Under the Radar: 2018 Top Markets

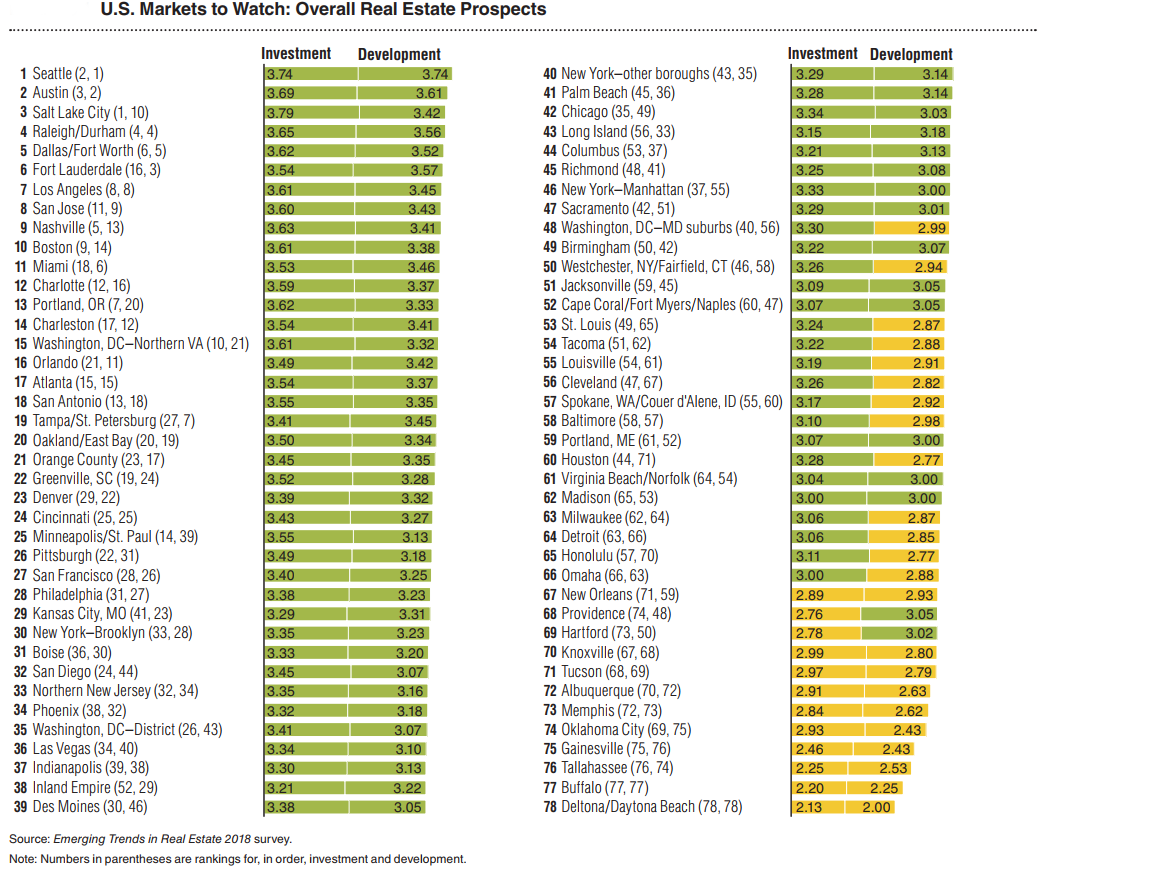

Investors are no longer thinking big in big cities, as secondary markets have stolen the spotlight by offering younger and highly educated workforce, diverse economy and job opportunities. According to the Urban Land Institute and PwC's Emerging Trends in Real Estate 2018 report, secondary markets have become successful replicas of the competitive metros, but where should you actually focus your attention?

The real estate industry has seen major shifts and changes that have altered the shape of the existing U.S. markets. A new report conducted by the Urban Land Institute and PwC compiled the answers of 800 interviewed individuals and the survey responses of more than 1,600 individuals, which resulted in an outlook on investment and market development trends. An important note is that the answers were recorded between June and August, before Hurricane Harvey and Hurricane Irma hit parts of Texas and Florida.

Analysts believe that traditionally top-performing markets are the ones that continue to spark investor interest, as most are looking for maximized return and little risk. However, as these gateway markets become highly competitive, other specialists admit it’s time to shift attention towards secondary markets, especially where top-performing submarkets have a longer expansion cycle.

Case in point, the top 20 markets include four top secondary markets, four markets that are adjacent to primary markets, ten secondary markets and only two primary ones. Seattle emerged as the top-performing market, surpassing Austin. Los Angeles and Boston managed to make it to top 10, while San Francisco and Manhattan fell several spots.

