ULI, EY Predict ‘Ecosystem’ of Workplaces

Flexibility was the consistent theme among responses to a global survey on the future of work.

Post-pandemic work life around the world will be centered on flexibility in activity and location, according to the Urban Land Institute and EY.

READ ALSO: How the ‘Shrinking Middle’ Is Impacting the Office Market

ULI and EY surveyed 555 real estate professionals for the first global report on how the redefined workplace will impact real estate and cities.

The broad range of respondents surveyed between Aug. 4 and Sept. 15 included investors, developers, architects, planners and other service providers. Forty-four percent of the respondents were from North America, 41 percent from Europe, 13 percent from the Asia-Pacific region and 2 percent from elsewhere.

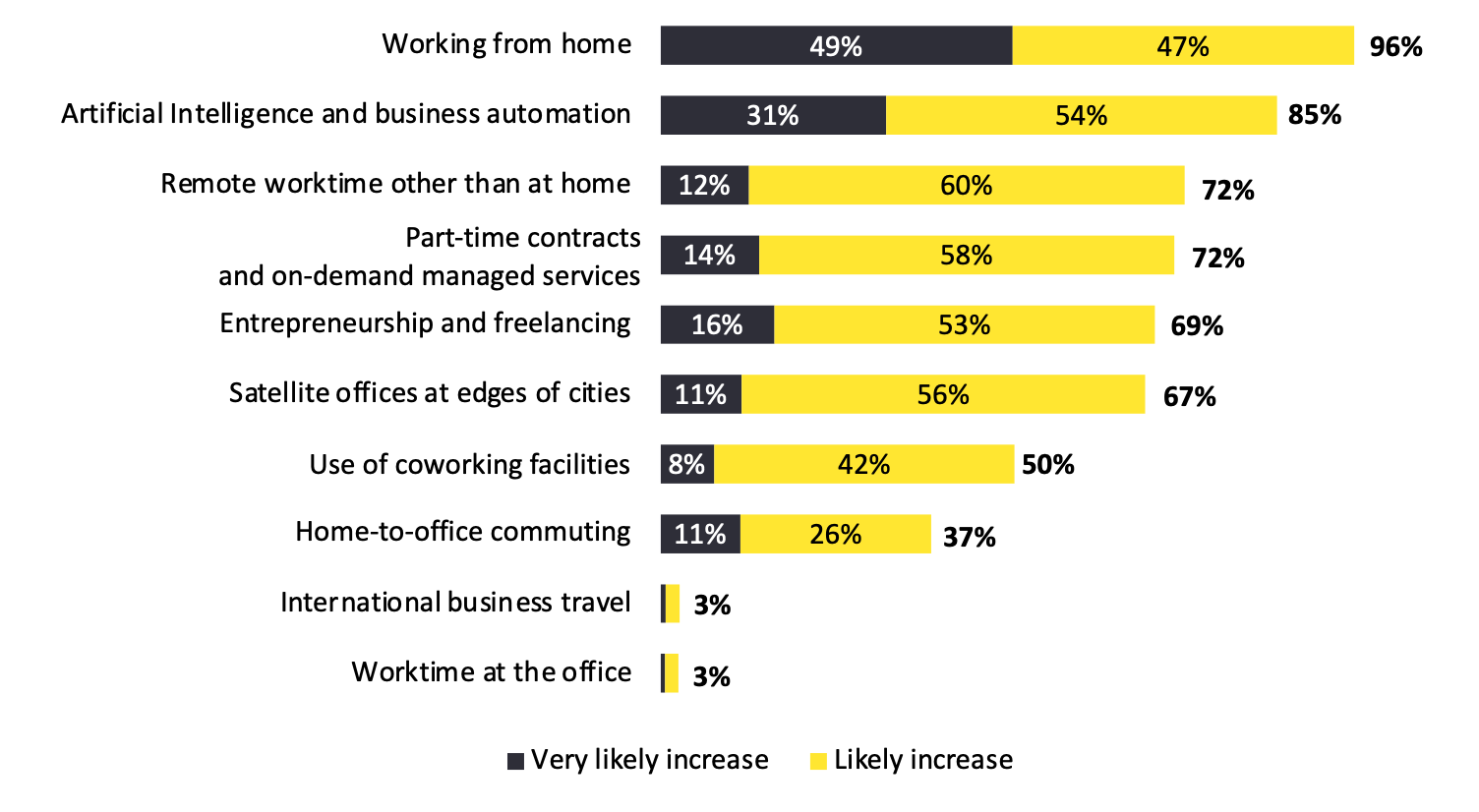

The report found that both in the short term while the pandemic is underway, and within three to five years from now, real estate professionals expect increased remote work, with 96 percent saying they expect more home working, while 72 percent expected more remote work away from home and 67 percent favored more use of satellite offices at the edge of cities.

The report notes this will result in an ecosystem of workplaces that blend uses of residential, hospitality and office spaces and a shift in language from “office” to “workspace.”

Lisette van Doorn, CEO at ULI Europe, who wrote the report, “Future of Work 2020: A Global Real Estate Player’s Point of View,” with EY Consulting Associate Partner Vincent Raufast, said in a prepared statement that flexibility was the consistent demand they were hearing from respondents. Employees will expect it from their employers and occupiers will expect it from their landlords, she said.

