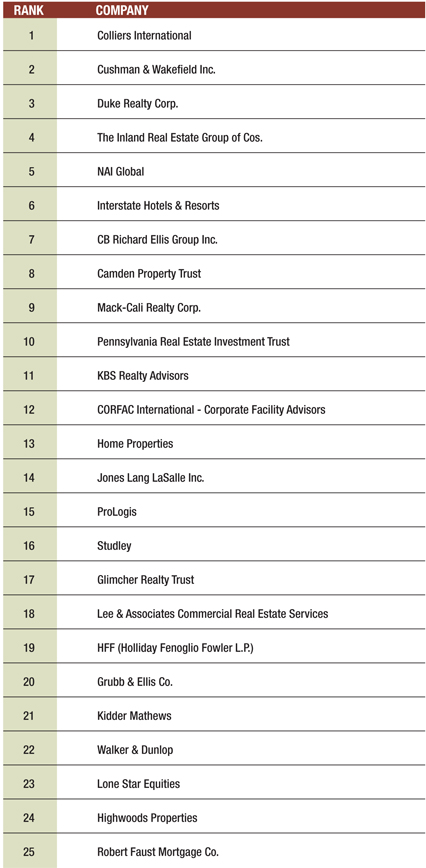

Top U.S. Real Estate Companies

The CPE-MHN ranking of the top U.S. real estate companies.

Determining the Best of the Best

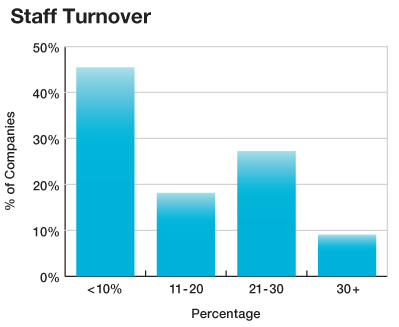

The multifamily and commercial real estate industry is an important part of the U.S. economy, and its members will play a leading role in the country’s performance in 2011 and beyond. Some of these companies will be leaders, while others may have a less extensive—or even a less positive—influence. The role each company will play is determined in large part by corporate culture, staff capabilities and strategic approach moving forward.

But nothing is that simple. When we started planning the MHN-CPE index of America’s Top Real Estate Companies, we came up with a list of criteria that we felt would best define the most influential and powerful firms across a variety of sectors. What we learned is a lesson in how to determine what really makes a company the best in the business.

It takes a great deal more than high revenues and lots of employees to rank high on our index. The landscape of property firms—including owners, developers, service providers and others—includes some of this country’s most innovative, high-profile and socially conscious firms. But other considerations are critical as well, including employment stability, long-term management tenure, a consistent company history under the same name and certain aspects of geographic and sector diversity. When we balanced these elements, we developed a picture of what it really takes to be the best in the industry, with a ranking that reflects the most significant and talented commercial real estate firms.

We applied our formula consistently and found that there is nevertheless room for variation in company strengths.

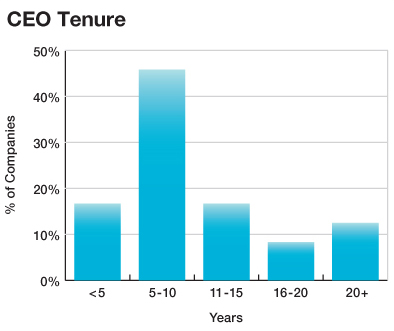

For some, CEO tenure was very impressive, with certain executives being at the helm for more than 40 years. A larger number, quite surprisingly, had fewer than 15 years of experience running the business, but in either case, long-running stability in management is a key factor in the survival and growth of commercial real estate companies.

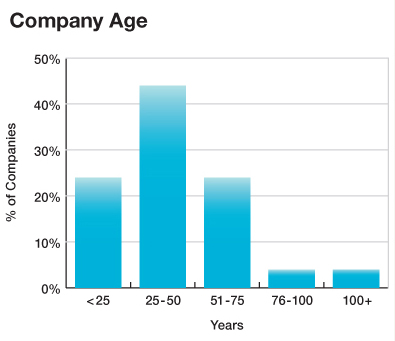

Another factor providing stability is the length of time firms have been in business, under the same or similar brand names and with substantially identical lines of business. We somewhat discounted the leadership and results of firms that merged repeatedly with others or changed their core business opportunistically, feeling that gradual growth comes from doing something better than anyone. Some firms have been in business for more than 100 years, while there were “newcomers” with closer to 20 years in existence. At the same time, an impressive number of firms with fewer than 10 years in the industry showed rapid growth. Considering the timing, with the most recent recession wreaking such havoc on commercial real estate, all the firms demonstrated some sense of reacting to market conditions—but not always positively.

The diversity among firms was understandable, and we took a detailed look at what regions and sectors were covered across the spectrum of respondents. Rather than discount lack of variety in regions, our formula instead considered the balance between the firms’ holdings or client operations overall and the location of their principal core assets or client operations. Our leaders all showed strong relationships, growth and balance, along with other factors, and that helped many of them rise in the rankings.

Of course, as is the nature of surveys in which firms self-select the information provided, we validated what we could but were left to work with missing data from both public and private companies that did not wish to disclose certain details. Sometimes, powerful or not, there are still areas not open for discovery. But even that may contribute to what makes for a great company.

—Jack Kern, Research Editor

You must be logged in to post a comment.