ULI Report Aims to Accelerate Renewable Energy in CRE

A new study explains the why and the how of renewable energy implementation in commercial real estate.

While buildings are responsible for 40 percent of global emissions, the use of renewable energy in commercial real estate is growing slowly while energy demand from the sector rises.

To help facilitate adoption, ULI has issued a new report titled “Renewable Energy Strategies for Real Estate,” which lays out the business case for renewable energy and assists property owners in sorting through the myriad on-site and off-site options.

Listen Also: Is This Solar’s Time to Shine in CRE?

Renewable energy initiatives, according to the report, help owners lower energy costs, earn additional income, and access incentives. They help owners meet investor and tenant expectations. They create community benefits by increasing affordability for multifamily tenants, strengthening grid resistance by lowering demand and aligning with current and future regulations. And they help owners meet their own sustainability goals by helping them earn certifications and achieve net zero goals.

The report explains in-depth the various renewable energy options available to owners and the types of arrangements owners can make with utilities, third-party providers and tenants. It also ranks renewable options based on their “greenness.” At the bottom of the green scale would be grid power, followed by National renewable energy credits, carbon offsets, regional/state RECs, physical or specific resource with site-specific RECS, and on-site renewables—the greenest.

Solar, wind and geothermal are all being used to create electricity at the building or grid level, but the report focuses heavily on solar as it is the most commonly used on-site renewable globally.

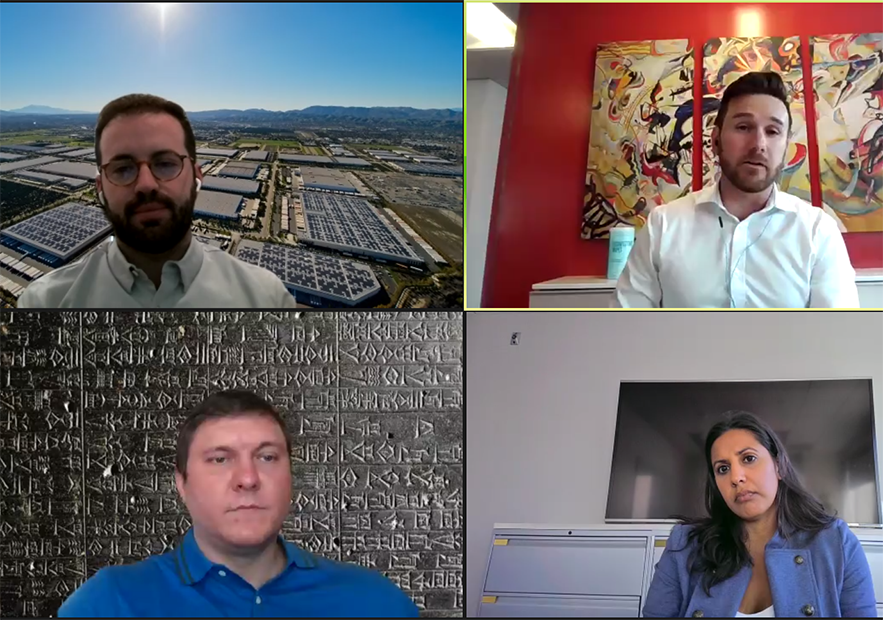

Clockwise: Alex Perlman, senior manager, Energy Programs, Prologis; Eric Tilden, senior director, ESG, WashREIT; Joe Indvik, director of Carbon & Finance Solutions, RE Tech Advisors; and Vaishali Sampat, director of Sustainability, Kilroy Realty Corp.

“If perhaps you looked at solar three or four five years ago and decided it wasn’t right for whatever reason, the combination of costs coming down and employment rates going up and all the various finance and ownership models now available, may mean it is time to revisit solar,” said Joe Indvik, director of Carbon & Finance Solutions, for RE Tech Advisors, who moderated the webinar during which the report was rolled out.

Indvik was joined by sustainability managers representing three different property owners in three different property types: Alex Perlman, senior manager, Energy Programs, Prologis (industrial); Vaishali Sampat, director of Sustainability, Kilroy Realty Corp. (office and life sciences); and Eric Tilden, senior director, ESG, WashREIT (multifamily).

The speakers, each of whom is shepherding their company’s renewable energy journey, helped amplify some of the key takeaways from the report, particularly the need to customize solutions because, while the business case for renewable energy is sound, each renewable energy project has its own set of economics depending on the goals of the sponsoring organization, the building’s unique features, and, especially, the location.

“There are huge amounts of regional variations,” said Tilden.

In Texas for example, energy is cheaper so solar investments may not pencil out as well as they do in San Diego, where energy rates are higher. Regional variations also include: the availability of incentive programs, utility policies on things like net metering, and value throughout the day. Building-level considerations include material and installation costs, roof size and the age of the roof. Tilden asked: “Can the solar be there for 15 years?”

Other key takeaways from the report were: The demand for renewable energy is growing so it is a good idea to begin exploring renewable energy options to gain experience and build relationships with service providers; energy efficiency is the first step toward net zero followed by on-site renewables and then off-site; and on- and off-site renewable energy deal structures are complicated, so it is best to enlist the help of reputable outside consultants.

“We’re not solar experts,” said Sampat. “We’re not renewable energy experts so we have a consultant that we bring on board to help us coordinate the feasibility studies. They go out to bid for us. They help us negotiate contracts along with our lawyers. That’s been really helpful for us to make sure we get a favorable deal.”

Solar in Action

Each of the panelists’ companies are using solar on their assets to offset consumption of natural gas and other non-renewables. How they are using solar depends a lot on roof size and how much energy the tenants consume.

Many of Prologis’ warehouse properties are long on roof size, but the tenants are not consuming enough energy to justify large solar installations. Instead, the owner assembles batches of smaller sub 300 kw systems that only occupy 25-30 percent of the roof.

“We believe every customer of ours should have access to renewables on-site if they are in a favorable state where the policies make sense and the roof can support it,” said Perlman.

Meanwhile, in “last-touch” facilities in more urban environments, there is less available roof space and the owner tries to maximize efficiency through larger panels off-site.

At Kilroy’s properties, solar is offsetting about 7 to 10 percent of energy use depending on the property. Life science properties, where the EUI (energy per square foot) is a lot higher, consume the least amount of solar. Office properties, particularly in San Diego, “where there are carports for miles,” consume the most, Sampat said.

WashREIT has solar panels installed at two D.C. high-rise properties where there is not a lot of roof space. The panels generate about 25 percent of the properties’ electricity use, but it is really a fraction of that when you consider the heating load provided by natural gas.

The full report is available from ULI.

You must be logged in to post a comment.