CMBS’s Coming Headwinds

The CMBS market is well positioned for another stable year, but at this late stage in the current cycle, the market faces a number of challenges.

By Sanyu Kyeyune

By all accounts, the CMBS market is poised for another robust year, despite facing slight headwinds from the slowdown in maturities. After risk retention took hold, the volatility that had characterized 2016 mostly dissipated in 2017, making way for a highly liquid lending environment, marked by strong investor appetite and competitive pricing. With more at stake, originators have increased their underwriting discipline, maintaining tight spreads and helping to ensure the credit quality of new loans. As in 2017, late-cycle economic expansion is generating healthy demand across all property types, making CMBS an attractive source of capital for investors seeking outsize yields. But pressure points have begun to emerge, intensified by secular shifts.

Muted volume

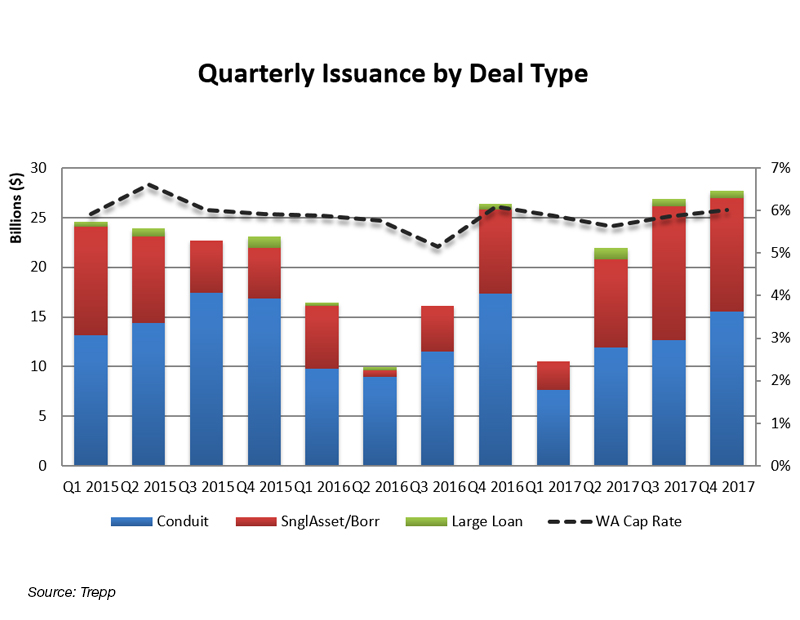

In last year’s fourth quarter, private-label issuance reached nearly $28 billion, marking a slight uptick from the previous quarter and bringing full-year volume to $86 billion, by Trepp’s tally. At nearly 26 percent, this was a considerable jump over 2016, when pricing uncertainty led a number of market players to remain on the sidelines.

Despite apprehension about the effects of risk retention rules, their introduction at year-end 2016 did not materially impede 2017 issuance because the market adapted well to the anticipated changes. Investor demand ended up being strong in 2017, driving in spreads and contributing to issuance volume that easily exceeded market forecasts, according to Kroll Bond Rating Agency (KBRA).

Still, the industry should expect to see fewer loans issued in 2018: KBRA predicts that private-label originations will drop by about 25 percent to $65 billion, while conduit issuance should come in at around $35 billion—a 30 percent decrease from 2017. Single-borrower originations, on the other hand, are likely to be in line with or slightly below 2017, at approximately $30 billion.

“Single-asset/single-borrower (SASB) has grown as a percentage of total private-label issuance. For those larger deals—in the $1 billion range—CMBS can be a good solution since there aren’t a lot of other lenders who can handle that scope,” explained Gary Horbacz, principal & head of CMBS credit research for PGIM Fixed Income. “Part of that is due to significant interest by overseas buyers in trophy assets in primary markets, a good example being New York City offices,” said Horbacz. Recently, Horbacz has observed a pullback of foreign capital from the U.S., a trend that he does not expect to reverse any time soon: “While I think there will be a healthy SASB pipeline in CMBS, I think the proportion of total private-label issuance may decline slightly.”

The current cycle’s inflection point led Gabriel Silverstein, SVN Institutional Capital Markets chair & managing director of SVN | Angelic, to forecast 2018 SASB volume differently. “When groups that have large amounts of money raised find it more challenging to deploy that capital at this late period in the cycle, you’ll see more mega-deals,” he commented.

