ULI’s Forecasts for CRE Industry, Economy

The semi-annual survey of real estate economists and analysts focuses on rent, returns and transaction volume trends.

William Maher, ULI member and Director of Americas Research & Strategy, LaSalle Investment Management. Image courtesy of LaSalle Investment Management

Economists participating in the latest Urban Land Institute’s forecast see some slowdowns in economic indicators impacting the commercial real estate market, but are generally upbeat for the next few years. They point to positive gross domestic product growth, slower but solid job increases and steady markets and returns through 2021.

READ ALSO: Future Housing Trends Toward “Hipsturbia”

William Maher, ULI member and director of Americas strategy and research at LaSalle Investment Management, said in a prepared statement that forecasts remain positive overall, despite the escalation of the U.S.-China trade war, the inverted yield curve for U.S. Treasury bonds—which is often an early sign of a recession—and the slowing economic growth in Europe, especially in the U.K. and Germany. Despite some of those issues, Maher, who was among the CRE economists and analysts this week on a ULI members-only webinar, stated he expects real estate fundamentals to stay healthy. He also noted the current expansion should continue to set records, helping to deliver higher returns than initially predicted and keeping interest rates low.

The semi-annual forecast covers 2019 through 2021 and is based on surveys of 41 economists and industry analysts at 32 leading real estate organizations conducted by the institute’s Center for Capital Markets and Real Estate. Key takeaways in the 48-page Real Estate Economic Forecast include:

- In a forecast that is unchanged since May, U.S. GDP will grow by 2.3 percent this year, down from 2.9 percent in 2018. It is projected to be about 1.7 percent in 2020 and rise slightly to 1.9 percent in 2021.

- While many economists are predicting slower job growth, as the number of skilled or qualified workers goes lower, the ULI forecast is up from the previous survey and calls for net job growth to average 1.7 million a year through 2021. The year-by-year breakdown predicts job growth of 2.2 million in 2019, 1.4 million in 2020 and 1.5 million in 2021. The national unemployment area rate should remain at 3.7 percent this year, the lowest in 50 years. It should increase to 4.1 percent by 2021.

- The expected yields on the 10-Year U.S. Treasury note were down from predictions six months ago and even more dramatically from a year ago. Yields are forecast to be 1.8 percent for 2019, 2.0 percent for 2020 and 2.3 percent for 2021. Maher notes the declines should be positive for real estate values.

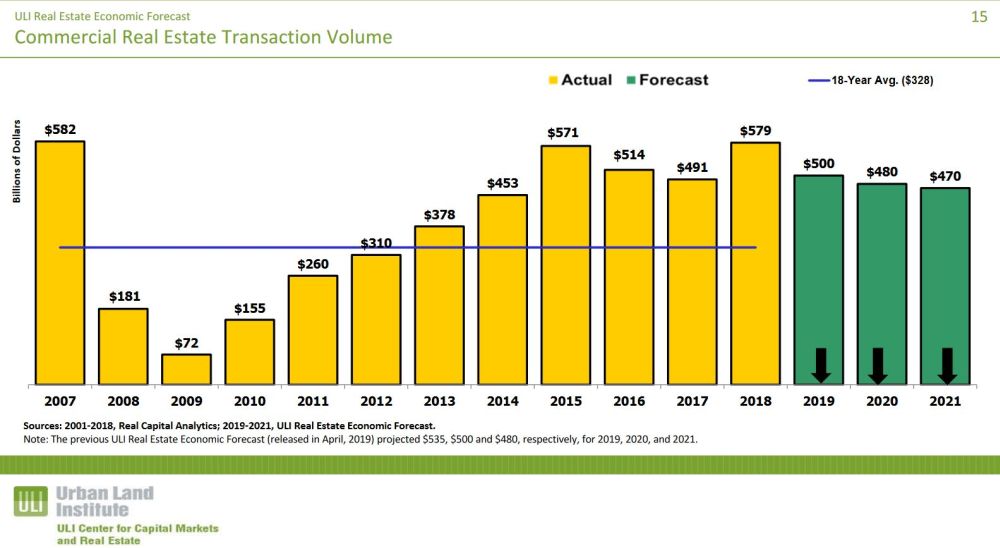

- Real estate transaction volumes, which were strong in 2018 at $579 billion, are expected to moderate. Economists are predicting volumes of $475 billion in 2019, $450 billion in 2020 and $415 billion 2021. Annual CMBS issuance is also expected to drop slightly to $75 billion in 2019 and 2021, and $65 billion in 2020.

- Commercial real estate prices are expected to moderate over the next three years. Still all price growth is higher than initially predicted, at 5.1 percent for 2019, 4.0 percent for 2020 and 3.9 percent for 2021.

- Continued economic growth with lower interest rates is expected to lead to lower real estate returns that are higher than the previous update. Total returns are predicted to be 6.0 percent for this year, 5.2 percent for 2020 and 5.5 percent for 2021. REIT returns, spurred by a very strong start to this year, are expected to be higher than the prior update. They are expected to average 9.8 percent for the next three years, up from the forecast six months ago of 5.7 percent this spring. U.S. REIT returns are up by 28 percent year-to-date as of September 2019, already besting the 15 percent that had been forecast for the year.

- Rent growth is expected to increase or be flat for all property types, except industrial and hotels, which are expected to see lower increases. But industrial is still expected to see a 3 percent average boost for 2019 through 2021. Apartments are projected to see the next highest increase, with a 2.5 percent growth followed by office, 2.1 percent; hotels, 1.4 percent RevPAR growth and neighborhood and community center retail, 1.3 percent.

You must be logged in to post a comment.