US Economy Moves Forward

New presidential policies will dictate how the economic pie is sliced, according to economist Peter Linneman.

The election is finally over, and we (especially swing-state voters) now get a well-deserved 12-month break from political madness before the midterm election campaigns begin in earnest. Will it matter much to the overall economy that Donald Trump was elected president and that Republicans control Congress? A bit, but not nearly as much as people claim. Remember that both Presidents Barack Obama and Trump controlled a unified government during their first two years in office, and yet both struggled mightily to get their pet policies (health care for Obama and tax reform for Trump) adopted just before the clock ran out on this control. And remember that lower (or higher) income tax rates have a limited impact, as 60 percent of the population pays no income tax. This includes most workers receiving tips as well as most Social Security recipients.

Any new president and their policies will have some impact on the economy, but what is more notable is the distributional impact of policies. For example, in the days after the election, the stock market was up overall—including the fossil fuel sector—but the renewable energy sector was down by a lot. Politics is less about the size of the economic pie and more about how the pie is sliced. Staying with the energy example, whether the fossil fuel sector or the renewable energy sector “won” politically, you are still going to turn on the lights when it gets dark tonight, and you will still drive your car home from work. So the general economy will chug along regardless of who is in power.

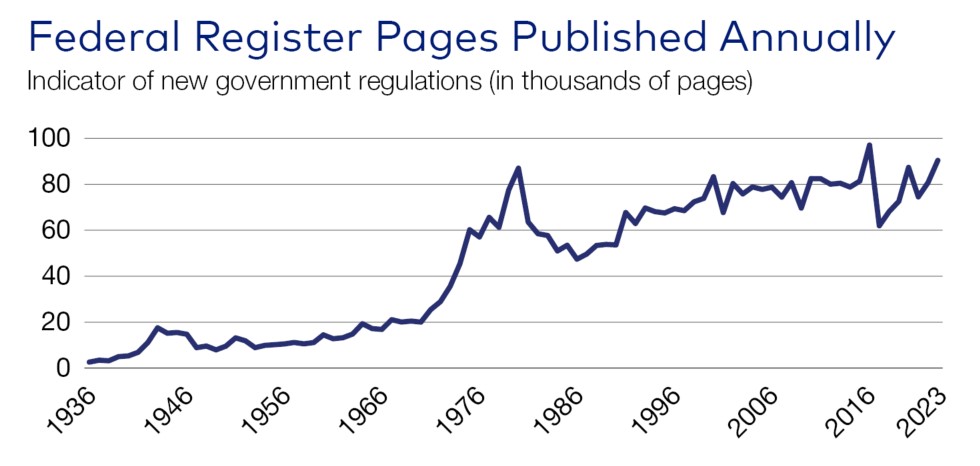

That said, we believe that a Trump presidency will prove to be a bit better in terms of the size of the economic pie. This is due to an expected decrease in federal regulations and individual, corporate and capital gains tax rates remaining largely unchanged (versus rising had Harris won). We use the Federal Register (which includes all the rules, regulations, new laws, etc., that businesses and people have to follow) as a benchmark. The Trump administration (2017-2020) averaged 72,478 pages in the Federal Register per year, while the Obama (2009-2016) and Biden (2020-2023) administrations averaged 81,539 and 81,897 pages, respectively. In 2024, the Federal Register is expected to have had the most pages ever, surpassing the 97,000-page record set during the last year (2016) of the Obama administration. A great deal of lobbying and corresponding compliance went into those pages. These resources could have otherwise been used for growth.

Many of the 2017 tax cuts will sunset at the end of 2025, with their fate to be determined by a unified Republican government. We expect that you will not see the corporate or capital gains tax rates notably change. Nor will depreciation deductions be altered, but there will probably be a renewal of Opportunity Zones.

One can argue that we need higher taxes and more regulations, but there is no doubt that research shows that both are drags on growth. Keeping taxes low and regulations muted could mean an additional 20 to 40 basis points of GDP growth per annum. So while we do not expect a 300-basis-point Trump bump in growth, the impact will be positive.