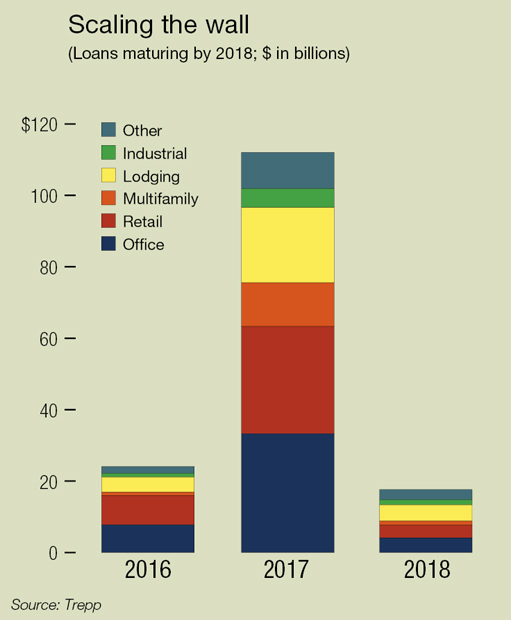

Credit stability

Several factors contribute to the anticipated decline in total issuance: The industry is approaching a tipping point, and at the tail end of an already lengthy economic recovery, rent growth continues to moderate, while new supply—and in turn, vacancy rates—continues to rise. Although property fundamentals remain healthy across sectors, valuations have reached near- or above-peak levels amid historically low cap rates, a trend that could compromise the credit quality of new loans. Compounded by expected higher interest rates, fewer scheduled maturities and limited refinancing opportunities, the CMBS market faces new challenges in 2018.

There are bright spots, however. “Lenders are more disciplined now,” said Silverstein. “They’re no longer underwriting deals based on significant upside.”

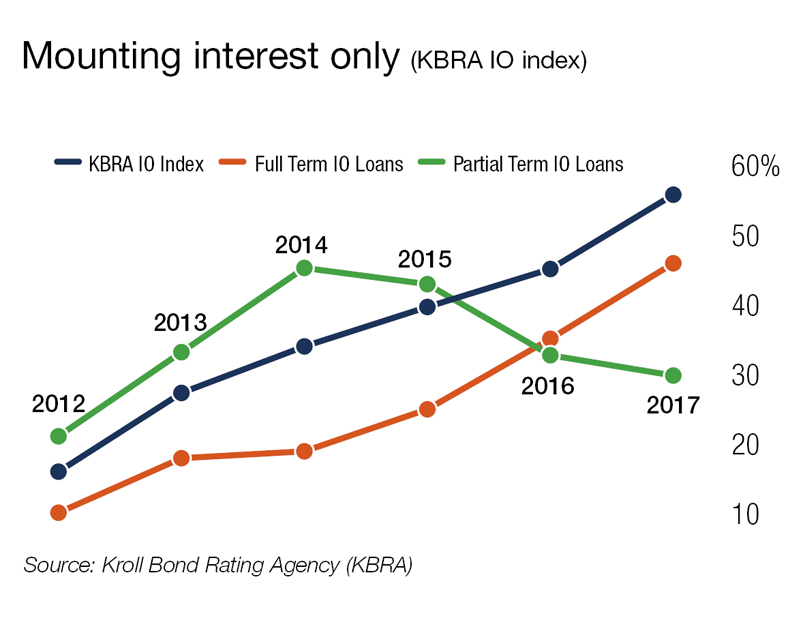

New issue credit metrics reflect this increased conservatism: In its 2018 outlook, Moody’s found that conduit loan leverage has been decreasing while debt coverage has risen, providing a boost to credit quality in the long term. Additionally, loan leverage—as quantified by the rating agency’s proprietary loan-to-value ratio (MLTV)—had declined to just below its pre-crisis, 2007 peak. At the same time, the debt service coverage ratio, measured by MDSCR, had reached its first cycle high since 2013, boosted by an increasing share of interest-only loans.

Warning signs

“There is a higher composition of interest-only loans in the CMBS market now than there was 12 to 14 months ago,” noted Joe DeRoy, senior vice president & CMBS program leader of KeyBank Real Estate Capital. The uptick is due in part to CMBS originators increasingly competing with permanent lenders, namely banks and insurance companies, noted Huxley Somerville, managing director & head of U.S. CMBS at Fitch Ratings. But due to their high risk of maturity default, interest-only loans comprising a growing share of collateral pools should evoke caution, industry experts agreed. KBRA Senior Managing Director Eric Thompson suggested that fewer expected loan originations could create additional competition among originators in 2018. As these capital providers vie for customers, more interest-only loans are likely to be issued with greater indebtedness held outside of the trust, resulting in weaker credit structures and collateral quality.

