U.S. Quarterly Property Index

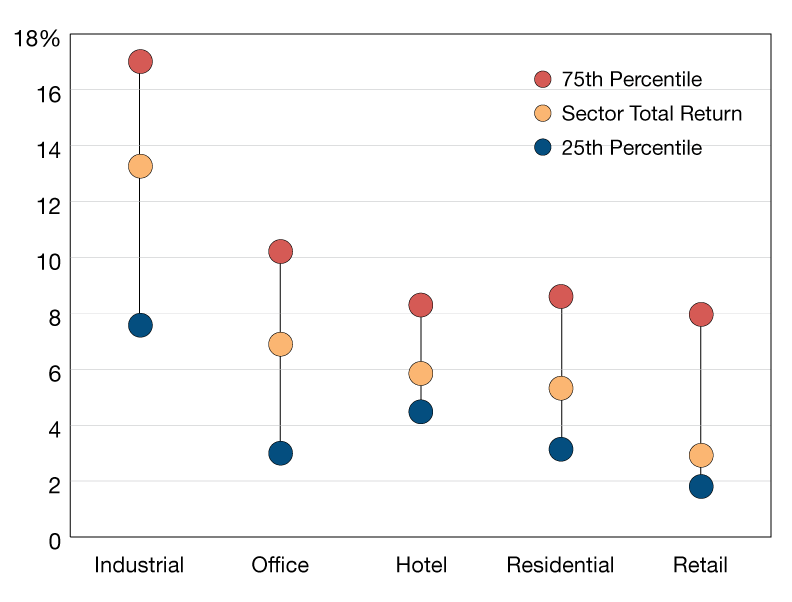

The highest total return was achieved by the industrial sector at 13.3 percent and the weakest total return was for retail at 2.9 percent.

12-month total return ending Q1 2019

Ranking the investment performance of U.S. property sectors over the year to march does not yield any major surprises. The highest total return was achieved by the industrial sector at 13.3 percent and the weakest total return was for retail at 2.9 percent. The fact that these two sectors find themselves at opposite ends of the spectrum can probably be explained by the fact that technology is changing, and is expected to further change, consumer behaviors. As e-commerce has grown, warehouse and distribution assets in the industrial sector have benefited but concerns have grown for traditional bricks and mortar shopping centers.

If we look at the performance of assets in the top and bottom quartiles by sector though the story becomes a bit more interesting. The industrial total return masks the largest interquartile spread (9.4 percentage points). For retail assets, the interquartile spread is lower at 6.2 percentage points but also has a substantial positive skew. This shows us that while overall retail performance has been relatively weak compared to the other sectors, the performance of top quartile retail assets has been more in-line with some of the other sectors. The large interquartile spreads demonstrate just how diverse asset-level real estate can be and why relative performance analysis can be so helpful for investors and managers trying to better understand their portfolios.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.