are all meant to attract shoppers and bring retailers record revenues, according to a new report.

“As e-commerce reshapes modern retailing, blurring the lines between online and in-store activity, retailers and shopping center owners must continue to adapt with fresh approaches,” said CBRE Head of Retail Research of the Americas Melina Cordero, in prepared remarks. CBRE’s 2017 U.S. holiday trends guide outlines four trends shaping this season as it unfolds.

Retail pop-up strategies intensify

Short-term retail leases (often referred to as “pop-up shops”) have evolved from a trend last season to a full-blown sensation this season. Retailers and retail center owners favor the flexibility and experimentation allowed by short-term leases and shoppers appreciate the variety of a shifting roster of stores. Several of the largest U.S. mall owners have designated space in their strongest properties for pop-ups.

“They benefit both the landlord and tenant by allowing fresh, new concepts access to space on a temporary and cost-efficient basis. At the same time, they allow these new incubator concepts access to thousands of customers while they tweak their concepts for future growth and profitability,” said Chris Hodge, senior vice president at CBRE.

U.S. consumers prefer combining online and in-store shopping, making omni-channel platforms critical to retailer growth. This season will see an increased emphasis on new technologies in pop-up concepts as retailers experiment with new strategies to lure the increasingly tech-savvy shopper.

M-commerce investments on display

M-commerce investments on display

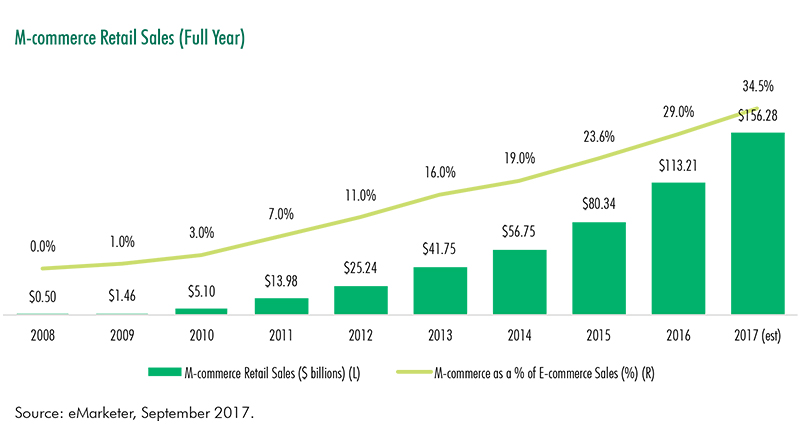

It’s no secret that e-commerce is claiming a growing portion of retail sales. What’s less often highlighted is the growth of mobile commerce. Marketing and research firm eMarketer forecasts that more than a third of online sales this year will occur on phones and tablets. CBRE expects online sales to continue to grow, with mobile technology playing a more prominent role than a few years ago as retailers seek new ways to generate sales and collect strategic data. Apps that can collect key customer information on preferences and shopping habits, enable retailers to generate tailored product offerings and advertising.

As consumer expectations for convenience and speed continue to rise, brick-and-mortar brands are adding mobile technology as an integral component to omni-channel success. More than 50 percent of online sales are made by brick-and-mortar brands.

Joel Murphy, CEO of New Market Properties, reveals the strategies his grocery store tenants are using to compete in the e-commerce space, in an interview for Commercial Property Executive.

Furthermore, discount and off-price retailers gained momentum during the last downturn. CBRE predicts that the category will take additional market share this season, spurring mid-market retailers to discount their prices to compete.

Pop-ups go industrial

The surge of online sales during the holiday season can create instant, short-term demand for warehouse and distribution space. This could cause potential headaches for retailers trying to ensure prompt delivery to customers. But new services have emerged to provide a “pop-up warehouse” model in which demand for short-term industrial space in a given market is matched with suppliers. Early results show higher efficiency and lower costs.

A study by Flexe, one of the early on-demand warehouse providers, found that users who utilize on-demand flexible warehouse space to augment a single-peak seasonal inventory surge, can improve warehouse utilization by almost 100 percent and cut overall seasonal warehouse and inventory costs in half.

“CBRE has identified these trends by examining public and proprietary data, querying our retail professionals and listening to our clients. We see these trends as natural steps for retailers striving to perfect their omni-channel operations for selling across all channels and to enhance consumers’ experiences in each,” said Brandon Famous, CBRE senior managing director of retail advisory, transaction services & retail leader, the Americas.

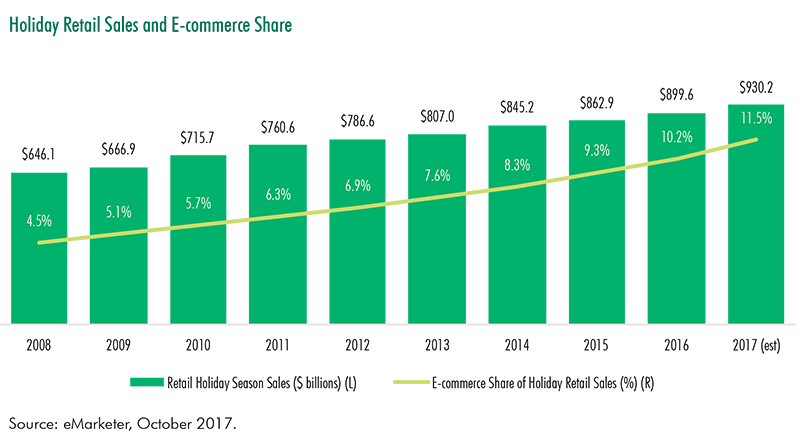

Retail sales across all channels are expected to rise between 3.6 and 4 percent this holiday season, according to the National Retail Federation. Like last year, much of this growth will be driven by increased internet sales. eMarketer predicts e-commerce will account for 11.5 percent of total retail sales in the November-December period.

Retail sales across all channels are expected to rise between 3.6 and 4 percent this holiday season, according to the National Retail Federation. Like last year, much of this growth will be driven by increased internet sales. eMarketer predicts e-commerce will account for 11.5 percent of total retail sales in the November-December period.

Graphics courtesy of CBRE

You must be logged in to post a comment.