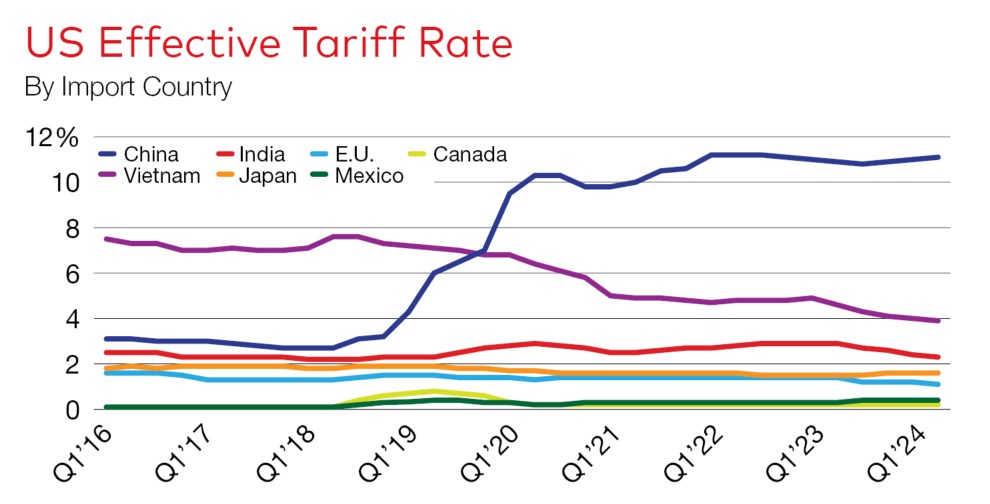

As for tariffs, Trump harmfully implemented them during his first term, and the Biden administration unfortunately kept them in place. Trump campaigned on significantly raising further tariffs. Research shows that tariffs have no particular impact on the trade deficit, which reflects foreigners wanting to invest in the U.S. However, higher tariffs will lead to higher prices on protected items, resulting in a drag on the economy. And while tariffs can forestall the demise of a weak industry, better, cheaper, faster ultimately wins.

The rhetoric on tariffs largely belies the facts. The average U.S. tariff rate on imports fell from about 30 percent in 1900 ($30 per $100 of imports) to about 9 percent in 1967, to about 2 percent from 2000 to 2017. In 2018, Trump raised tariff rates on goods from China from an average of 2.5 to about 10 percent. Tariffs on other countries were basically unchanged during Trump’s first term, except the average tariff on Vietnam fell from about 7.5 to 5.5 percent. These changes resulted in an increase in the overall average tariff rate to about 3 percent ($3 on $100 of imports) during the last two years of Trump’s term. The Biden administration also raised the average tariff on Chinese goods by about 100 basis points, while the average tariff on Vietnam fell another 100 basis points and the average tariff on other countries remained the same. As a result, the average tariff rate during the Biden administration was basically unchanged versus the last two years of Trump.

If all of the tariffs that Trump spoke about during the campaign are implemented (which is highly unlikely), it is estimated that the average tariff rate would triple. This would put it back to the levels in 1967. Note that while tariffs are anti-growth, there is no clear statistical relationship between real GDP growth and average tariff rates. This is because imports are only about 15 percent of GDP. This means a 100-basis-point increase in average tariffs translates into about 15 basis points on aggregate GDP. Changes of this magnitude are swamped by other economic movements.

As it relates to real estate, higher economic growth means more space demand across the board. More jobs, more retail sales and more money to spend feed the demand for real estate. If higher tariffs are implemented, markets handling imports will have modestly less industrial space demand. Markets handling domestically produced goods will have a little more warehouse demand. Neither impact will be overwhelming. And national rent controls are thankfully off the table. But always remember that many factors impact the size of the economic pie, most of which are far more consequential than politicians. Stated most bluntly, our economy is stronger than our politicians.

Dr. Peter Linneman is a principal & founder of Linneman Associates (www.linnemanassociates.com), Professor Emeritus at the Wharton School of Business, University of Pennsylvania, author of “Real Estate Finance and Investments: Risks and Opportunities,” and co-author of “The Great Age Reboot: Cracking

the Longevity Code for a Longer Tomorrow.” Follow Dr. Linneman on X: @P_Linneman

You must be logged in to post a comment.