Upscale, Upper Midscale Growth Drives Lodging Construction

What you see isn’t always what you get, and the most recent lodging construction spending figures reflect that notion.

By Anna Spiewak, News Editor

TMI Hospitality opened the 91-suite Langhorne SpringHill Suites by Marriott in Pennsylvania in August 2012.

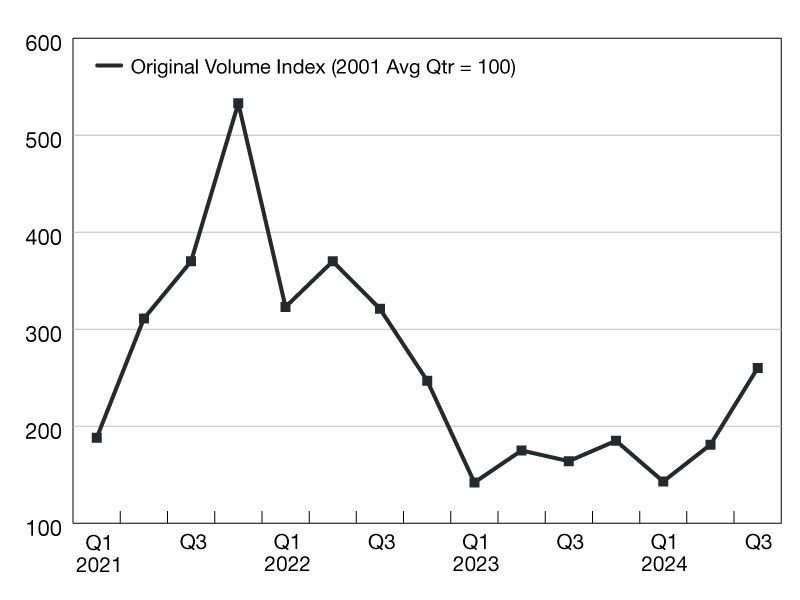

What you see isn’t always what you get, and the most recent lodging construction spending figures reflect that notion. Hotel construction spending, while moving at what appears to be a snail’s pace month over month, has seen a significant uptick year over year.

Construction spending on lodging fell by 0.3 percent from October to November, according to the Census Bureau. But spending on lodging construction rose a whopping 21.9 percent in November when compared to the same month a year prior, to $11.5 billion from $9.4 billion.

While the lodging construction pipeline has fewer upper luxury properties this year compared to last, the number of upscale and upper midscale hotels under construction actually rose by 38 percent year over year in the fourth quarter of 2012.

According to Lodging Econometrics, which tracks hotel construction, there are currently a total of 2,758 hotels in the pipeline. The total pipeline entails all hotels that are under construction, scheduled to start construction in the next 12 months or in the early planning stages. Last year, there were 2,753 hotels under construction, indicating a flat pipeline. That was attributable to a decline in the number of upper luxury projects. On the other hand, there are 630 upscale and midscale hotels under construction right now, compared to just 458 at the same time last year, according to Lodging Econometrics president Patrick Ford.

“This is always typical in the start of a new real estate cycle,” Ford explained. “The new real estate cycle is underway; it consists of lots of upscale brands and upper midsize brands from top franchise companies” as opposed to luxury product.

This tends to happen because smaller hotels with fewer rooms move through the pipeline much faster, with financing readily available for under-200-room Marriott Courtyards, Residence Inns, Hilton Garden Inns and other popular brands that are being constructed by an “experienced developer,” according to Ford.

One company with eight hotels currently under construction and set to open later this year or in 2014 is TMI Hospitality, based in Fargo, N.D. TMI is currently constructing five limited-service hotels and three extended-stay properties, where guests stay five nights or more and have greater amenities available, including restaurants, swimming pools and tennis courts. These projects are currently taking place in five different states, including two projects in California, one in Michigan, two in North Dakota, one in Ohio and one in Virginia, according to a TMI spokesperson.

Experts attribute the growth of lodging construction spending to a number of factors. According to Jan Freitag, senior vice president of global development at STR, these include a 6.8 percent increase in RevPAR performance, from $61.02 in 2011 to $65.17 in 2012, which encourages both investment and construction; availability of assessed debt after financing froze up completely during 2008-2009; and a loosening of loan-to-value ratios throughout the year.

Investment in distressed hotel properties has also contributed to the construction surge, according to Ken Simonson, chief economist for the Associated General Contractors of America. He noted that strong year-over-year RevPAR encourages the new owners to expand the properties. “Presumably, they want to restore them to a condition where they are competitive again, so you are getting a lot of renovation work,” he said.

Ford attributes the recent uptick in lodging construction spending more simply to the overall recovering economy. “Just as we expect the economy to keep going, so will hotel development keep going (upward),” Ford concluded. “I am hopeful myself that over the first quarter, as we resolve this fiscal cliff that’s in front of us, this will further reenergize travel, clear up some of the reservation that the business community has, and that consumers will be more positive about the future.”

Projects in the Pipeline:

Baywood Hotels Inc., Greenbelt, Md.

19 Hotels, 2,151 Rooms

Mostly upper midscale, and a few upscale chains, including brands such as Hampton Inn & Suites, Residence Inn and Home2 Suites by Hilton.

TMI Hospitality, Fargo, N.D.

19 Hotels, 1,773 Rooms

Both upscale and upper midscale chains, including brands such as Courtyard by Marriott, Staybridge Suites and Fairfield Inn & Suites.

Concord Hospitality Enterprises Co.,

Raleigh, N.C.

10 Hotels, 1,530 Rooms

Mostly upscale chains, including brands such as Cambria Suites, Hyatt House and Hilton Garden Inn.

Vision Hospitality Group, Chattanooga, Tenn.

Vision Hospitality Group, Chattanooga, Tenn.

11 Hotels, 1,139 Rooms

Mostly upper midscale and a few upscale chains, including brands such as Residence Inn, Hampton Inn & Suites and Fairfield Inn & Suites.

White Lodging Services Corp., Merrillville, Ind.

9 Hotels, 1,834 Rooms

Both upscale and upper midscale chains, including brands such as Hyatt Place, Fairfield Inn & Suites and Residence Inn.

Source: Lodging Econometrics

You must be logged in to post a comment.