Pacific

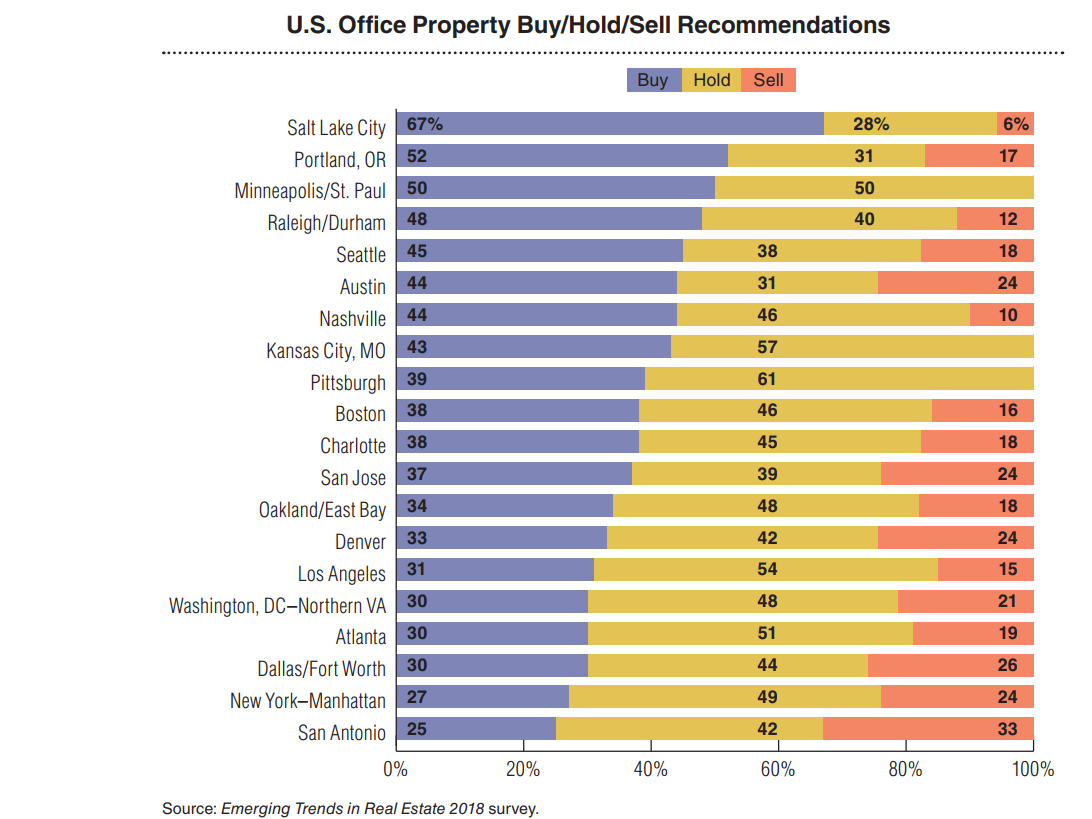

Seattle, Los Angeles, Portland, Ore., and the primary market-adjacent Oakland, Calif., and Orange County are the area’s best-performing markets. Known to house a large number of tech companies and a highly educated labor pool, these markets offer their residents a great quality of life, but which comes at a rather high cost. Seattle, San Francisco and San Jose, Calif., saw a rise in the number of tech startups, while Los Angeles and Portland have been supplying trained labor to multiple industries. While urban conglomerates are investment magnets, fringe markets like Oakland, Orange County, Inland Empire, Sacramento, Calif., and Tacoma, Wash., are a neat alternative to their costly neighbors.

However, housing affordability in San Francisco, San Jose, Seattle and Honolulu is reduced. Seattle, San Francisco, Orange County and the Inland Empire are trying to stay smart by resorting to condos and micro units in order to minimize high construction costs. There’s also a pronounced need for infrastructure enhancements that would support growth.

South

Southern markets continue to be a popular destination thanks to positive demographics, low business costs and taxes, affordable living, and accentuated economic growth.

There’s an accentuated investor interest in Austin, Atlanta, Dallas/Fort Worth, Nashville, Tenn., San Antonio and Charlotte, N.C., as they attract a large number of Millennials. Additionally, southern markets have a strong academic footprint, as each of these markets has at least one high-caliber university. The employment rate is on the rise in the Dallas/Fort Worth and Atlanta markets, with Austin, Louisville, Ky., and Greenville, N.C., picking up the pace in the manufacturing sector, and Oklahoma City and Birmingham, Ala., in energy and technology. Memphis, Tenn., and Raleigh/Durham benefit from local and national economic initiatives, while New Orleans’ booming tourism and the predominantly business-friendly environment complete the region’s favorable image.

What the southern markets fear is a combination of their own incapacity to handle growth, high construction costs and the ongoing construction labor shortage. Charlotte, Dallas/Fort Worth and Raleigh/Durham are dealing with strict real estate regulations, while Birmingham and Nashville encountered issues with the present parking requirements. Public transportation is on the verge of becoming an issue in Memphis and Raleigh/Durham, while San Antonio, Richmond, Va., and Charlotte expressed their concern in regards to a shortage of affordable housing.