Based on survey respondents, impacts on the commercial real estate industry could include increased demand for flexible office footprints (96 percent), flexible lease contracts (66 percent) and a more widespread use of coworking facilities by large corporate occupiers (60 percent).

The majority of real estate professionals expect more than 60 percent of employees may be spending more than 40 percent of their time working remotely after COVID-19 subsides, compared to 20 percent of staff who were working remotely for 20 percent of the time before the pandemic.

More office and remote trends

Van Doorn told Commercial Property Executive the expected increase in remote working was not the biggest surprise to them because they had been hearing feedback about those kinds of changes in flexibility from earlier webinars and member discussions. But she pointed out that remote work doesn’t entirely mean working from home.

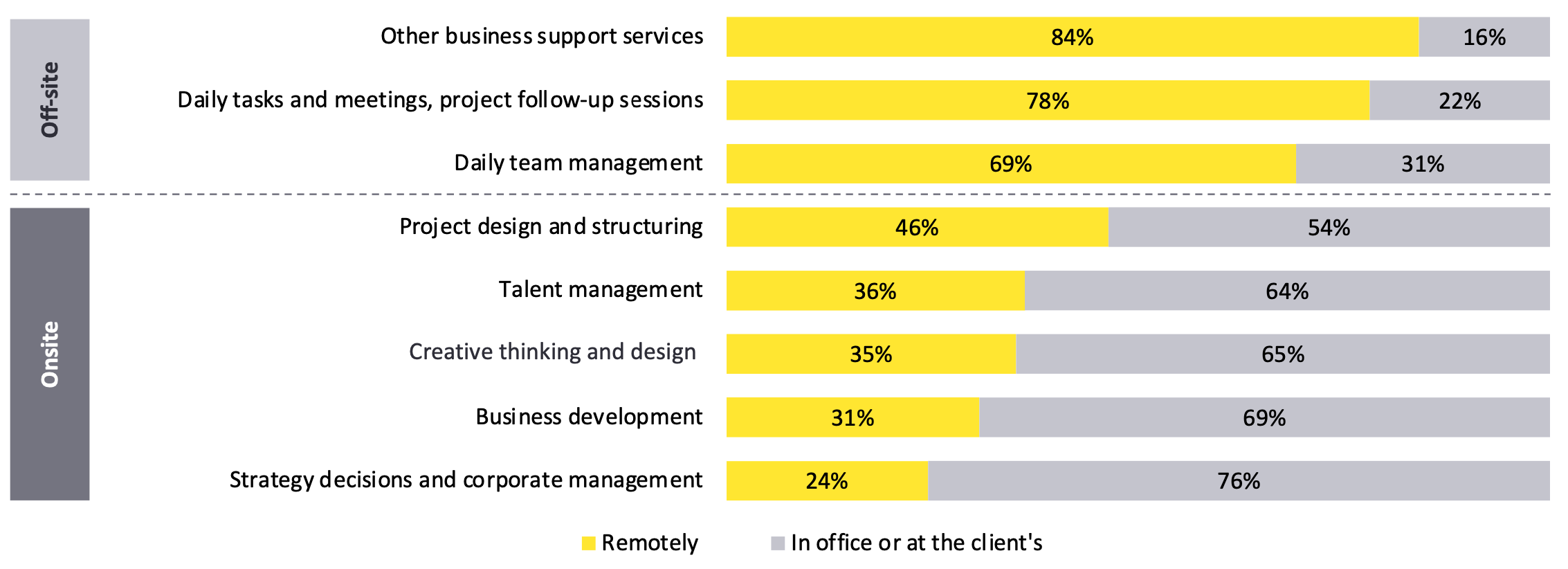

“Remote work consists of many different ways of working. For example, working from home, but also working from satellite offices or coworking spaces. It is basically any location other than the office,” she told CPE. “What we found quite striking was the paradox on the one hand, with a far greater focus on remote work, which at the same time makes the real estate so much more important, especially the quality of the space and location. This doesn’t only apply to the office, but also to many other spaces like residential, hospitality and third spaces, which are other locations than home or the office where people can work or meet.

“A real flight to quality is expected (for offices), not only in terms of health and well-being (cleaning, security, social distancing, etc.) but also related to collaboration and hangout spaces, amenities, services, etc., within the building and in the immediate surroundings,” van Doorn added.

The survey found 94 percent of respondents expect the demand for healthy building amenities to increase over the next three to five years, while 95 percent expect their buildings to feature new technology to make them safe during the pandemic. Ninety percent said there would be health-certified offices and 81 percent expect future offices to have more space for collaboration and meetings.

Over the short term, real estate players expect more uncertainty and reduction of office space along with the increased flexibility. The survey asked respondents if they expected a change in office space over the next three to five years, and more than half (53 percent) said they expect to see a decrease in their office spaces. Just 10 percent predicted an increase, while 37 percent said they don’t expect a change.

While total office space is likely to decrease, the quality of the real estate will be even more crucial, Raufast stated in the report. And respondents continue to see a key role for physical office space to create office culture (96 percent) and for recruiting and retaining employees (93 percent), as well as to prevent a loss of staff and creativity.

While those surveyed said in the short term there will likely be an increased focus on suburban and/or satellite offices, over the longer term they expect an “urban renaissance and regeneration of urban cores.” That could be coupled with a new demand for central business district or urban locations where employers and employees “enjoy the benefits of mixed-use, vibrancy and services.”

You must be logged in to post a comment.