Understanding the Immigration Equation

Mark Fitzgerald of Affinius Capital on how population shifts shape the U.S. economy and real estate.

The resilience of the U.S. economy coming out of the pandemic has surpassed expectations. Many economic forecasters expected a significant slowdown heading into 2023 given that historically taming outsized inflation required a softening labor market to slow wage growth. Instead, the economy has not just defied expectations but posted some of the strongest growth in recent memory:

- Real GDP growth in 2023/24 averaged 2.8 percent annually—the highest two-year period since the mid-2000s.

- Inflation-adjusted retail sales growth averaged 2.4 percent annually between December 2019 and December 2024, nearly double the 1.3 percent annual growth from 2000-2019, according to the U.S. Census Bureau. (Non-inflation adjusted retail sales growth figures are 6.7 percent and 3.5 percent, respectively.)

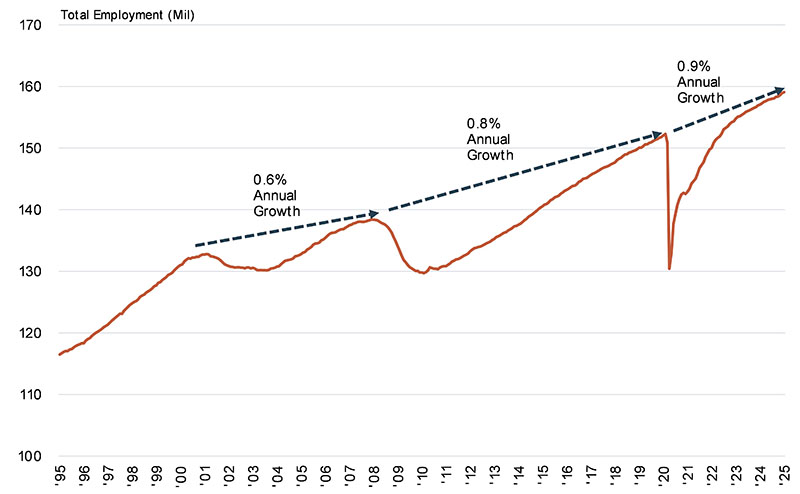

- Employment growth has averaged 0.9 percent annually, peak-to-peak, since February 2020, outpacing the average growth rate of 0.7 percent over the previous two cycles (see Exhibit 1), despite a dramatic slowdown in domestic population growth.

Exhibit 1: Peak-to-peak U.S. Employment Growth

That last point is particularly notable: Domestic natural population growth has averaged just 350,000 annually over the past five years, compared to 1.4 million annually in the 15 years leading up to 2020. The unemployment rate has stayed below 4.3 percent since November 2021, signaling a market near “full employment” and generally a harbinger of slowing employment growth as available workers are in short supply—yet employment growth remains robust. So, what explains this divergence?

Immigration as growth engine

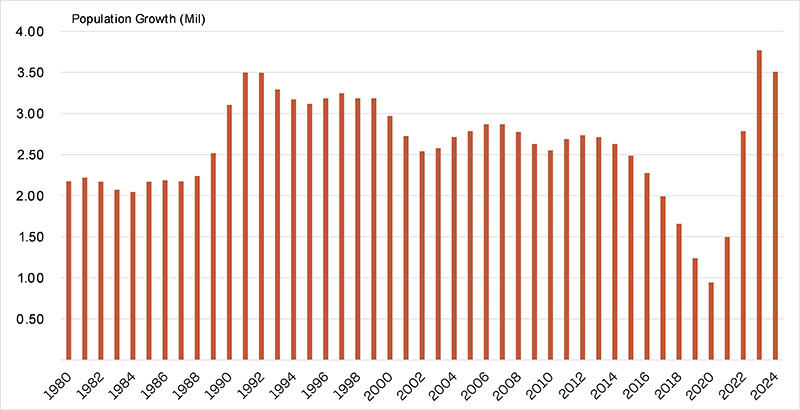

A significant factor behind this economic outperformance is outsize population growth driven by immigration. The U.S. Census recently revised its demographic estimates, revealing that population growth hit an all-time high of 3.8 million in 2023, with 2024 close behind at 3.5 million (see Exhibit 2). This surge was almost entirely due to immigration, not natural population growth, which has slowed structurally due to lower birth rates, aging demographics and a temporary mortality spike from the pandemic.

