TPG, Digital Realty Form $1.5B Joint Venture

The deal involves three Northern Virginia data centers.

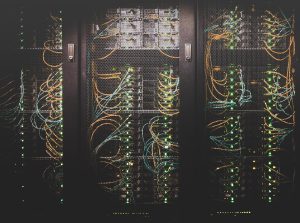

A cable network connectivity rack. Digital Realty’s facilities in Ashburn offer clients access to more than 160 cloud and network service providers. Image by Taylor Vick via Unsplash

Digital Realty has entered into a $1.5 billion joint venture agreement with TPG Real Estate Partners. The global colocation and interconnection provider will sell an 80 percent stake in three stabilized data centers in Ashburn, Va. Kirkland & Ellis LLP advised the buyer in the transaction.

TPG made the investment through its latest opportunistic real estate equity fund, TPG Real Estate Partners IV. The fund closed in October with $6.8 billion in secured commitments.

Digital Realty expects to gain $1.3 billion of gross proceeds from the joint venture and associated financing. These funds will be used to pay debt, transaction-related expenses and for other purposes.

The three hyperscale data centers have a combined IT capacity of 104 megawatts and are leased to investment-grade customers. The facilities are valued at a cap rate of 6.0 percent, based on annualized in-place cash net operating income, signed leases and planned move-outs. Digital Realty will continue to manage their daily operations.

Digital Realty operates 16 data centers in the Northern Virginia market, including the ones sold to TPG. These facilities have a combined capacity of 576.9 megawatts and comprise 452,800 square feet of total colocation space.

Surging demand in Northern Virginia

This transaction came on the heels of another similar deal completed by Digital Realty last month. The data center provider agreed to sell a 65 percent interest stake in two hyperscale facilities in Elk Grove Village, Ill., to GI Partners. That transaction was funded with a $450 million loan provided by Barclays, Citigroup and Morgan Stanley, according to The Real Deal.

Data proliferation and mass adoption of cloud computing have continued to drive demand for more space. Although Northern Virginia remains the largest market in the U.S., concerns about power availability have somewhat constrained new supply, a CBRE report found. Strong demand kept vacancy rates in the market at a record 1.8 percent as of the first quarter, the same source shows.

Among recent commitments in the region was Amazon’s planned $35 billion investment over a period of 17 years. The e-commerce giant’s cloud provider arm, AWS, will effectively double its presence in Northern Virginia.

You must be logged in to post a comment.