ULI Economic Forecast: Tailwinds, Hurdles or Both?

What larger trends mean for the major asset categories, according to the latest national survey of experts.

ULI’s Spring Meeting is being held in New York. Image by Fotios Tsarouhis

The Urban Land Institute’s latest economic forecast, released Tuesday at the organization’s annual Spring Meeting, reflects the real estate sector’s relief at averting a major slowdown this year. However, capital markets constraints continue to be a source of worry.

For the short term, the latest forecast predicts strong macroeconomic headwinds. Despite a robust economy, high interest rates will continue to exert downward pressure on valuations and returns, at least until next year. The forecast is more optimistic about the economic environment in 2025 and 2026, expecting the real estate sector to gain ground.

The continued strength of the economy is expected to correlate with growing demand for space. Experts now expect the economy to grow at a quicker pace than they thought just half a year ago, with growth projections for 2025 and 2026 at 1.7 percent and 2.0 percent, respectively. The report’s forecast is based on the median of forecasts from 39 economists and analysts across 34 real estate investment, advisory and research firms.

Mixed messages

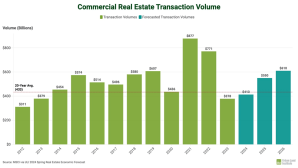

Chart courtesy of ULI

Meanwhile, average rent growth is expected to be strongest for industrial properties, followed by retail properties. While most asset classes are expected to fare well, the office sector continues to be a notable exception; rents are expected to contract 1.1 percent annually.

One challenge across sectors: Survey participants see negative valuations likely to exert more downward pressure on returns, compared to six months ago. For office properties, the average annual return is expected to be less than 1.9% until 2026. Retail assets are slated to net the highest annual returns, averaging 4.6 percent. Industrial properties, meanwhile, are forecast to produce returns of 3.3 percent.

You must be logged in to post a comment.