Exhibit 2: U.S. Annual Population Growth

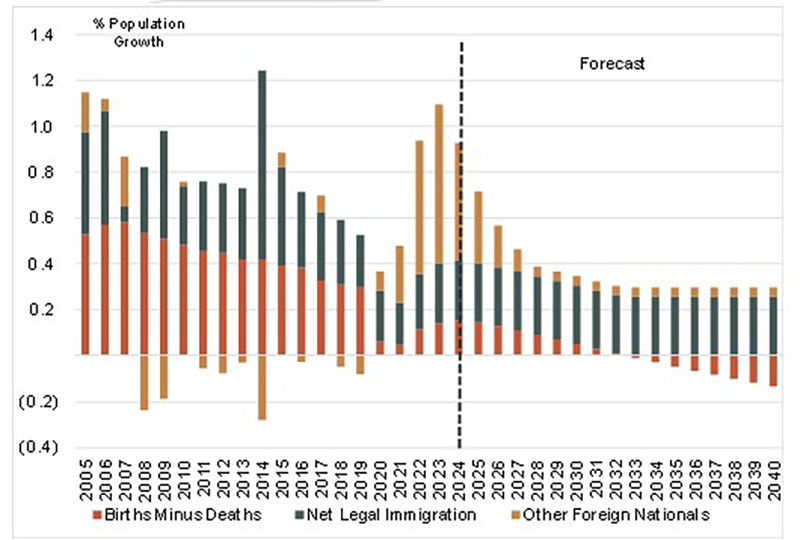

Consider this: Since 2020, net immigration has accounted for 87 percent of U.S. population growth, and it is projected to account for over 70 percent of growth over the next five years (see Exhibit 3). Looking forward, net immigration forecasts vary widely even across government agencies—ranging from the CBO’s middle-ground estimate of 1.2 million annually to the Census Bureau’s conservative 870,000 or the Social Security Administration’s 1.4 million. Note that in the CBO estimates below, over the next five years, legal immigration is projected to remain relatively flat from recent levels, at approximately 920,000 per year, while illegal immigration is projected to decline substantially, from an average of 2.1 million the past three years to just 480,000 the next five years.

Exhibit 3: Components of U.S. Population Growth

The economic impact of outsize recent demographic growth is evident:

- The outperformance of real GDP growth the last two years versus its 20-year average shrinks by half when adjusted on a per capita basis.

- Immigrants disproportionately contribute to the growing workforce: 78 percent of immigrants are working-age (16-64) compared to just 61 percent of the U.S.-born population, reports the American Immigration Council.

Potential impact of shifting immigration policy

Given the importance of migration on demographics and economic growth, any significant shift in immigration policy could create ripple effects. Illegal immigration is estimated to be the primary driver of the recent immigration surge; the illegal immigration population nearly doubled from just over 10 million in 2020 to 18 million today. With two out of three illegal immigrants working, they now account for 6 percent to 7 percent of the total U.S. labor force, according to AlpineMacro.

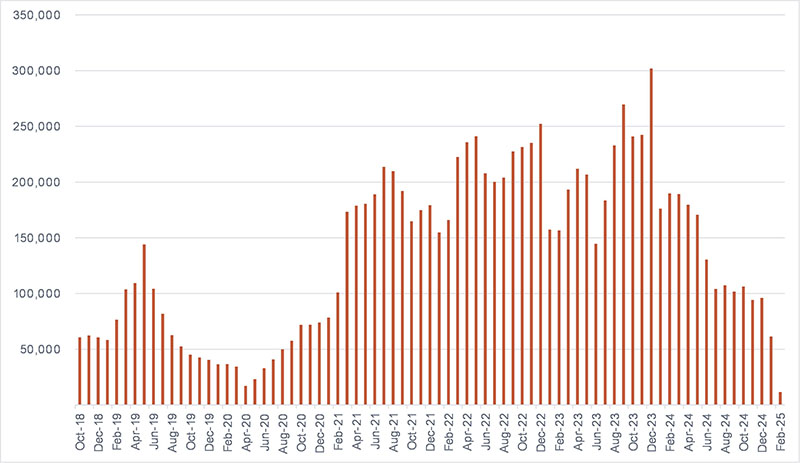

This rapid growth made immigration a focal point of policy, with the most immediate policy action being targeted enforcement, which generally has bipartisan support. The Biden Administration’s June 2024 Executive Order tightening border enforcement and asylum procedures had a rapid effect—border encounters dropped more than 50 percent in the second half of 2024 to 100,000 monthly. Encounters plummeted to 11,000 in February 2025, though it is important to note that elevated encounters in previous years were partially driven by voluntary apprehensions, fueled by favorable asylum policies.

However, while enforcement has dominated the conversation, broader immigration reform remains politically fraught and uncertain.

Exhibit 4: Southwest Land Border Encounters

Implications for real estate markets

Our baseline estimate for immigration currently aligns with mid-range estimates from government agencies. It is important to remember that:

- Approximately 75 percent of immigrants in the U.S. today are legal immigrants, according to Pew Research.

- Economic opportunity fuels migration as much as policy does. As of January 2025, the U.S. had 7.4 million job openings—well above the pre-pandemic average of 6.4 million between 2015 and 2019. Elevated construction wage growth (4.4 percent in 2024) is representative of ongoing labor shortages in key sectors.

- U.S. reindustrialization is reshaping labor demand. The U.S. manufacturing revival depends heavily on lower-educated labor—an area where immigration plays a key role.

If immigration slows more sharply than current projections, key real estate sectors could be impacted differently:

- Retail: Likely the hardest hit, as lower population and employment growth would dampen overall demand.

- Construction & supply: Critical real estate growth sectors (data centers, industrial, residential) would face more pronounced construction labor shortages. With 26 percent of U.S. construction workers being immigrants—half of whom are unauthorized to work, according to Pew Research—reduced labor availability could further inflate wages and exacerbate an already tight workforce (estimated 439,000 worker shortfall in 2025). Combined with the potential impact of increasing materials costs from tariffs, these sectors could experience increased replacement costs and constrained new development, creating upward pressure on rents and values for existing properties.

- Inflation and interest rates: The impact would be mixed—a smaller workforce could drive wage inflation, while slower population growth would weigh on overall demand.

Mark Fitzgerald is executive director & head of North American research for Affinius Capital.

You must be logged in to post a comment.