Creative Offices Create Value: Transwestern Report

“Converting retail and industrial properties is a profitable value-strategy,” according to the study.

By Barbra Murray, Contributing Editor

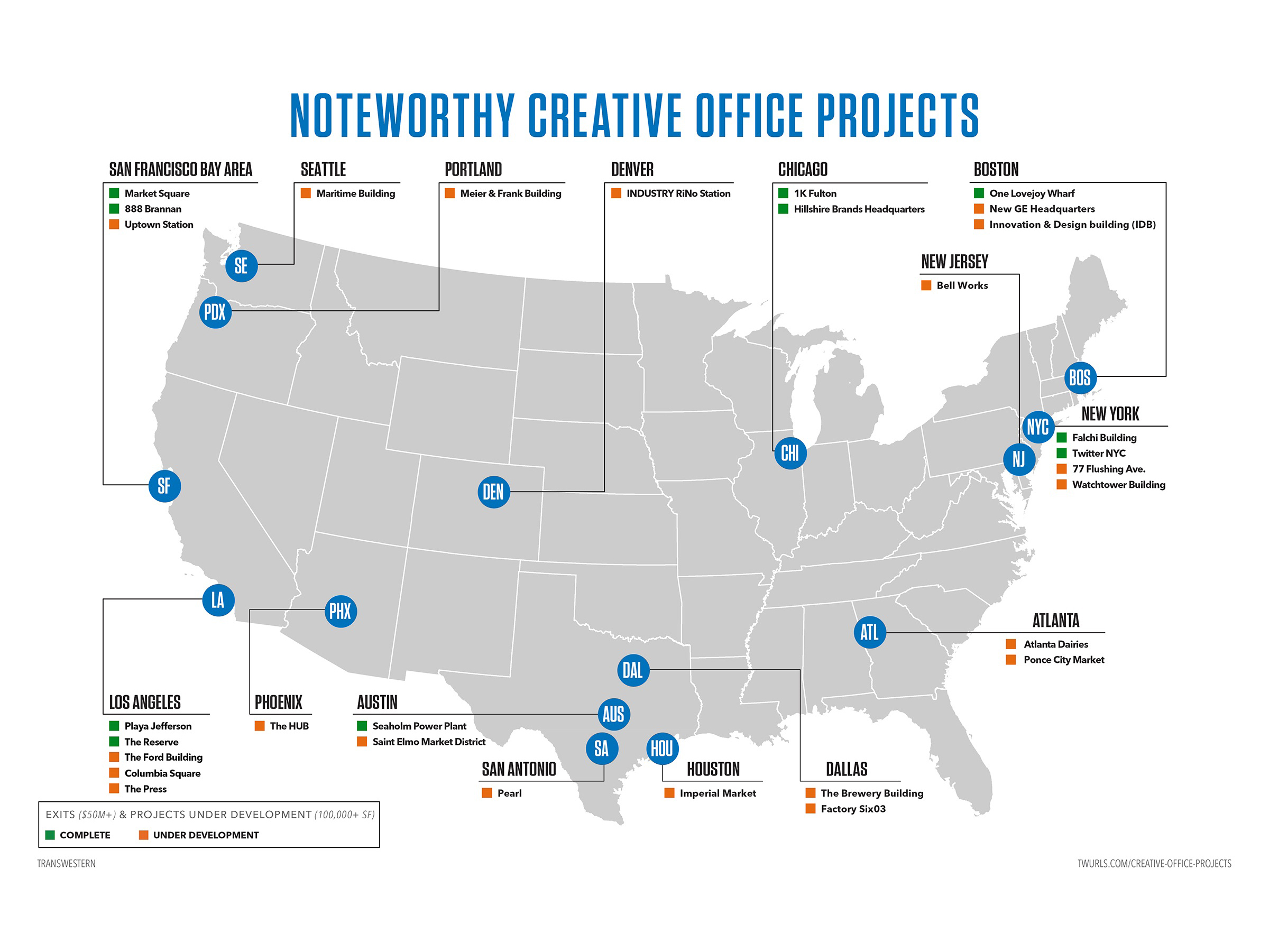

Houston—Creative office projects are proving to be quite the money-maker, according to Transwestern’s new report, Creative Office Projects: Adaptive Reuse Generates Staggering Returns for Investors. And an increasing number of owners are choosing to capitalize on the big bucks these properties are commanding today.

“The conversion of a property from industrial or retail use to creative office has become an increasingly popular value-add strategy for investors,” Michael Soto, director of research with Transwestern and co-author of the report, said in a prepared statement. Developers are merely giving the people what they want, and what they want is creative office space.

There’s a force behind every trend and, per the report, there are two supporting the creative office movement. Thanks to office users in the technology, advertising, media and information (TAMI) sector, creative office space has moved closer to the forefront over the last few years. Open floorplans, natural lighting, exposed interiors, common space—they’re all characteristics of the creative office space, which is designed to provide a flexible and convenient setting conducive to collaboration and creativity. The TAMI set likes it and so do the millennials that pervade these sectors. Also bolstering the demand for creative office space is the relocation of suburban tenants back to the cities, where increasingly coveted live/work/play properties are growing more plentiful.

As noted in the Transwestern study, adaptive reuse in the creative office market is old news; however, “what is new this cycle is the sheer volume of creative office exits nationally at core/core plus pricing.” The numbers are hard to ignore; the study points to a host of profitable creative office conversion transactions in 2016. In Chicago, four years after snapping up the old Fulton Market cold storage warehouse at 1000 W. Fulton St. for $27 per square-foot, Sterling Bay Co. sold the 531,200-square-foot property for $572 per square-foot, leaving the new owners with such tenants as Google, which maintains its Midwest headquarters at the transformed office site. In Boston, The Beal Cos. and The Related Cos. walked away with $150 million from the sale of the 232,000-square-foot 160 N. Washington St., which is home to the corporate headquarters of Converse Inc. The partners had acquired the former warehouse in 2012 for $22.5 million. The trend is evident on both coasts. Having purchased the former Citibank back-office flex call center at 12777 W. Jefferson Blvd. in Los Angeles for $33 million in 2011, Vantage Property Investors sold the 195,700-square-foot asset for $165 million.

Lucrative creative office conversion transactions in third-tier markets didn’t make it into the report—but they could in the future. “The adaptive reuse trend could certainly expand to tertiary markets. Local value-add investors are constantly seeking opportunities, and creative office conversions are one viable strategy to generate strong returns, assuming entry costs are favorable and there is tenant demand for differentiated office product,” Soto told Commercial Property Executive.

Despite its popularity, there’s competition out there for the adaptive reuse project in the creative office market. Owners of existing office assets and developers of new-build projects have taken note of office users’ growing attraction to the creative space, Soto shared with CPE, incorporating creative office features into their properties. “As a result, many traditional office projects are seeing an evolution in how they are branded, marketed, managed, and leased, as owners look for ways to keep their assets competitive in the marketplace,” he said.

Be they conversions or new developments, creative office properties are reeling in the big spenders, and will continue to do so. “Despite the recent increase in interest rates, buyers remain flush with capital that they need to deploy this year, which will keep transactional volume and pricing metrics high,” Soto concluded, speaking with CPE.

Images courtesy of Transwestern

You must be logged in to post a comment.