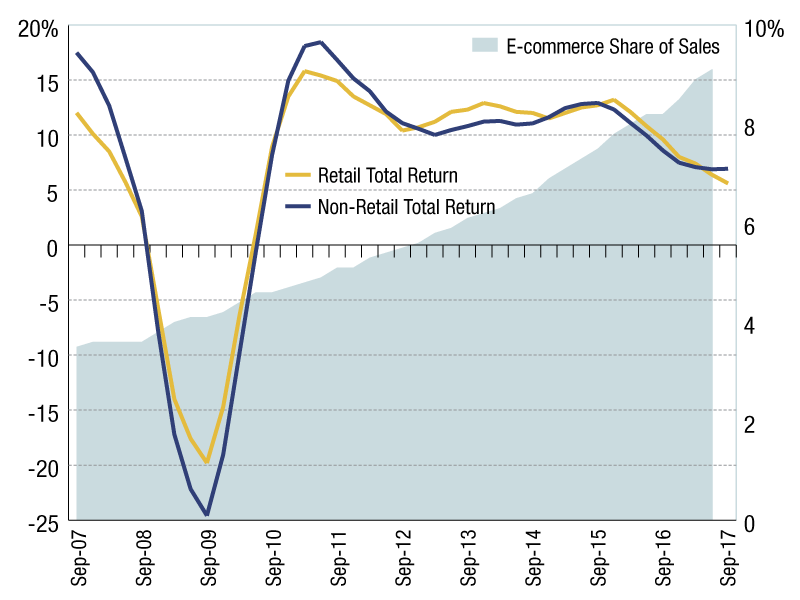

Total Return Performance of Retail vs. Non-Retail Assets

The “retail apocalypse” reflects fears that consumers are abandoning bricks-and-mortar stores in favor of online shopping, potentially spelling disaster for retail malls and shopping centers.

rolling 12-month returns and e-commerce share of sales

Retailer bankruptcies, department store struggles and empty malls have dominated recent headlines. The apparent culprit? A massive movement toward online shopping, driven by retail giants such as Amazon and Walmart. The “retail apocalypse,” as it has been named, reflects fears that consumers are abandoning bricks-and-mortar stores in favor of online shopping, potentially spelling disaster for retail malls and shopping centers. Given the outlook, are the fears of a retail demise justified? This chart compares the total return performance of retail assets against non-retail assets in the U.S. market. Despite the continued growth of e-commerce, there has been only a modest difference in the total returns of retail versus non-retail assets, especially in recent years. Over the five years to September 2017, the annualized total return for retail assets was 10.4 percent versus 10 percent for non-retail assets.

You must be logged in to post a comment.