Mountain

Salt Lake City makes a remarkable jump to the third place, while the once-favored Denver slipped down the list. The mountain region comprises a number of diverse markets found in different post-recession recovery stages. It has also been historically documented that when the Pacific markets become too expensive, the attention shifts towards the Mountain States. What makes this area desirable is a good quality of life that attracts a young, highly skilled workforce in Denver, Salt Lake City and Boise, Idaho. Add this to the reduced cost of living in Tucson, Ariz., Albuquerque, N.M., and Inland Northwest and a vibrant economic diversity (Denver and Salt Lake City’s technology, financial services and energy industries, Las Vegas’ tourism, Phoenix’s corporate expansions).

On the other hand, Boise, Denver and Phoenix have proved to be quite expensive and most of these markets lack much-needed construction workers. Las Vegas’ supply is tight and lacks lender confidence, but so do Albuquerque and Tucson.

South-Atlantic and Florida

Five markets from the area are in the top 20 due to positive demographics, good weather, reasonable cost of living and plenty of employment options. Like the Mountain States, the South–Atlantic and Florida areas include both primary markets (Washington, D.C.) and emerging ones (Deltona/Daytona Beach, Fla., Gainesville, Fla., and Tallahassee, Fla.).

Washington, D.C., boasts a high quality of life and is followed by the neighboring Richmond, Va., Virginia Beach/Norfolk, Va., and Orlando, Fla. Southwest Florida is also known for its low personal taxes that continue to attract people. The economy is driven by Richmond, Orlando and Deltona/Daytona Beach’s technology sectors, the port facilities in Tampa/St. Petersburg, southeast Florida, Jacksonville, Fla., Charleston, S.C., Virginia Beach/Norfolk and Richmond, as well as Charleston’s expanding manufacturing sector.

Washington, D.C., boasts a high quality of life and is followed by the neighboring Richmond, Va., Virginia Beach/Norfolk, Va., and Orlando, Fla. Southwest Florida is also known for its low personal taxes that continue to attract people. The economy is driven by Richmond, Orlando and Deltona/Daytona Beach’s technology sectors, the port facilities in Tampa/St. Petersburg, southeast Florida, Jacksonville, Fla., Charleston, S.C., Virginia Beach/Norfolk and Richmond, as well as Charleston’s expanding manufacturing sector.

However, the set of markets faces another challenge as there has been a perennial need for infrastructure investment in the Washington, D.C., and Tampa Bay/St. Petersburg markets. Additionally, Southwest Florida, Richmond and Charleston are all in need of measures which should hold together and improve their current growth plan.

Northeast

The area encapsulates multiple highly connected markets: New York City has strong ties to Brooklyn, Jersey City, Westchester/Fairfield and Long Island. Baltimore’s close proximity to the nation’s capital serves as a strong economic connection as well. Boston is only one of two primary markets that made it to the top 20.

The urbanization trend has taken New York City, Boston, Pittsburgh and Jersey City by storm, resulting in highly educated millennials, as well as new and redevelopment opportunities. Boston and New York City’s fight for the life science hub title continues to attract both government and foreign capital. Technology stays the key economic driver, while northern New Jersey and Baltimore remain sought-after by medical and health technology companies. Additionally, Pittsburgh is emerging as a center for robotics.

On the other hand, the entire northeast area needs infrastructure improvements, with a focus on the Westchester/Fairfield and northern New Jersey markets, which are not provided with access throughout the entire region. These areas are also burdened by a series of zoning regulations, while Pittsburgh could use more schools and public transportation improvements. Hartford, R.I., and Portland, Maine have been experiencing massive out-migration of qualified workforce and have been struggling with keeping it in place.

Midwest

Chicago is the region’s lone primary market, benefiting from an accelerated and constant urbanization. The Midwest was once famed for its chaotic demographics, but today, Cleveland, Columbus, Detroit, Des Moines and St. Louis record a high number of young people moving to the urban core. Cleveland, Columbus, Des Moines and Minneapolis have a high quality of life and reduced cost of living, while Indianapolis, Milwaukee, Wis., Madison, Wi., Minneapolis/ St. Paul, Des Moines, Cleveland and Columbus boast a strong labor force. Detroit, St. Louis, Kansas City, Omaha and Indianapolis are doing their best to attract businesses with their low taxes.

The area’s concerns consist of a lack of qualified workforce, especially in Cleveland, Detroit and Indianapolis. Although St. Louis, Minneapolis/St. Paul and Chicago recorded a certain degree of economic growth, they are in need of strong leadership more than ever. While major markets have no problems in attracting equity capital and acquisition of debt, Cleveland, St. Louis and Columbus are finding it difficult to pin themselves on the map for potential investors due to weak public relations or possible upcoming restrictive underwriting criteria.

Images courtesy of the Urban Land Institute and PwC

You must be logged in to post a comment.