According to KBRA Senior Director Larry Kay, the CMBS market should also heed the Federal Reserve’s unprecedented unwinding of its $4.5 trillion balance sheet, which began in October 2017. Since then, the central bank has allowed a monthly $6 billion in Treasuries and $4 billion in mortgage-backed securities to run off without reinvestment, with quarterly increases of $6 billion and $4 billion, capped at $20 billion and $30 billion, respectively.

Although modest rate hikes are expected, Kay said, “The winds of inflation, as well as concerns that the Fed is taking too much liquidity out of the system could trigger various bouts of market volatility during the year.” For this reason, Kay warned that “the credit markets could be bumpier, with continued pressure on the long end of the bond yield, which could negatively affect conduit issuance as the year plays out.”

Concentration concerns

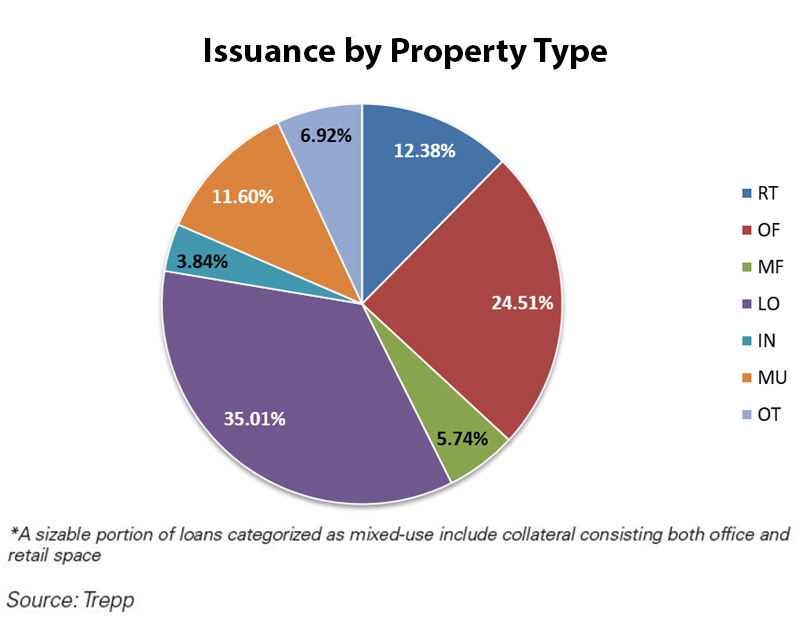

Sector performance naturally trickles down to the lender, and hotels, the most volatile property type, are impacting CMBS growth. “We’re still seeing a lot of hotel, which is a little concerning to us,” commented PGIM Fixed Income’s Gary Horbacz, although he averred that “generally, the collateral and demand look good.”

He continued: “There’s a lot more operating risk for hotels, and we’re definitely seeing an uptick in hotel construction. While RevPAR is positive for the country as a whole, there are certainly some markets where it’s negative, such as Manhattan, where there’s high supply.”

On average, Horbacz estimated hotel concentration comprises about 15 percent of the conduit pool, whereas leading up to the 2008 financial crisis, this figure was in the 5 to 10 percent range. While hotel fundamentals are unlikely to plummet, high exposure to the sector could be problematic in the event of a recession.

E-commerce continues to put negative pressure on CMBS loans with high retail concentration, namely Class B and C malls, leading PGIM to downgrade such pools. “Some of these malls need to reinvent themselves with more experience-driven offerings if they want to stay afloat,” said Horbacz. For industrial, however, e-commerce only continues to generate more demand, particularly for last-mile distribution properties.

Meanwhile, the office market is approaching a peak, according to Fitch Ratings. Suburban office is riskier still, yet single-tenant exposure rose to 17.2 percent in 2017, noted KBRA, up from 13.5 percent in 2016. According to the rating agency, office concentration consisted primarily of large loans on Manhattan office buildings, several of which were divided into pari passu notes.

Despite pockets of concern, the outlook for CMBS in 2018 is largely positive, bolstered by healthy capital inflows, stable credit performance, continued economic expansion and low interest rates. “CMBS (market players) are generally bullish, and property prices—while also at record highs—feel well supported,” noted Horbacz. “The market is pretty balanced right now.”

You’ll find more on this topic in the March 2018 issue of CPE.

You must be logged in to post a comment.