Southern Cities Shine in ULI-PwC Emerging Trends Report

On the publication's 40th anniversary, panelists discussed indicators of unprecedented change and identified new markets to watch at the ULI Fall Meeting in Boston.

By Sanyu Kyeyune

Left to right: Andrew Warren, Mary Ludgin, Mark Hansen, Mitch Roschelle, Tom Toomey, Ed Walter

PwC and the Urban Land Institute (ULI) released their Emerging Trends in Real Estate 2019 report at the ULI Fall Meeting in Boston. Now in its 40th year, the report highlighted the industry’s accelerated transformation and identified the top 10 markets for investment—seven of them in the South. Once again, Dallas/Forth Worth led the pack, and for the first time in the publication’s history, Brooklyn, Orlando and Tampa made the top 10.

Winning markets

The complete list includes these markets:

- Dallas/Fort Worth

- Brooklyn

- Raleigh-Durham

- Orlando

- Nashville

- Austin

- Boston

- Denver

- Charlotte

- Tampa

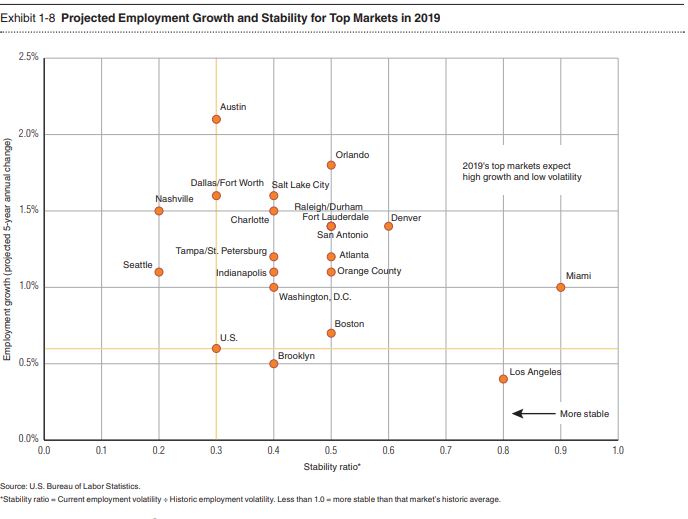

The prevalence of Southern cities is no coincidence, concurred industry practitioners and thought leaders during a panel discussion of the report. What those municipalities have in common is a high concentration of talent coming out of colleges and universities, and those job candidates have the skills that today’s quickly evolving workforce demands. Education, health care and technology are driving employment growth—and in turn, accelerating commercial real estate investment—in these cities.

Source: ULI, PwC

The panelists—ULI Global CEO Ed Walter; ULI Global Chair & Chairman, President, CEO & Director of UDR Inc. Tom Toomey; PwC Partner Mitch Roschelle; PwC Director of Real Estate Research Andrew Warren; Heitman Managing Director Mary Ludgin; and Prologis Senior Vice President & Investment Officer Mark Hansen—also identified easing into the future, investing in economic development and the growing value of amenities as trends to watch.

For cities, investing in infrastructure and encouraging transit-oriented development both signal the wave of the future, said Hansen, but these should be tackled incrementally, rather than as a singular, much larger capital expenditure. In order to be successful, Hansen encouraged cities to merge public and private interests to form the most effective partnerships. In Toomey’s view, improving economic opportunity across cities is also key to attracting the capital needed for real estate development.

The discussion revealed some interplay between the rise of online shopping and niche property types. While the self-storage asset class is still relatively small—and therefore not included in the report—Roschelle commented that the ease with which consumers can order and accumulate goods is contributing to higher demand for self-storage assets. “We’ve been investing in the sector since 1996, and while Millennials (say) they prefer experiences over (objects), in reality they use more storage than other generations (because of) the size of (their living spaces),” Ludgin qualified. While the demand picture for the sector is favorable, the supply impacts during this protracted recovery are placing pressure on revenue growth for REITs targeting the asset type. However, in cities with high concentrations of colleges and universities, the demand profile is stronger, noted Roschelle.

Source: ULI, PwC

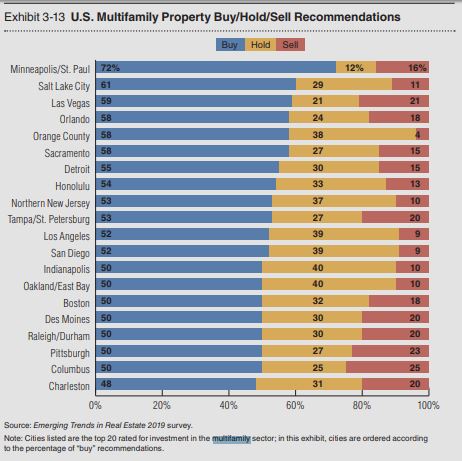

Led by office and multifamily, the ongoing amenities race continues to heat up. Beyond building in areas for socializing and fitness, employers are further upping their game by incorporating amenities like on-site gardens, as well as child and pet care. The survey showed that 81 percent of employers felt proper amenities were among the top three things they could offer employees. Speaking to his experience on the multifamily side, Toomey said, “Every community and price point we operate in is a different puzzle, but in the next three years, (residents will want) a lot more event space for gatherings because people don’t spend that much time in their apartments.”

Echoed by Walter, the consensus appears that cities must adapt by encouraging density in neighborhoods less recognized by investors, changing zoning regulations to expand affordable housing and building an economic base that educates and retains the local workforce. According to Walter, cities can achieve these goals by first “realizing that they have to invest in themselves.”

You must be logged in to post a comment.